Municipals improved Tuesday on the back of a strong primary led by the Washington Metropolitan Area Transit Authority's $788 million green bonds, gilt-edged Loudoun County, Virginia, and the New Jersey Infrastructure Bank, which sold competitively with tight spreads.

Triple-A municipal benchmark yield curves were bumped one to two basis points, lagging a four basis point rally in U.S. Treasuries after weaker economic data and dovish comments from Fed officials moved equities lower.

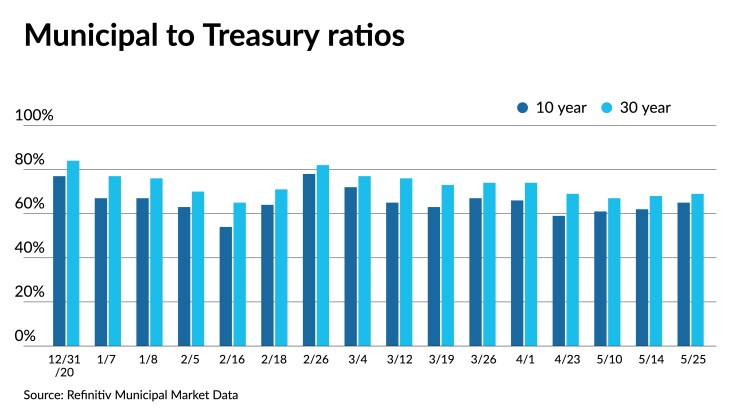

Municipal to UST ratios were higher as a result, closing at 65% in 10 years and 69% in 30 years on Tuesday, according to Refinitiv MMD. ICE Data Services saw ratios on the 10-year at 63% and the 30-year at 70%.

A larger number of deals coming to market across all credit sectors has offered up a fair amount of distraction for inventory distribution, said Kim Olsan, senior vice president at FHN Financial.

"The result is that secondary selling has trailed off to a daily figure of less than $500 million par value, likely a function of hefty cash inflows into mutual funds and allocations into the asset class from other constituents providing funds for syndicate settlements," Olsan said. Friday's bids-wanteds list totaled $388.9 million, slightly up from Thursday's $277.6 million.

Dealer holdings have risen in May.

"May’s daily trade count is 7% lower than the first four months of the year while dealer position carry has increased from $8.8 billion at the end of April to $10.9 billion as of May 12," she noted. "The mismatch in focus between the primary and secondary markets is offering inquiry a chance to find modest concession in older line items."

Dealer positioning will become more relevant if supply materializes as expected, Olsan said.

Since 2016, the June-July-August period has seen average dealer carry fall from a $25 billion high in 2018 to 2020’s $11 billion, Olsan said.

Lower dealer inventories have translated into pressure on municipal rates, as was seen in February during 2021's first sell-off. At that time, selling pressure was not being seen but dealer carry actually fell and exacerbated liquidity constraints.

In the current market climate, demand and the lack of supply is keeping things steady, with liquidity at the moment not a big concern.

In the negotiated market Tuesday, BofA Securities repriced $788.8 million of dedicated revenue green bonds (Climate Bond Certified) for WMATA (/AA/AA/AA+) with bumps of five to 11 basis points. Bonds in 2023 with a 5% coupon yield 0.13% (-7), 5s of 2026 at 0.56% (-5) 5s of 2031 at 1.15% (-5), 3s of 2036 at 1.71% (-8), 5s of 2041 at 1.52% (-9), 5s of 2046 at 1.64% (-11) and 4s of 2046 at 1.80% (-10).

In the competitive market, Loudoun County, Virginia, (Aaa/AAA/AAA/) sold $156.5 million of unlimited tax general obligation bonds to Morgan Stanley & Co. LLC. Bonds in 2021-2022 and 2034-2040 were all away, with 5s of 2021 at 0.07%, 5s of 2022 at 0.10%, 5s of 2026 at 0.53%, 4s of 2031 at 1.05%, 2s of 2036 at 1.77% and 2s of 2040 at 1.92%, callable in 12/1/2030.

The New Jersey Infrastructure Bank (Aaa/AAA/AAA/) sold $118.6 million of environmental infrastructure green bonds to BofA Securities. Bonds in 2022 with a 5% coupon yield 0.10%, 5s of 2026 at 0.53%, 3s of 2031 at 1.11%, 2s of 2036 at 1.78%, 2s of 2041 at 2.07%, 2s of 2046 at 2.20% and 2.25s of 2050 at 2.32%.

Frisco, Texas, ISD (Aaa/AAA//) PSF guarantee (Aa1/AA+// underlying) sold $90 million of unlimited tax general obligation bonds to Citigroup Global Markets Inc. with 4s of 2022 at 0.09%, 5s of 2026 at 0.50%, 4s of 2031 at 1.07%, 2s of 2036 at 1.79%, 2s of 2041 at 2.03%, 2.125s of 2046 at 2.20% and 2.25s of 2051 at 2.32%.

BofA Securities priced $92.8 million of tax-exempt major new infrastructure project revenue bonds for Ohio (Aa2/AA//) with 5s of 2021 at 0.10%, 5s of 2022 at 0.12%, 5s of 2026 at 0.61%, 5s of 2031 at 1.10% and 5s of 2032 at 1.23%. A taxable tranche, $58 million, saw bonds priced at par at 0.15% in 2021 and 0.52% in 2024.

Citigroup Global Markets priced $105.1 million of solid waste disposal revenue bonds (Waste Pro USA, Inc. Project) for the Florida Development Finance Corp. (////). Bonds in 2032 with a 3% coupon yield 2.375%.

