-

The consumer confidence index suggested expectations have slipped, and the Richmond Fed's services survey also offered a dim view ahead.

November 24 -

Housing starts and building permits both rose in September, as the housing market remains the "best part of the U.S. economy."

October 20 -

Initial jobless claims rose in the latest week, while the Empire State manufacturing index slipped, and the Philadelphia Fed's rose.

October 15 -

The housing market continues to lead all sectors in recovery, althoough a manufacturing and two services surveys also showed signs of recovery.

September 22 -

Jobless claims declined, but remain elevated, housing starts and building permits also slid, while manufacturing in the Philadelphia region expanded at a slower pace.

September 17 -

Consumer confidence sputtered even as new home sales surged, highlighting an uneven economic recovery.

August 25 -

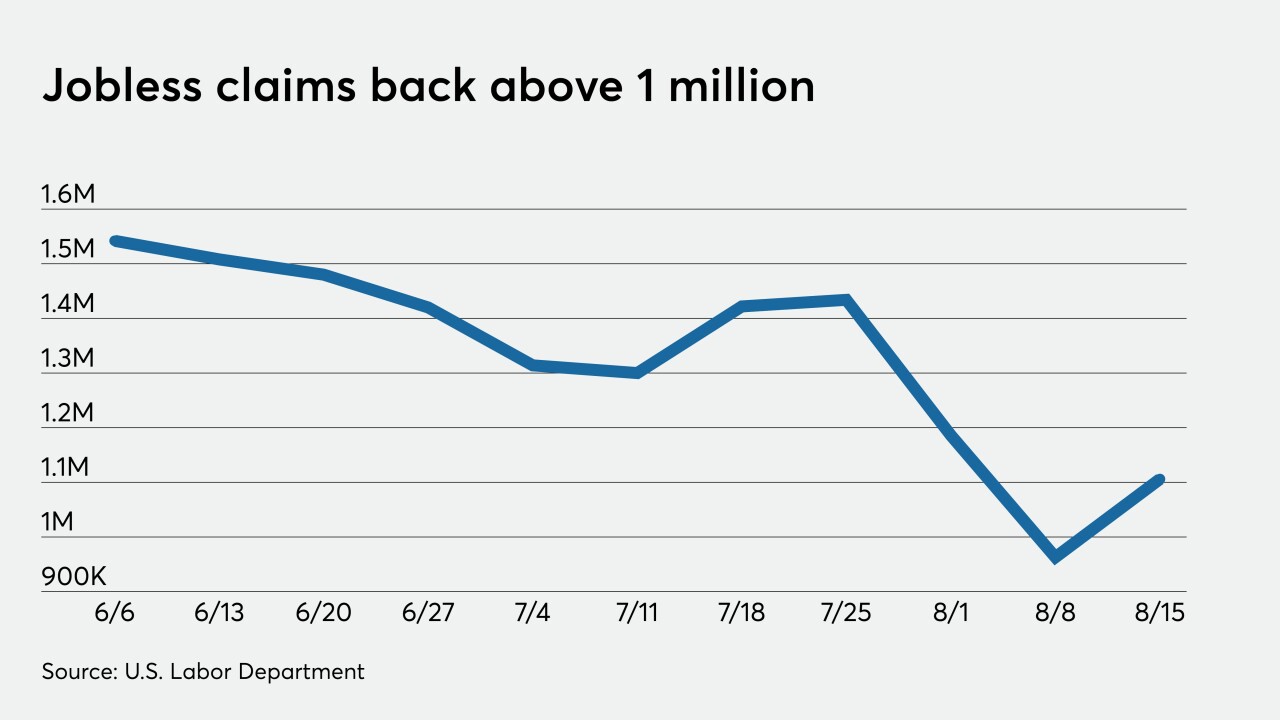

Jobless claims grew, manufacturing expansion weakened and leading indicators grew less than last month.

August 20 -

The nominations, essentially along party lines, move to the full Senate.

July 21 -

A handful of economic indicators offered no clarity about the economy, which appears to be improving marginally, but remains fragile.

July 16 -

The U.S. central bank should consider holding off on raising interest rates until inflation is above its 2% target, Philadelphia Fed President Patrick Harker said.

July 15 -

Data released on Tuesday suggest the economy remains weakened by the impact of the coronavirus.

June 23 -

Mostly stronger-than-expected data suggests improvement, with a long way to go.

June 18 -

Although up from the worst levels, indicators are not signalling recovery.

May 26 -

Numbers in the fall will offer clearer picture of where economy is.

May 21 -

Inflation, low before the coronavirus shut the economy, drops further.

May 12 -

The U.S. economy will likely need more fiscal stimulus as it weathers a “severe” contraction from the effects of coronavirus-prompted shut downs, according to Federal Reserve Bank of Dallas President Robert Kaplan.

May 1 -

Existing home sales fell 8.5% last month as the Philadelphia Fed said its indexes fell to record lows in April.

April 21 -

As the Federal Reserve continues trying to keep markets liquid as the stock market sinks, economic data are showing the effects of COVID-19.

March 19 -

The U.S. central bank is weighing whether to expand the scope of its interventions in financial markets being battered by concerns over the coronavirus, Philadelphia Federal Reserve Bank President Patrick Harker said.

March 19 -

The Conference Board reported Tuesday that its consumer confidence index improved rose to 130.7 in February.

February 25