Federal Reserve

Federal Reserve

-

Investors are probably in for disappointment if they continue to fight the Fed.

August 24 -

Federal Reserve Bank of Minneapolis President Neel Kashkari said U.S. inflation is very high and the central bank must act to bring it back under control.

August 24 -

Directors at two of the Federal Reserve's 12 regional branches favored a 100-basis-point increase in the discount rate in July, minutes of discount-rate meetings show.

August 23 -

Former Treasury Secretary Lawrence Summers called on the Federal Reserve to deliver a clear message saying it will need to impose "restrictive" monetary policy that drives up the U.S. unemployment rate in order to quell inflation.

August 22 -

Federal Reserve Bank of San Francisco President Mary Daly said the central bank should raise interest rates "a little" above 3% by the end of the year to cool inflation, pushing back against investor bets that officials would then reverse course.

August 18 -

Two Federal Reserve officials responded to softening inflation data by saying it doesn't change the U.S. central bank's path toward even higher interest rates this year and next.

August 10 -

The Federal Reserve is committed to cooling inflation and needs to raise interest rates to a little above 4% to ease demand, Cleveland Federal Reserve Bank President Loretta Mester said.

August 4 -

St. Louis Fed Bank President James Bullard said he favors a strategy of "front-loading" big interest-rate hikes, and he wants to end the year at 3.75% to 4%, while his Richmond counterpart, Thomas Barkin, said the central bank was committed to lowering inflation and a recession could happen.

August 3 -

Federal Reserve officials said they want strong evidence that the hottest inflation in four decades is on a sustainable downward path before declaring victory in their fight against it.

August 2 -

The day after the Federal Open Market Committee's next meeting we will analyze the increase and the signals about what rate hikes may be coming.

-

The large primary was led by two $700-plus million of revenue bonds from the Port of Seattle and the Georgia Ports Authority.

August 2 -

John Luke Tyner, fixed income analyst at Aptus Capital Advisors, discusses yield curve inversion with Bond Buyer Managing Editor Gary Siegel. Tyner looks at recession possibilities and how the Federal Reserve’s actions will impact the economy, the yield curve and recession. (23 minutes)

August 2 -

Federal Reserve Bank of Minneapolis President Neel Kashkari said the central bank is committed to doing what’s necessary to bring down demand in order to reach policy makers’ 2% long-term inflation goal, a target that remains far off.

August 1 -

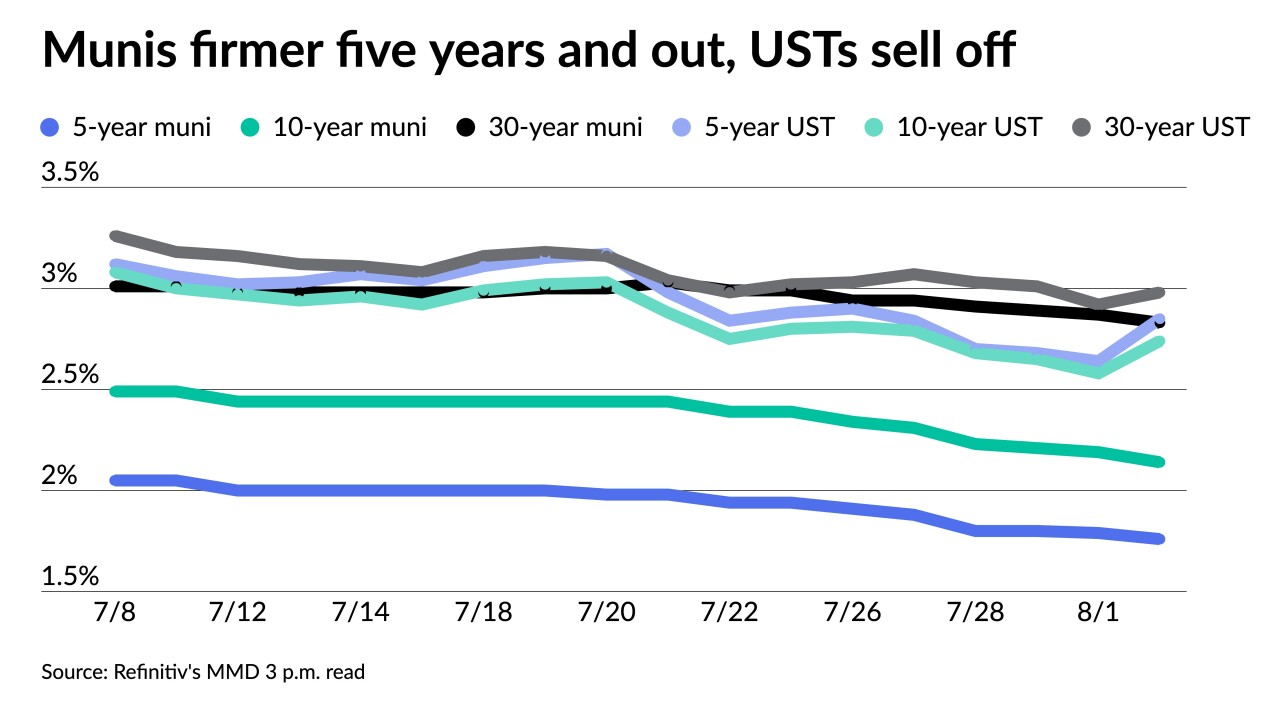

Municipals will end July with positive returns across all sectors. The Bloomberg Municipal Index shows a 2.49% return in July, moving year-to-date losses lower to 6.71%.

