-

Based in New York City, Ted Hynes has almost 40 years of experience in the fixed-income markets, the last 15 at Raymond James.

February 26 -

The bonds are rated Aa2 by Moody's Investors Service, AA by S&P Global Ratings and Fitch Ratings and AA-plus by Kroll Bond Rating Agency. All four rating agencies have a stable outlook on the credit.

February 26 -

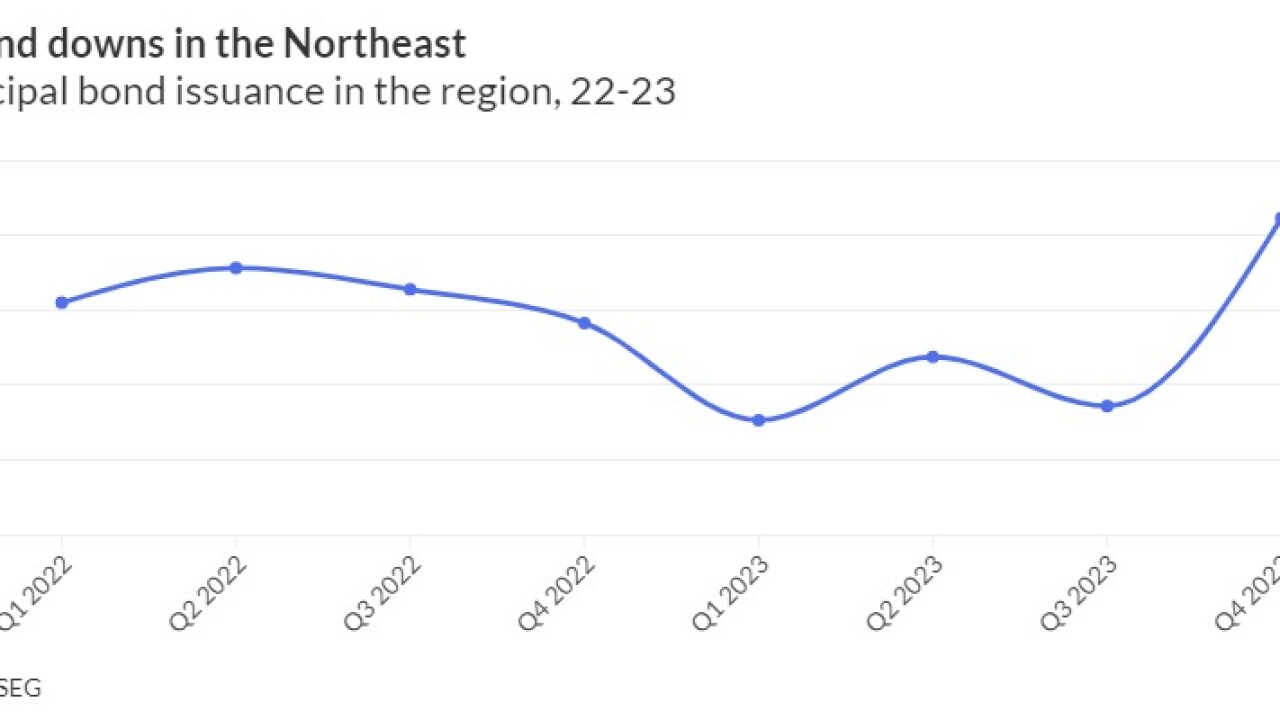

An off year from municipal bond issuers in the Northeast in 2023 pulled the national volume numbers into negative territory.

February 26 -

Supply is expected to increase in the coming weeks, and there may be more rate-direction volatility, said Kim Olsan, senior vice president of municipal bond trading at FHN Financial.

February 22 -

The top five bond financings have an average dollar volume of nearly $1.5 billion.

February 21 -

Robert Poole, a leading expert in the U.S. public-private partnership transportation sector, joins infrastructure reporter Caitlin Devitt to talk about upcoming deals including toll lanes and bridges in the Southeast and high speed rail in the West as well as states that are advancing P3s and action on the federal front. (37 minutes)

February 20 -

Meanwhile in New York, the state doubles down on climate investments and restricts investments in some big oil and gas companies as the city blasts several big banks as they pull out from the Climate Action 100+ initiative.

February 16 -

Messina, a veteran public finance lawyer, will focus on senior living and life-plan communities.

February 14 -

The value of the fund rose from the $246.3 billion reported in the second quarter while returns improved to 6.18% in the third quarter from negative 1.59% in the prior period.

February 13 -

Maura Healey's budget plan for fiscal 2025 features more money for the Commonwealth Transportation Fund, which would increase its bond capacity by $1.1 billion.

February 13