Federal Reserve

Federal Reserve

-

The Federal Reserve chair said there are no economic indicators calling for rapid rate cuts. He also addressed Fed independence, the impact of Trump's economic agenda and more.

November 14 -

In a speech, Federal Reserve Gov. Adriana Kugler said sound monetary policy comes when electoral politics are kept out of central banking.

November 14 -

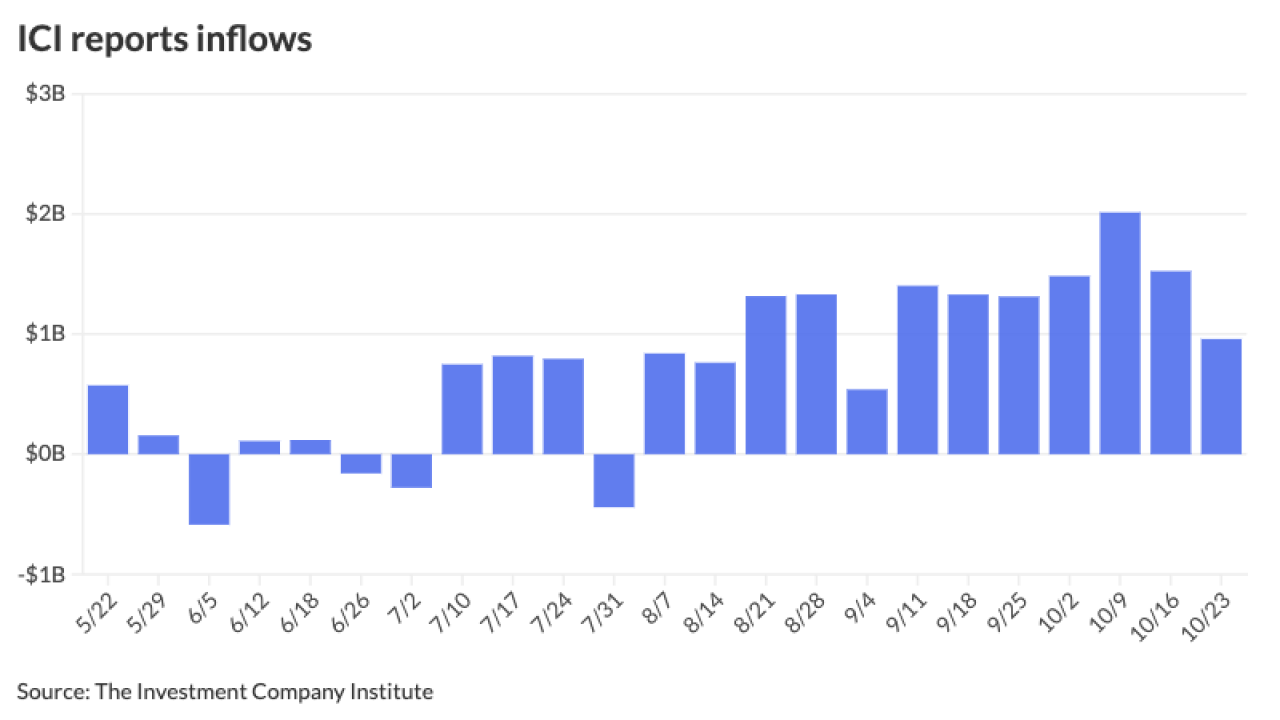

Despite the post-election selloff, inflows continued this week as LSEG Lipper reported investors added $1.263 billion to municipal bond mutual funds for the week ending Wednesday, compared to $658.5 million of inflows the prior week. High-yield inflows returned.

November 7 -

While this meeting is a slam dunk, the election and data makes the December meeting more of a question, some analysts said.

November 5 -

The Federal Reserve began cutting rates in September. The December meeting is its last of 2024. Will the cutting continue, or will there be a pause? Doug Peta, Chief Strategist, U.S. Investment Strategy, at BCA Research, discusses the meeting and future policy.

-

Municipals largely stayed in their own lane Wednesday, digesting the large slate of new issues as supply dwindles heading into election week, with Bond Buyer 30-day visible supply falling to $5.56 billion.

October 30 -

"We have made good progress, but inflation is still running above the FOMC's 2% objective," said Federal Reserve Bank of Cleveland President Beth Hammack.

October 25 -

The Federal Open Market Committee is expected to cut interest rates at its September meeting, which will also provide a new Summary of Economic Projections. Marvin Loh, senior macro strategist at State Street Global Markets, examine the meeting, the SEP and Fed Chair Powell's press conference.

-

Analysts remain divided about what the stronger-than-expected consumer price index will mean for Federal Reserve policymakers since the Fed appears to be concentrating on the labor market.

October 10 -

After cutting rates 50 basis points in September, the Federal Open Market Committee meets after Election Day to determine monetary policy. Gary Pzegeo, head of fixed income at CIBC Private Wealth U.S., provides his take on the latest move.

-

This week, Federal Reserve Gov. Michelle Bowman cast the first dissenting vote at an FOMC meeting in years. On Friday, she explained why the economic data she's seen didn't convince her of the need to cut rates as much as her fellow governors thought.

September 20 -

While the municipal market barely budged following the Fed's decision to cut rates 50 basis points, Thursday saw muni yields rise up to two basis points, depending on the scale, but still lagged the weakness in USTs. LSEG Lipper reported $716 million of inflows into municipal bond mutual funds.

September 19 -

The Fed's 50 basis point cut surprised many, as a looming federal election and all the uncertainty that brings complicates efforts at forecasting.

September 19 -

Given the Fed's reluctance to "surprise markets or take actions that could be perceived as overtly political," Interactive Brokers Chief Strategist Steve Sosnick said, "we find it hard to believe that anything other than 25 bp is the likely outcome for the upcoming FOMC meeting."

September 16 -

The Federal Reserve's inspector general says the reserve bank CEO did not trade on confidential information or have conflicts of interest, but did violate central bank rules and policies.

September 11 -

"The numbers are weak, but not cusp of recession weak," Chris Low, chief economist at FHN Financial, said.

September 6 -

"Employers were more selective with their hires and less likely to expand their workforces, citing concerns about demand and an uncertain economic outlook," the report said.

September 4 -

The Fed's expected September rate cut will "make market conditions more conducive to moving projects forward" said Dodge Construction Network's chief economist Richard Branch.

August 26 -

"Fed watchers will be parsing Powell's comments for signs that a 50bp rate cut is on the table for September," noted Lauren Saidel-Baker, an economist with ITR Economics. "However, the notoriously tight-lipped chair is unlikely to confirm this, making a 25bp cut the most likely outcome."

August 21 -

Federal Reserve Gov. Michelle Bowman said she has concerns about an uptick in inflation and will need to see more positive data before supporting an interest rate cut.

August 20