The final month of 2017 proved to be abnormally busy for municipal investors as the market braced for the final outcome of proposed tax changes. Issuers decided to not wait for the final outcome of the tax bill but rather sold as many advanced refunding and private activity issues as possible due to their potential prohibition in the bill. This resulted in a record month for issuance of $62.5B, surpassing the previous record set back in December of 1985 at $54.7B. On December 22, President Trump signed the 2017 Tax Cuts & Jobs Act (H.R.1 or the “New Act” or “Act”), which was passed by Congress on December 20, 2017. Private Activity Bonds were ultimately spared by the final bill, while advanced refundings were not.

The final bill had several elements which will impact the municipal markets. This piece focuses on the key municipal related provisions and their potential impact. The bill proved to be a mixed result for the municipal market and leaves several questions unanswered as we illustrate in the following discussion.

INDIVIDUAL PROVISIONS:

Tax Rates:

The Act did not result in a significant change for individual investors at the highest tax bracket. The top rate for individuals was reduced from 39.6% down to 37%. The top rate for individuals of 37% begins at $500,000 for single taxpayers and $600,000 for married filing jointly. In order to comply with certain budgetary constraints and deficits in the out-years, the Act imposes a sunset or expiration date on many of the individual tax provisions. For tax years beginning January 1, 2026, the schedule of tax rates would expire with a reversion back to the to the Pre-Act tax rates, with a maximum rate of 39.6%, unless changed by Congress.

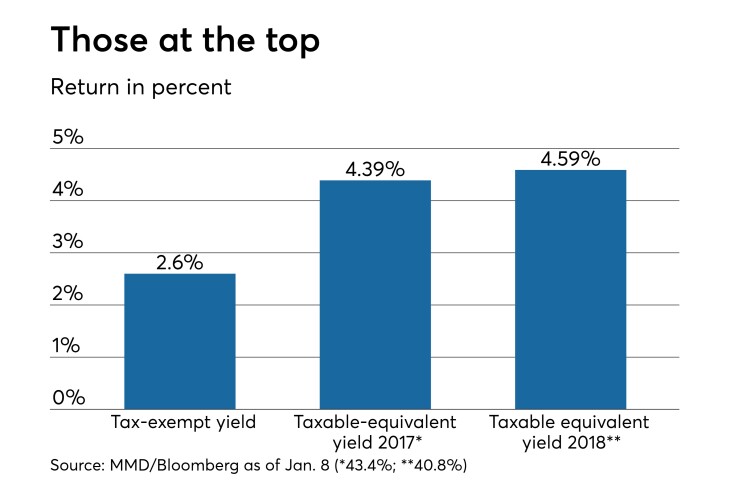

Exhibit 1 demonstrates the impact from the change in the tax rate for individuals in the top tax bracket. Please note that the Net Investment Income Tax (NIIT) of 3.8% was not modified by the Act. Interest on municipal bonds is excluded from the 3.8% tax.

*43.4% tax bracket includes the 39.6% federal tax bracket plus the 3.8% NIIT tax, and state tax. This is the highest bracket.

Impact:

We do not expect a significant impact from the reduction in the top tax rate from 39.6% to 37%. The net result is a slightly lower TEY, but municipals still remain attractive relative to other taxable fixed investments for taxable investment accounts.

State and Local Tax Deduction (SALT) is Capped at $10,000 (Joint) and $5,000 (Married Filing Separately).

Under the prior law, individual taxpayers that itemized their deductions under are generally permitted to deduct from their taxable income several types of nonbusiness taxes paid at the state and local level, including real and personal property taxes, income taxes, and/or sales taxes. Under the Act, for tax years beginning in 2018, individuals that itemized their state and local taxes on Schedule A, all nonbusiness state and local tax deductions, including state and local income and sales taxes and property taxes will be capped at $10,000 ($5,000 for married taxpayers filing a separate return).

