The primary market saw the two largest deals of the week touch down, as yields rose again with comprehensive tax reform just a few

Secondary market

The MBIS municipal non-callable 5% GO benchmark scale was weaker Wednesday on trading through the market close.

The 10-year muni benchmark yield rose to 2.378% from Tuesday’s final read of 2.329%, according to

The MBIS benchmark index, which is comprised of investment-grade municipal securities, is updated hourly on the

Top-rated municipal bonds were weaker. The yield on the 10-year benchmark muni general obligation was five basis points higher to 2.13% from 2.08% on Tuesday, while the 30-year GO increased to 2.73% from 2.68%, according to a final read of MMD’s triple-A scale.

U.S. Treasuries were weaker to end Wednesday. The yield on the two-year Treasury inched up to 1.86% from 1.85%, the 10-year Treasury yield climbed to 2.50% from 2.46% and the yield on the 30-year Treasury rose to 2.88% from 2.82%.

On Wednesday, the 10-year muni-to-Treasury ratio was calculated at 85.4% compared with 84.5% on Tuesday, while the 30-year muni-to-Treasury ratio stood at 94.9% versus 94.9%, according to MMD.

Primary market

"Deals got done today but it was slower than it normally would be when the two biggest deals price," said one Southwest trader. "The market was weaker again, I am sure those who came today in hindsight would have liked to come a day or two earlier but demand was still there - seeing as this was likely the last big issuance day of the year."

The biggest deal of the week priced on Wednesday, after

Barclays Capital ran the books on Houston’s $1.005 billion of pension general obligation taxable bonds. The bonds were priced at par to yield from 2.203% in 2019 to 3.925% in 2032. A term bond in 2035 was priced at par to yield 4.061% and a term bond in 2047 to yield 3.961%. The 2019 maturity was about 35 basis points above the comparable Treasury, The 2032 maturity was about 145 basis points above the comparable Treasury, The 2035 maturity was about 120 basis points above the comparable Treasury and the 2047 maturity was about 110 basis points above the comparable Treasury. The deal is rated Aa3 by Moody’s Investors Service and AA by S&P Global Ratings. The bonds, which will not be free to trade until Tuesday, Dec. 26, are secured by a direct tax levied on all taxable property in the city.

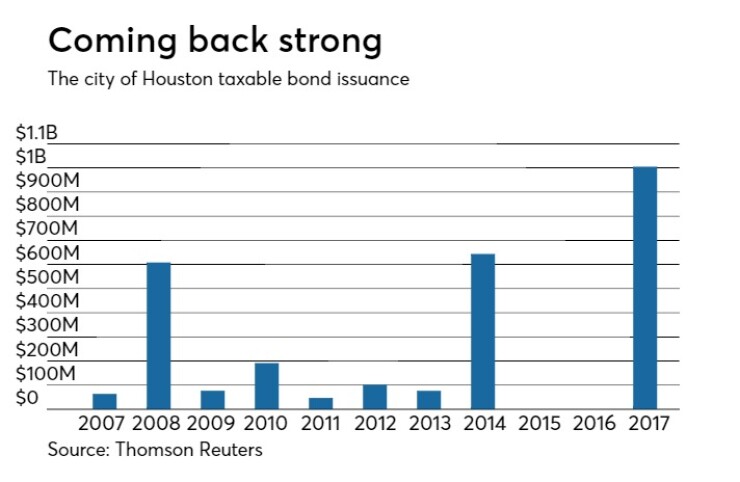

Since 2007, Houston has issued roughly $2.81 billion of bonds, with the most issuance before this year occurring in 20104 when it sold $678 million of bonds. That was the last time Space City sold taxable bonds before Wednesday’s sale.

The proceeds will be used to fund a portion of the unfunded liabilities of two of the city's single employer pension systems with $750 million going to the Houston Police Officers' Pension Systems, and $250 million going to the Houston Municipal Employees Pension System.

Jefferies priced the Railsplitter Tobacco Settlement Authority, Ill.’s $678.61 million of settlement revenue bonds on Wednesday. The bonds were priced to yield from 2.48% with a 5% coupon in 2022 to 3.08% with a 5% coupon in 2028. The deal is rated A by S&P with the exception of the 2028 maturity, which is rated A-minus by S&P.

Citi priced Palomar Health, Calif.’s $151.96 million of refunding revenue bonds. The bonds were priced to yield 3.83% with a 5% coupon in 2042 and 3.48% with a 5% coupon in 2047. The deal is rated Ba1 by Moody’s, BBB-minus by S&P, BB-plus by Fitch, with the exception of the 2047 maturity totaling $101.96 million that is insured by Assured Guaranty Municipal Corp., and rated A2 by Moody’s, AA by S&P and AA-plus by Kroll Bond Rating Agency.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.