Goldman Sachs on Monday distributed a pre-marketing wire on the Sales Tax Securitization Corp.’s $366.2 million of tax-exempt bonds that indicated wider spreads than Chicago saw in last month’s sale.

The issue will be priced on Tuesday and is composed of tax-exempt and taxable bonds. Details on the expected $300 million of taxables, which are due in 2048 with a make-whole call feature, were not available.

The pre-marketing wire put the size of the tax-exempt portion of the deal at $366.2 million and offered spreads to the Municipal Market Data’s AAA benchmark scale of 55 basis point on serials ranging from 2031 to 2038.

The term bonds for $91.75 million in 2043 and $117 million in 2048 offered a spread of 60 basis points with a 5% coupon and a 95 basis point spread with a 4% coupon. The other spreads are all based on 5% coupons. The syndicate was also seeking buyer input on a preference for a 4% or 5% coupon on the 2048 term bond.

The spreads indicated in the scale are higher than the approximately 36 to 40 basis points over the MMD scale that the corporation saw in December when it offered $575 million of tax-exempts and taxables in its

This week’s deal was originally sized at $795 million and later upsized to $898 million before the city and its finance team decided last week to delay the issue and restructure it to include the taxable paper.

The deal is rated AA by S&P Global Ratings and AAA by Fitch Ratings and Kroll Bond Rating Agency.

In the competitive sector on Monday, the Anoka-Hennepin Independent School District No. 11, Minn., sold $150 million of Series 2018A general obligation school building bonds.

Robert W. Baird won the bonds with a true interest cost of 3.2675%. The issue was priced to yield from 1.43% with a 5% coupon in 2019 to 3.40% with a 3.375% coupon in 2041; a 2043 maturity was priced as 3 3/8s to yield 3.42%.

The deal, which is backed by the Minnesota School District Credit Enhancement Program, is rated AA-plus by S&P.

On Tuesday, Goldman will price for retail investors the state of Connecticut’s $800 million of Series 2018A

Bank of America Merrill Lynch is set to price the Port Authority of New York and New Jersey’s $832 million deal, consisting of $677 million of 207th Series of consolidated bonds subject to the alternative minimum tax and $155 million of taxable 208th Series consolidated bonds on Tuesday. The deal is rated triple-A by Moody’s Investors Service and S&P.

Also, BAML is expected to price the Maryland Stadium Authority’s $426 million of revenue bonds for the Baltimore City Public Schools’ construction and revitalization program on Tuesday. The deal is rated Aa3 by Moody’s, AA-minus by S&P and AA by Fitch.

Additionally, BAML is set to price for retail the Massachusetts School Building Authority’s $395 million of Series 2018A subordinated dedicated sales tax bonds on Tuesday. The deal is rated Aa3 by Moody’s, AA by S&P and AA-plus by Fitch.

And BAML is expected to price for retail the city and county of Honolulu’s $305 million of wastewater system revenue bonds, consisting of: Senior Series 2018A&B first bond resolution refunding bonds; and Junior Series 2018A taxable and Series 2018B refunding second bond resolution bonds. The senior bonds are rated Aa2 by Moody’s and AA by Fitch and the junior bonds are rated Aa3 by Moody’s and AA-minus by Fitch.

On Tuesday, the University of Washington will competitively sell $135.99 million of Series 2018 general revenue bonds. The deal is rated Aaa by Moody’s and AA-plus by S&P.

Prior week's actively traded issues

Revenue bonds comprised 56.02% of new issuance in the week ended Jan. 19, up from 55.91% in the previous week, according to

Some of the most actively traded bonds by type were from Colorado, New York and Pennsylvania issuers.

In the GO bond sector, the Grand River Hospital District, Colo., 5.25s of 2037 traded 25 times. In the revenue bond sector, the New York Metropolitan Transportation Authority 4s of 2019 traded 41 times. And in the taxable bond sector, the Pennsylvania Commonwealth Financing Authority 3.864s of 2038 traded 81 times.

CUSIP requests waned in 2017, despite December rush

Municipal CUSIP requests increased to 1,683 in December from 1,372 in November, CUSIP Global Services said on Monday, reflecting a rush to market by issuers concerned about tax reform and its implications for the bond market.

CUSIP orders for municipal bonds totaled 1,535 last month, up from 1,220 in the prior month.

CUSIP said the surge was due in large part to the tax reform bill, passed on Dec. 20, which removed the tax-exemption from advanced refundings, which states and municipalities use to reduce borrowing costs. Early versions of the bill also threatened to remove the tax-exemption for private activity bonds, but that provision was not included in the final bill.

On a year-over-year basis, municipal request volume was down 17% through the end of 2017, reflecting ongoing volatility in municipal issuance over the course of the year.