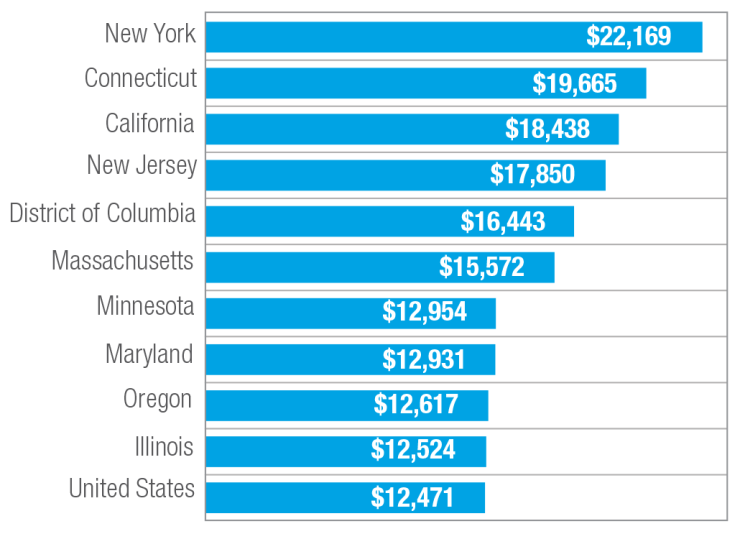

The cap on the SALT deduction is expected to have the most significant impact in high tax states. According to IRS SOI data on itemized deductions in 2015, the average amount of SALT deduction claimed by the top ten states was $17,363 per return or nearly 140% of the national average. The State of New York has the highest average amount of SALT deduction at $22,169 per return, followed by Connecticut at $19,685 and California at $18,438.

The chart below shows the top 10 states and the average SALT deduction for 2015:

Source: IRS Statistics of Income Division, Historical Table 2, September 2017

Impact:

The $10,000 cap on state and local tax deductions could make it challenging for state and local governments in high tax states to continue to deliver the current level of public services as their individual taxpayers will no longer be able to deduct the full amount of state and local taxes from their federal tax returns, which serves to increase the effective federal tax rate. Over time, state and local governments could face resistance to proposed increases in state and local taxes to fund public infrastructure projects and gain approval of general obligation and dedicated tax revenue bond ballot measures. This could pressure finances and have a detrimental impact on credit quality. This may be exacerbated, over the long run, by potential out migration from individuals in high tax states to lower or no tax states. The mortgage deduction caps (discussed below), can also contribute to negative credit forces through price degradation in high price, high tax states that now face SALT deduction limitations.

Many of these high states are evaluating proposals which would shift an income tax to an payroll tax that would be tax deductible under federal law or allow individual tax payers to tax a federal tax deduction on amounts that are directly donated to the state and local government, with the individuals receiving a dollar for dollar credit for the donation against their state and local tax obligations. Any new donation/tax credit structures proposed by the individual states would have to pass IRS scrutiny and legal challenges.

The potential positive resulting from the limit on SALT deduction may be a pickup in demand for in-state bonds in the higher tax states. As deductions or write-offs decrease and taxable income increases, in-state tax-free municipals remain an attractive option for portfolios.

Mortgage Interest Deduction for New Acquisition Indebtedness for Housing Capped at $750,000 ($375,000 for Married Filing Separately)

The Act limits the mortgage interest deduction as an itemized deduction on $750,000 of new acquisition indebtedness ($375,000 in the case of married taxpayers filing separately). The prior law permitted interest on underlying mortgage loans that represent acquisition indebtedness of up to $1 million ($500,000 for married individual filing separately) plus home equity indebtedness of up to $100,000 to be deductible. While tax payers with mortgages executed prior to 12/31/2017 still can deduct interest associated with the loan of up to $1 million, the deduction on home equity interest is suspended. The law remains in forces for tax years beginning December 31, 2017 and before January 1, 2026.

