Municipal bond buyers will be looking to a variety of bonds slated to hit the screens next week

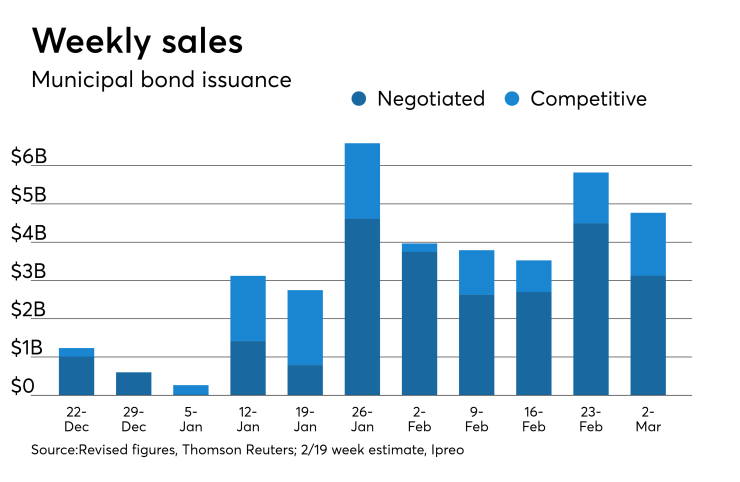

Ipreo estimates volume for next week at $4.76 billion, comprised of $3.12 billion of negotiated deals and $1.64 billion of competitive sales.

Primary market

Baltimore County, Md., tops the slate as it will issue about $837 million of bonds and notes in four separate competitive offerings.

On Wednesday, the county will sell $225 million of general obligation metropolitan district bonds, 80th issue, and $121 million of 2018 GO consolidated public improvement bonds.

On Thursday, the county will sell $246 million of Series 2018 consolidated public improvement general obligation bond anticipation notes and $245 million of Series 2018 metropolitan district general bond anticipation notes.

In the negotiated sector, Goldman Sachs will price Alabama’s Black Belt Energy Gas District’s $653 million of gas prepay revenue bonds for Project No. 3.

Also on tap, RBC Capital Markets will price the New York State Thruway Authority’s $600 million of Series L general revenue refunding bonds.

And two airports deals will be hitting the screens.

Bank of America Merrill Lynch is set to price Houston, Texas’ $417 million of airport system subordinate lien revenue and refunding bonds consisting of Series 2918A bonds subject to the alternative minimum tax and Series 2018B non-AMT bonds.

Barclays Capital is set to price Los Angeles’ Department of Airports $376 million of Series 2018 AMT subordinate revenue bonds for Los Angeles International Airport.

Bond Buyer 30-day visible supply at $8.16B

The Bond Buyer's 30-day visible supply calendar increased $1.07 billion to $8.16 billion on Friday. The total is comprised of $2.98 billion of competitive sales and $5.18 billion of negotiated deals.

Previous session's activity

The Municipal Securities Rulemaking Board reported 45,325 trades on Thursday on volume of $12.99 billion.

California, Texas and New York were the states with the most trades, with the Golden State taking 15.675% of the market, the Empire State taking 10.813% and the Lone Star State taking 10.612%.

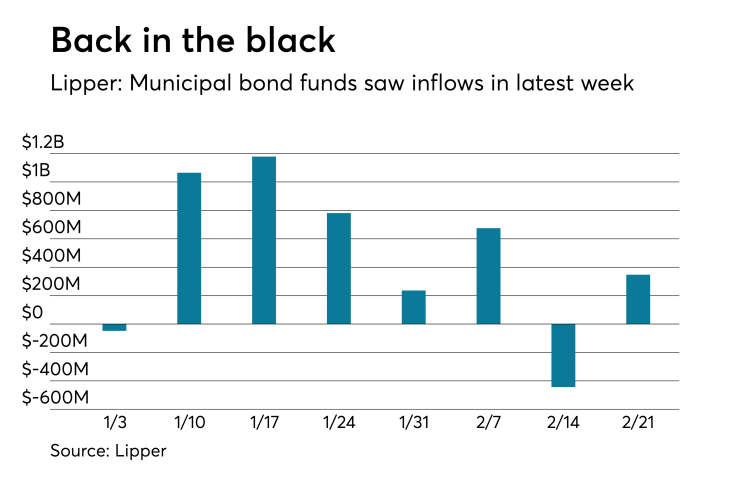

Lipper: Muni bond funds saw inflows

Investors in municipal bond funds again reversed course and put cash back into the funds in the latest week, according to Lipper data released on Thursday.

The weekly reporters saw $347.403 million of inflows in the week of Feb. 21, after outflows of $443.409 million in the previous week.

Exchange traded funds reported outflows of $18.979 million, after outflows of $60.759 million in the previous week. Ex-ETFs, muni funds saw $366.381 million of inflows, after outflows of $382.649 million in the previous week.

The four-week moving average was positive at $203.707 million, after being in the green at $312.146 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds had outflows of $52.672 million in the latest week after outflows of $102.806 million in the previous week. Intermediate-term funds had inflows of $491.709 million after inflows of $201.425 million in the prior week.

National funds had inflows of $354.086 million after outflows of $410.442 million in the previous week. High-yield muni funds reported outflows of $5.074 million in the latest week, after inflows of $20.088 million the previous week.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.