-

Underwriters reportedly offered spreads to the Municipal Market Data’s AAA benchmark scale of 55 basis points on serials ranging from 2031 to 2038.

January 23 -

MacKay Municipal Managers has released its list of the top five trends to watch for in the municipal market this year.

January 23 -

A pre-marketing wire on the Sales Tax Securitization Corp.'s $366.2 million of tax-exempts indicates the Chicago deal may see wider spreads than in its bond sale last month.

January 22 -

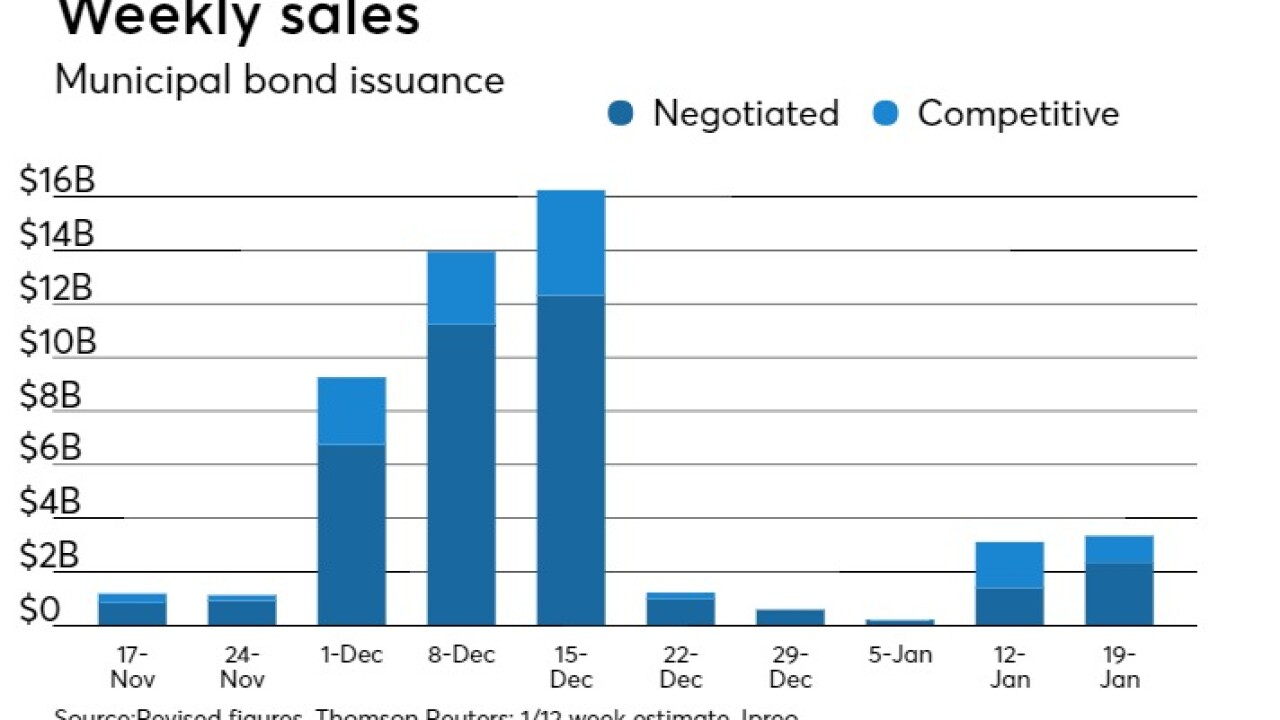

Although tax reform concerns pushed issuers into the market in December, CUSIP requests for the year, were lowest since 2014.

January 22 -

Municipal bond traders return to work with yields and the revamped Chicago deal in their sights.

January 22 -

The city will see Monday if its retooled sales tax securitization issue is a go with the market.

January 19 -

Muni volume in the last week of January is forecast to match that of the first three weeks combined, satisfying pent-up investor demand.

January 19 -

Municipal bond prices remain under pressure at midday as U.S. Treasury yields hit three-year highs and the market looks to next week's $7.17 billion slate.

January 19 -

Munis came under pressure as Treasuries weakened on concern over a possible government shutdown and traders looked ahead to a return to normal in deal volume next week.

January 19 -

Chicago plans to jump into the market with next securitization when its "tone" improves.

January 18 -

The Sales Tax Securitization Corp.’s bond deal was delayed until at least next week, Chicago officials said, citing the market's "weak start" to the year.

January 17 -

The Sales Tax Securitization Corp.’s highly anticipated bond sale has been delayed until at least next week due to market conditions, Chicago officials said.

January 17 -

Municipal bond buyers are waiting to see details on the high-rated, but high-yielding sales tax securitization coming from Chicago on Wednesday.

January 17 -

Municipal bond buyers will focus on the high-rated but high-yielding sales tax securitization deal coming from Chicago on Wednesday.

January 17 -

The municipal bond market on Tuesday priced the first of the week’s big new issues, before buyers turned their focus to the high-rated, but high-yielding sales tax securitization coming from Chicago on Wednesday.

January 16 -

The municipal bond market saw the first of the week’s big new issues price in the primary. Buyers will see about $3.35 billion of new deals hit the screens this week, with most of the volume coming on Wednesday and Thursday.

January 16 -

Chicago’s Sales Tax Securitization Corp. returns to the municipal bond market this week, offering high-yielding, high-rated paper to buyers hungry for supply.

January 16 -

Municipal bond buyers and traders expect $2.36 billion of negotiated deals and $986.4 million of competitive sales.

January 16 -

Tax-exempt issuance again dominates the calendar, after a week of mostly taxable deals .

January 12 -

A special-purpose corporation is selling nearly $800 million to refund some of the city's lower-rated GOs.

January 12