Impact:

The cap on the interest on mortgage debt that is deductible under federal income tax will have a negative impact on housing prices in certain areas with high housing values. Mortgage applications will now have to factor in the ability of the applicant to qualify if a portion of the interest on the mortgage is no longer tax deductible. The $10,000 cap on SALT deductions could further impact the mortgage qualification process for high value housing in certain markets such as New York, California, and New Jersey. With less ability to reduce federal taxable income through itemized deductions, investors in high tax states could serve to tighten spreads on in-state municipal bonds by becoming buyers of in-state municipals

Individual AMT Retained, But Modified with Higher Exemption Amounts

Under the Act, for tax years beginning after December 31, 2018 and before January 1, 2026, the AMT exemption for individuals is increased from $86,200 for individuals to $109,400 for joint returns and surviving spouses, from $55,400 to $70,300 for single filers and from $43,100 to $54,700 for married couples filing separately. The AMT phase out amount have been increased from $508,900 to $1 million for married filing jointly, from $344,700 to $500,000 for individuals and from $254,450 to $500,000 for married couples filing separately. The net result of the changes will result in significantly fewer individuals being subject to the AMT tax.

Impact:

With far fewer individuals exposed to the AMT due to the higher exemption and phase-out amounts, we expect that the spread between AMT and non-AMT paper will continue to narrow. The market already tightened spreads prior to the final bill. That trend should continue as more investors learn they are no longer subject to the AMT tax.

CORPORATE PROVISIONS:

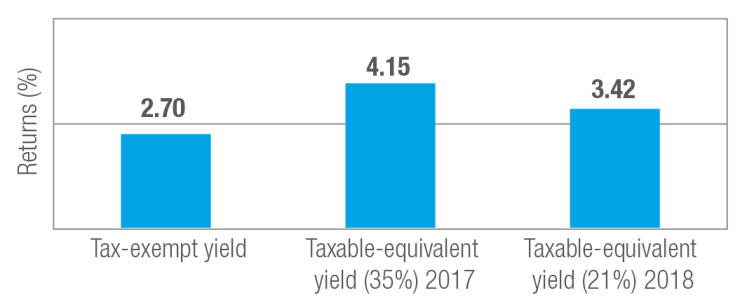

There was a significant change for corporate investors in the Act. Under prior tax law, corporations were subject to paying graduated tax rates that started at 15% (for taxable income $0-$50,000, 25% for taxable income of $50,000 to $75,000, 34% for taxable income of $75,001 to $10,000,000, and 35% for taxable income over $10,000,000.

Under the Act, for tax years beginning December 31, 2017, the corporate tax rate is a flat 21%. This is permanent change and a significant one for corporations at the highest tax rate of 35%.

Source: MMD/Bloomberg, as of January 8, 2018.

Impact:

The much lower corporate tax rate makes investing in municipal bonds by banks, insurance companies and corporations less attractive. According to the most recent Flow of Funds data prepared by the Federal Reserve, US chartered banks hold 14.73% of outstanding municipals, property-casualty insurance companies holds 9.0% of outstanding municipals, and life insurers hold 4.94% of outstanding municipals. Given that much of the municipal portfolios of banks and insurance companies were purchased during a period of higher book yields, we do not expect that these investors would become net sellers after the Act unless rates rose significantly higher and the ability to replace current book yields opportunistically materialized. We would expect that banks and P&C insurance companies would become “opportunistic” buyers of municipals when the ratio of municipals to treasuries becomes attractive. This could lead to increased market volatility and higher yields/wider spreads during periods of mutual fund outflows, until levels reach attractive levels. With respect to demand from the banks, municipals are expected to be granted HQLA 2B status which would further incent banks to be holders of municipals. This would allow certain municipal bonds to count toward LCR (Liquidity Coverage Ratios) which must be periodically calculated under Dodd Frank.

Corporate Alternative Minimum Tax (AMT) is repealed

Under prior tax law, a corporate alternative tax (AMT) of 20% is imposed with certain exemption and phase out amounts.

Under the Act, for tax years beginning after December 31, 2017, the corporate AMT is repealed.