“A great deal of the end-of-year surge in municipal identifier requests was driven by the crush of issuers racing to raise capital ahead of tax reform,” said Gerard Faulkner, director of operations for CUSIP. “Now that we see that the final version of the bill preserves the tax-exemption on private activity bonds, we expect muni request volumes to move back into a more normalized range.”

Long-term muni note CUSIP requests rose to 24 last month compared to 20 in November. Short-term muni note CUSIP demand also increased last month as 89 orders took place compared to 82 in previous month.

For 2017, total municipal security CUSIP orders for all muni asset classes was 15,503, down 15% from the prior year's 18,235 orders. Last year’s results marked the first time total annual muni CUSIP orders dropped below 16,000 since 2014 when 15,509 identifiers were sought.

Among top state activities, CUSIPs for scheduled public finance offerings from Texas issuers were the most active in 2017 with 1,603 orders. New York was next with 1,469 municipal CUSIP orders followed by California issuers with 1,244 CUSIP requests.

“We’ve seen a fair amount of volatility in month-to-month CUSIP request volumes, driven by a combination of technical and market factors this year,” said Richard Peterson, senior director at S&P Global Market Intelligence. “As we turn our sights to 2018, we are currently poised for healthy new issuance volumes in U.S. equities and municipal bond markets.”

Secondary market

The MBIS municipal non-callable 5% GO benchmark scale was mixed in late trading.

The 10-year muni benchmark yield fell to 2.376% on Monday from the final read of 2.378% on Friday, according to

The MBIS benchmark index is updated hourly on the

Top-rated municipal bonds finished weaker on Monday. The yield on the 10-year benchmark muni general obligation rose one basis point to 2.14% from 2.13% on Friday, while the 30-year GO yield increased one basis point to 2.74% from 2.73%, according to the final read of MMD’s triple-A scale.

U.S. Treasuries were weaker on Monday. The yield on the two-year Treasury rose to 2.07% from 2.06% on Friday, the 10-year Treasury yield gained to 2.66% from 2.64% and the yield on the 30-year Treasury increased to 2.93% from 2.91%.

On Monday, the 10-year muni-to-Treasury ratio was calculated at 80.5% compared with 80.8% on Friday, while the 30-year muni-to-Treasury ratio stood at 93.6% versus 93.8%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 40,037 trades on Friday on volume of $10.08 billion.

California, Texas, and New York made up the top three states with the most trades on Friday with the Golden State taking 13.506% of the market, the Lone Star State taking 12.415% and the Empire State taking 9.577%.

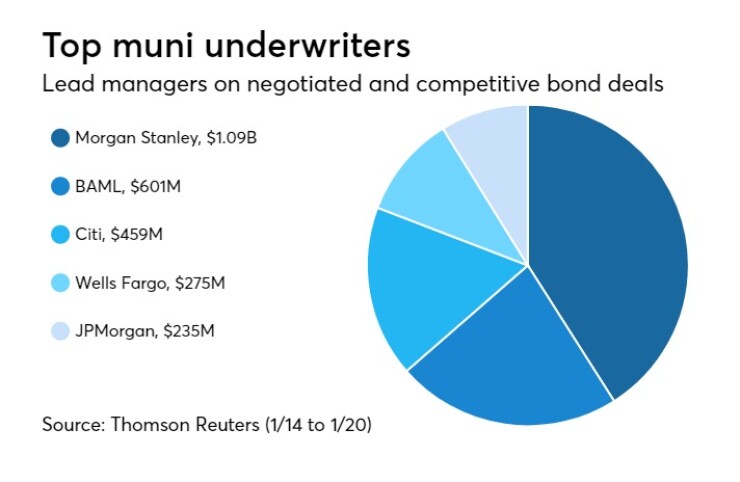

Previous week's top underwriters

The top municipal bond underwriters of last week included Morgan Stanley, Bank of America Merrill Lynch, Citigroup, Wells Fargo Securities and JPMorgan Securities, according to Thomson Reuters data.

In the week of Jan. 14 to Jan. 20, Morgan Stanley underwrote $1.09 billion, BAML $600.9 million, Citi $458.5 million, Wells $274.8 million and JPMorgan $235.1 million.

Treasury sells discount bills

Tender rates for the Treasury Department's latest 91-day and 182-day discount bills were mixed on Tuesday, as the three-months incurred a 1.430% high rate, unchanged from 1.430% the prior week, and the six-months incurred a 1.615% high rate, up from 1.600% the week before. Coupon equivalents were 1.455% and 1.651%, respectively. The price for the 91s was 99.638528 and that for the 182s was 99.183528.

The median bid on the 91s was 1.400%. The low bid was 1.380%. Tenders at the high rate were allotted 41.71%. The bid-to-cover ratio was 2.84.

The median bid for the 182s was 1.595%. The low bid was 1.570%. Tenders at the high rate were allotted 31.14%. The bid-to-cover ratio was 3.00.

— Yvette Shields and Gary Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.