-

Fed Chair Powell's Congressional testimony failed to move municipal bond prices ahead of this week's new issue slate.

February 27 -

The municipal bond market is expected to give a warm reception to variety of new issues in the smaller-than-average $4.8 billion calendar.

February 26 -

The municipal market sees a lighter-than-average supply slate of $4.8 billion head their way this week.

February 26 -

Buyers will vie for about $4.8 billion of bonds next week.

February 23 -

“We’re headed to a place where we don’t necessarily want to be,” said the city's chief financial officer.

February 16 -

Municipal bond buyers adopted a cautious tone on Tuesday, waiting for trading volatility to die down before jumping back into the market.

February 6 -

Some municipal bond traders are describing an apathetic mood in the municipal market on Tuesday.

February 6 -

Municipal bond yields are rising as buyers look ahead to another smaller-than-average slate of sales heading to market next week.

February 2 -

Bond traders and buyers will keep an eye on rising yields as the municipal bond market sees a smaller than average primary slate scheduled for sale next week.

February 2 -

Municipal bonds strengthened Tuesday as the primary market shifted to holiday mode after breaking the December record for issuance.

December 26 -

The municipal market will be staffed by skeleton crews as the calendar has no negotiated deals and only small competitives, which don't even total $3 million — and another long holiday weekend right around the corner.

December 26 - Finance and investment-related court cases

The city of Houston can move forward with its plan to sell $1 billion in bonds on Friday as part of Mayor Sylvester Turner's landmark pension reform passed by the Texas Legislature earlier this year, a judge ruled.

December 22 -

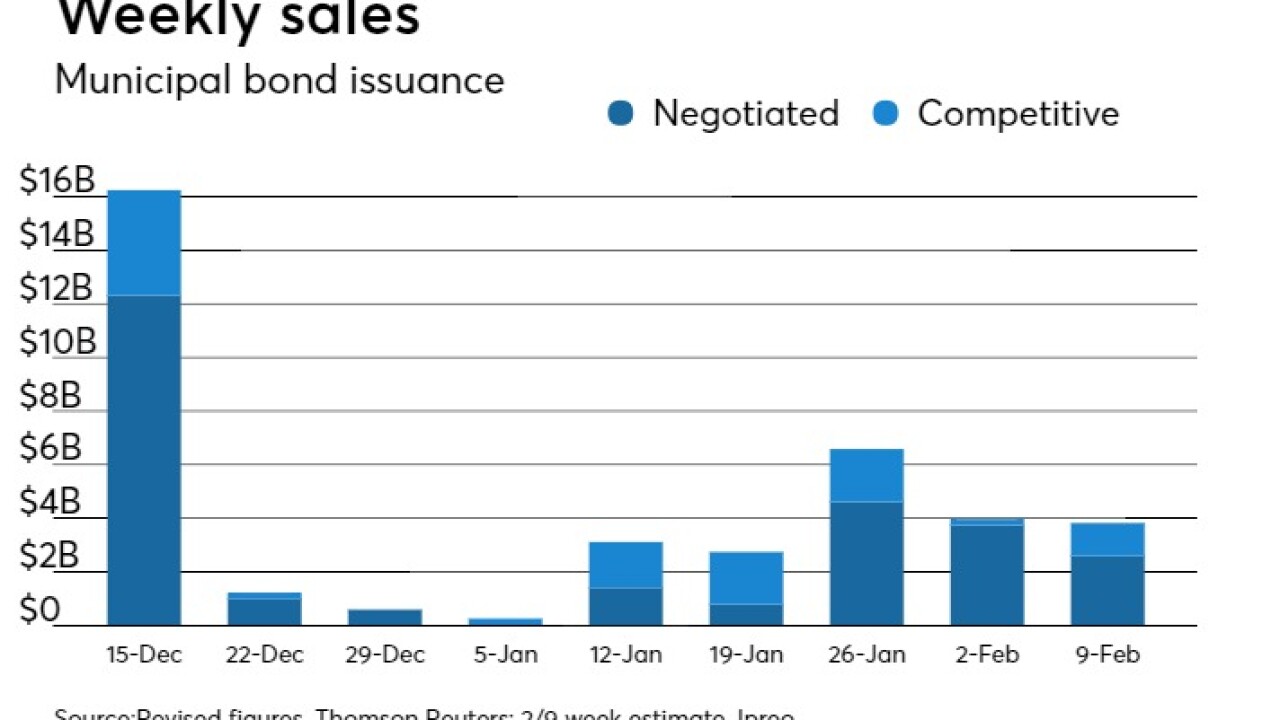

The muni market absorbed almost $58 billion, a record for December, before a holiday hiatus to end the year.

December 22 -

The long holiday weekend comes at a perfect time for tired muni market participants after a furious few weeks of action spurred by tax reform.

December 22 -

The two largest deals of the week touched down, as yields rose with comprehensive tax reform just a few President Trump pen strokes away from becoming official.

December 20 -

The primary market is still waiting for the last few deals of the week to hit, as both the holiday weekend and tax bill becoming law draw closer.

December 20 -

Only a handful of larger deals remain for pricing in the market on Wednesday, as comprehensive tax reform is imminent.

December 20 -

Breakneck action continued in the primary market as issuers flooded the market ahead of the tax reform vote, in order to get deals closed before the end of the year.

December 19 -

Houston alerted investors to a last-minute lawsuit questioning the legality of the election process as the city priced $1 billion of voter-approved bonds.

December 19 -

The action continued on Tuesday in the primary market as issuers flooded the market ahead of the tax reform vote, in order to get deals done and closed before the end of the year.

December 19