Impact:

The elimination of corporate AMT increases the relative attractiveness of AMT bonds for certain corporate investors. The loss of new AMT carry forwards reduces the benefit of tax-exempt income for property and casualty insurance investors. Overall no significant impact to the market from this provision.

Market Related Factors:

Elimination of Tax-Exempt Advance Refundings

Under the Act, interest on advance refunding bonds (i.e., refunding bonds issued more than 90 days prior to the redemption of the refunded bonds) would be taxable. Interest on “current” refunding bonds would continue to be tax-exempt. The effective date for this provision applies to bonds issued after 12/31/2017. Municipal borrowers would only be able to refinance their outstanding governmental purpose debt under a “current” refunding, where the municipal securities being refunded will mature of be redeemed within 90 days from the date of issuance of the refunding issue.

Impact:

The elimination of tax-exempt advance refundings is projected to significantly reduce the gross and net supply of tax-exempt bonds over the next three years. Market participants estimate that the elimination of advance refundings would reduce annual municipal supply by 10% to 15%. The inability to conduct advance refundings limits the ability of state and local government borrowers to take advantage of current low interest market conditions to reduce the costs of financing their existing municipal debt. Bond refundings have been used by state and local governments to achieve present value savings on interest costs. The low interest rate environment over the past several years has enabled governmental borrowers to achieve significant debt service savings. According to J.P. Morgan, the average issuance of tax-exempt refundings over the past ten years was $53 billion. In 2015, according to the IRS, Statistics of Income Division, the amount of advance refunding of tax-exempt governmental bonds in 2015 was $117.509 billion issued through 3,029 issues. This was equal to around 30% of total long-term issuance in 2015. There could be an increase in taxable advance refundings. We also expect that due to the elimination of tax-exempt advance refundings that municipal issuers over time will seek to migrate from a premium coupon structure (5.0%) with a standard 10-year call provision to market yield coupons and a 5-7 year call protection. Market acceptance of this potential structural change will be a question mark as will the cost to issuers of using a non-standard structure.

CONCLUSION:

The immediate impact of the tax bill will come from the supply/demand technical aspect of the market. The market should see less supply, certainly in January and likely the first quarter, due to the amount of advanced refunding and PAB issuance that was pulled forward ahead of the Act. Lower municipal supply combined with potentially increased demand, as investors realize the impact from losing significant deductions, should provide a solid backdrop to the municipal market for at least the early part of this year. As noted, there is discussion in some high tax states of potentially modifying their tax systems or creating charitable giving through governmental funds which will have to be monitored for their impact assuming they are recognized by the IRS. The slightly lower tax rate at the highest income levels, does not result in a significant change in value that would be detrimental to demand for the asset class. Corporate participation, in the tax-exempt market, will become more opportunistic in nature as the lower 21% tax rate does significantly change the relative value proposition for those entities.

The credit impacts from the Act are longer term in nature and less certain. SALT elimination and the $750,000 mortgage cap could weigh on property values through lower Assessed Valuations (AVs) over the medium to long term. Based on the most Federal Reserve data for Q317, 81% of tax revenues at the local level come from property taxes. Lower AVs could result in lower property tax revenues particularly in those locales that have less flexibility to raise taxes, those with high property values and taxes. State tax revenue is predominantly derived from two sources: income (50%) and sales tax (42%). Lower tax rates for corporations and individuals are expected to provide a marginal boost to the economy. Street estimates are for a .2-.3% increase to GDP as a result of the Act. The realization of economic improvement and its magnitude will ultimately decide if the if there is a net credit impact on states from the potential issues at the county, city, and local levels.

The structural impacts from the Act will play out overtime but pose many questions. With the loss of advanced refundings, do issuers attempt to sell issues with lower coupons and shorter calls? Do investors accept this change but get compensated for less call protection (note at one time the standard structure for a municipal term bond was a 5.00 coupon with a 10 year premium call declining to par in 8 years). Do we see more bullet, non-call structures? If these changes occur, what is the impact to the duration of the market? All of these could potentially result in significant structural changes to the municipal market. Time will tell.