-

S&P raised CPS' junk rating by one notch, saying federal funds will boost an "already positive financial trajectory."

April 5 -

The junk-rated school district won an upgrade and saw its secondary bond market spreads narrow as it expects to pocket about $1.8 billion in new aid.

March 12 -

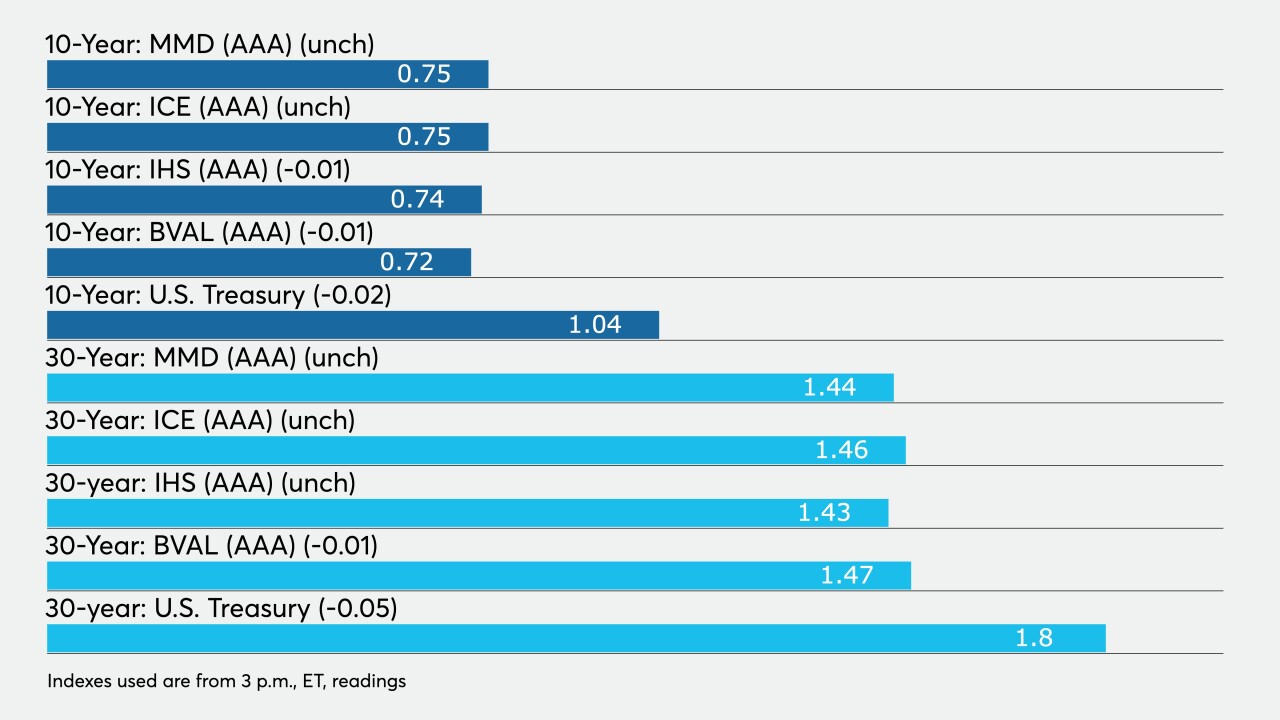

High-yield continues to be sought after as high-grade paper is yielding about 0.70% in 10 years and 1.40% or lower in 30 years and credit spreads continue to tighten in nearly every sector. Ratios are near 20-year record lows.

February 1 -

The junk-rated district that is managing the COVID-19 pandemic's fiscal impact with the help of federal relief trimmed spread penalties as investors were drawn to the extra yield offered for the junk paper.

January 29 -

Chicago Board of Education bonds were repriced to lower yields by as much as 37 basis points, showing just how far investors will go for any incremental yield.

January 28 -

Federal COVID-19 relief aid cushions the district's balance sheet but labor, state budget, and pension woes remain.

January 25 -

Returns of all the investment grade options "pale in comparison to those for municipal high-yield," which should bolster Texas gas and Chicago public schools deals.

January 25 -

Chicago Public Schools will get more than it budgeted for from the federal emergency relief bill; the Illinois Regional Transportation Authority got a bit less.

December 29 -

The Chicago Board of Education warns of tough spending decisions ahead if the federal government doesn't act on a new stimulus/relief package.

August 27 -

The coronavirus adds to the fiscal challenges facing the already junk-rated school district, which is the nation's third-largest.

August 18