July 29 -

Total July volume was $25.598 billion in 520 deals versus $37.573 billion in 1,013 issues a year earlier, according to Refinitiv data.

July 29 -

Former Treasury Secretary Lawrence Summers said he was concerned the Federal Reserve is still engaging in “wishful thinking” about how much it will take to bring inflation down from four-decade highs.

July 29 -

Municipals are poised to end July in the black. Demand for muni product has been strong this summer, with analysts expecting supportive market technicals through August with a likely continuation of positive performance.

July 27 -

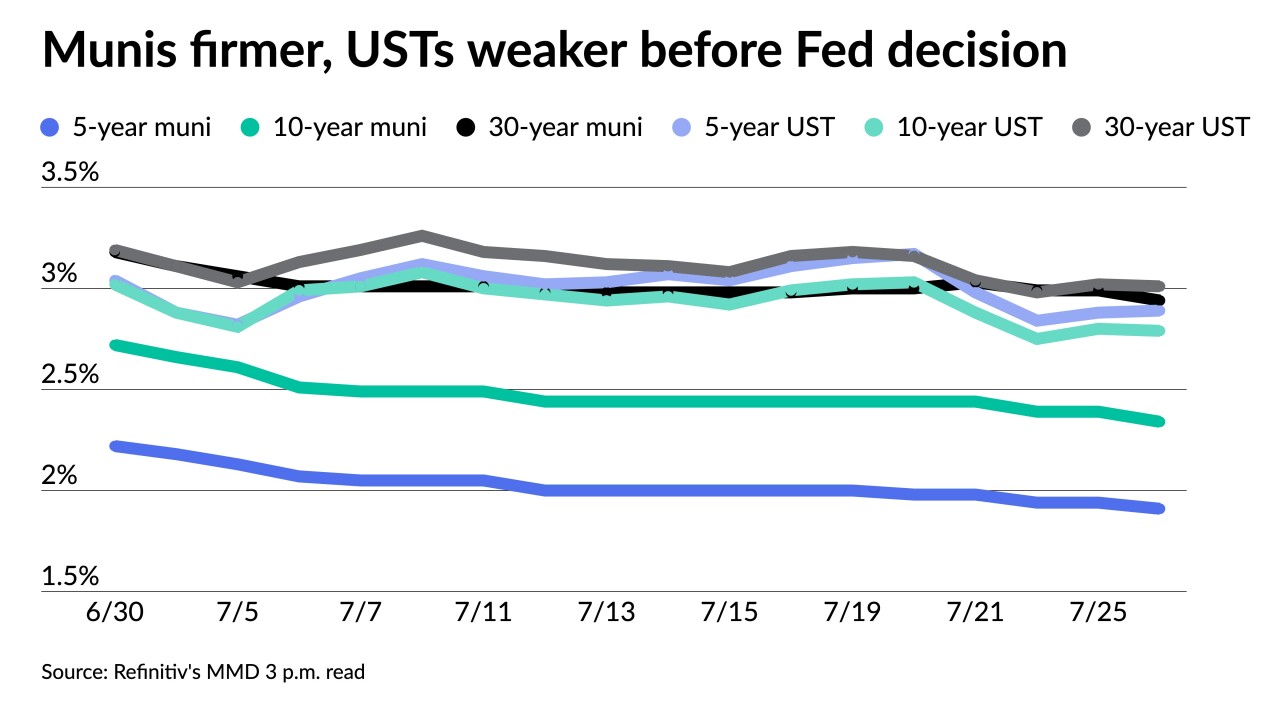

Investors sit on the sidelines, waiting to see how much the Fed will hike rates. The consensus appears to be another 75 basis point rate hike, though a full point hike could be on the table.

July 26 -

A new study found that following the recent law in Texas law barring muni underwiriting by banks discriminating against the oil and gas industry, municipalities face higher borrowing costs after many players exited the market.

July 18 -

The Federal Reserve’s Inspector General said Chair Jerome Powell and former Vice Chair Richard Clarida’s trading activity had not broken any laws or rules, but the probe into the former heads of the Dallas and Boston regional Fed banks remained open.

July 14