Want unlimited access to top ideas and insights?

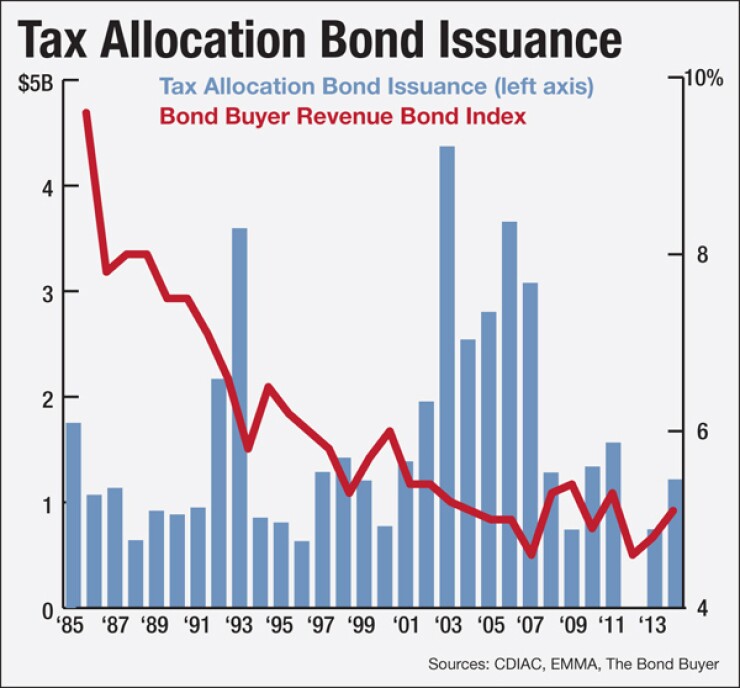

Three years after Governor Brown signed Assembly Bill 26 into law dissolving all redevelopment agencies in the State of California, the issuance of refunding bonds by "successor" agencies has finally hit its stride. Since the beginning of this year, more than $1.2 billion of refunding bonds have been issued by 28 successor agencies, compared to $745 million all last year, and just $1.70 million in 2012.

By all accounts, the surge in issuance reflects a confluence of factors including relatively low interest rates, strong and improving credit quality, the re-emergence of bond insurance as a stable credit enhancement, and the ready availability and market acceptance of reserve fund surety policies.

With each new issue that comes to market, investors seemingly gain a better understanding of, and increased comfort with the sector, leading to broader investor participation, improved secondary market liquidity and tighter credit spreads. For example, insured successor agency refunding bonds with underlying ratings of 'A' that priced in June and July of this year had credit spreads from 2024-2028 that were approximately 40 basis points lower on average than comparable bonds priced 6-12 months ago.

Strong Credits

The surge in issuance reflects a consensus among rating analysts, bond insurers and investors that most successor agency refunding bonds are high-grade credits. To wit, approximately 70% of all post-Dissolution refunding bonds have been rated in the A-category by S&P, with another 15% rated AA-minus. Moreover, approximately 70% of all issues have been at least partially insured by AGM or BAM, including 85% of issues rated below AA-minus. Underlying credit strengths include:

- The Dissolution Act prohibits the issuance of new-money bonds, effectively closing all liens on pledged revenue and putting a floor under debt service coverage,

- With broad-based if uneven growth in assessed value occurring in many communities throughout California, downside credit risks are clearly receding,

- The Dissolution Act provides clear statutory authority to secure successor agency refunding bonds with a lien on 'former' tax increment revenues; additionally, the Act permits successor agencies to secure refunding bonds with revenues from multiple project areas and to pledge the former 20% housing set-aside, in many cases giving a boost to debt service coverage, and

- The subordination of pass-through payments to the payment of debt service on refunding bonds ensures investors are first in line to get paid.

If weakness lurks within the structure of these credits, it probably lies in the 'flow of funds'. For one thing, the whole "ROPS Process" of paying debt service on these bonds is rather convoluted. Also, the extent to which county auditor-controllers and successor agencies strictly adhere to the priority order of payments stipulated in trust indentures remains a bit of a mystery. And of course, there's always the risk, however remote, that the Legislature may someday revisit Dissolution and change the rules again, rendering existing arrangements moot.

Some successor agencies such as Morgan Hill have taken steps to mitigate these risks by validating their bonds and by utilizing a tri-party indenture that includes the County as a signatory; but, most issuers have not taken such steps.

Pockets of Ambivalence

Although the issuance of tax allocation refunding bonds may well approach $2 billion this year, there's easily another $1 billion or more of outstanding tax allocation bonds that can and should be refunded - good credits with high coupons, currently callable at par - but which successor agencies have chosen not to refund.

One reason why successor agencies forgo the issuance of refunding bonds is that pursuant to the Dissolution Act, host cities receive on average only about 15% of the debt service savings, with the lion's share going to other local taxing entities - counties, school districts, community colleges, special districts, etc. As such, the narrow financial incentive for successor agencies to issue refunding bonds may be quite modest, whereas the time and effort involved in issuing such bonds may loom large.

Additionally, not only has Dissolution been a huge money-loser for host cities, and highly disruptive to business-as-usual, but the whole process of dissolving redevelopment agencies has been extremely time-consuming, costly, contentious and draining. As such, for wholly non-financial reasons successor agencies may also be ambivalent about issuing refunding bonds.

Such ambivalence has created an opening for banks to pitch direct private placements, with some success. Under the circumstances, it's easy to see the allure of issuing refunding bonds with no official statement, no rating, no insurance, no continuing disclosure and no reserve fund. But private placements are unlikely to capture a large share of the market due to the limits on size, term and structure that most banks must abide.

Final Thoughts

Owing to the current favorable interest rate environment and tighter credit spreads, many post-Dissolution refunding bonds have generated outsized savings of 8%-10% or more of refunded par, measured on a present value basis. In the aggregate, post-Dissolution refunding bonds have likely netted in excess of $100 million of present value savings, with the promise of more to come.

From 2002 until passage of the Dissolution Act, approximately $23.3 billion of tax allocation bonds were issued by California redevelopment agencies. Depending on market conditions, from one-quarter to one-third or more of those bonds will eventually become good refunding candidates, and all else equal, most of those bonds will be refunded.

However, if the State wants to maximize refunding savings then the Legislature should authorize "oversight boards" to issue refunding bonds on behalf of successor agencies. Oversight board members are drawn directly from the very local taxing entities that benefit most from refundings, and therefore have the greatest incentive to act accordingly.