Secondary trading and scales

Trading showed Hawaii 5s of 2022 at 0.11%. New York City TFA 5s of 2022 at 0.11% versus 0.13% Monday. King County School District #405, Washington, 5s of 2023 at 0.19% versus 0.22% Monday. North Carolina 5s of 2023 at 0.19%. Anne Arundel 5s of 2025 at 0.42%-0.41%.

Baltimore County, Maryland, 5s of 2028 at 0.77%. Maryland 5s of 2029 at 0.91%. Virginia College Building Authority 5s of 2029 at 1.00%.

West Virginia 5s of 2033 at 1.25% versus 1.27% original. Fairfax County, Virginia, 4s of 2038 at 1.41%-1.40% versus 1.57% original. Massachusetts water green bond 5s of 2039 at 1.35% versus 1.38% on May 8 and 1.44% original. Charlotte, North Carolina, 3s of 2039 at 1.61%-1.60% versus 1.65%-1.61% Friday. West Virginia 5s of 2042 at 1.57% versus 1.59% original.

On Refinitiv MMD’s AAA benchmark scale, yields were bumped one basis point to 0.09% in 2022 and 0.13% in 2023, the 10-year stayed at 1.01% and the 30-year dropped one basis point to 1.56%.

The ICE AAA municipal yield curve showed yields fall two basis points to 0.09% in 2022 and 0.14% in 2023, the 10-year fell a basis point to 1.00% while the 30 fell two to 1.57%.

The IHS Markit municipal analytics AAA curve showed yields fall one basis point to 0.09% in 2022 and 0.12% in 2023, the 10-year to 0.97% and the 30-year to 1.56%.

The Bloomberg BVAL AAA curve showed yields steady at 0.08% in 2022 and 0.10% in 2023, steady at 0.97% in the 10-year and the 30-year fell two to 1.56%.

The 10-year Treasury was yielding 1.56% and the 30-year Treasury was yielding 2.26% near the close. Equities were down on the day with the Dow losing 119 points, the S&P 500 fell 0.32% and the Nasdaq lost 0.14% near the close.

Inflation redux

Tuesday’s economic data was “mostly disappointing” according to one analyst, and Wall Street may be ready to see inflation as transitory.

“Inflationistas look like they might be ready to throw in the towel, as we are supposed to be seeing accelerating growth and mounting price pressures, but right now the surge across commodity prices has eased, the housing market hit a top, and consumers’ short-term optimism retreated,” according to Ed Moya, senior market analyst for the Americas at OANDA. “The inflation debate is not over, but the majority of Wall Street believes it will be transitory.”

The latest reads, which show higher inflation, do “not appear to be the precursor of a persistent movement to undesirably high levels of inflation,” Federal Reserve Bank of Chicago President Charles Evans said Tuesday morning in a virtual event hosted by the Bank of Japan. “I have not seen anything yet to persuade me to change my full support of our accommodative stance for monetary policy or our forward guidance about the path for policy.”

Federal Reserve Bank of Richmond President Thomas Barkin noted that market measures of inflation haven’t yet reached 2% on an annual basis.

And Fed Vice Chair Richard Clarida said “in upcoming meetings" the Federal Open Market Committee may be able to begin discussing tapering asset purchases. But, he hedged in the Yahoo! Finance interview, saying, “It’s going to depend on the flow of data that we get.”

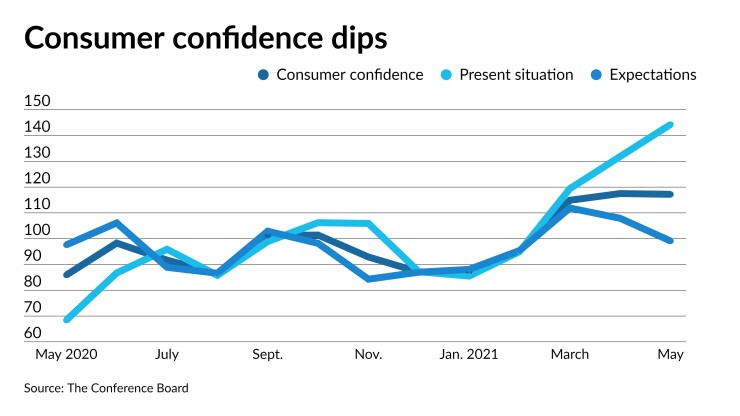

The consumer confidence index slipped to 117.2 in May from a downwardly revised 117.5 in April, originally reported as 121.7, the Conference Board reported.

Economists polled by IFR Markets expected a 119.0 read.

The present situation index gained to 144.3 from a revised 131.9, originally reported as 139.6 and the expectations index dropped to 99.1 from a revised 107.9, first reported as 109.8.

With “millions of job openings,” Moya said, “no one was surprised that the present situation improved.” But the “massive drop” in expectations Index showed a massive drop, which could show some data have peaked. “If growth is already starting to slow down, this will support the argument that inflation will be transitory.”

As the COVID pandemic and restrictions ease, “what's got consumers still feeling so down?” asked Wells Fargo Senior Economist Tim Quinlan and Economic Analyst Sara Cotsakis. “A case can be made that while consumer see a light at the end of the tunnel, some are still wondering if that light is an oncoming train. A pandemic mindset, we are learning, is a hard thing to shake.”

While confidence slipped as did expectations, based on inflation concerns that “could rattle confidence for a while,” they said, although the Wells Fargo economists see “robust” spending in the months ahead.

Separately, new homes sales fell 5.9% to a seasonally adjusted annual pace of 863,000 in April, from a downwardly revised rate of 917,00 in March, originally reported as 1.021 million.

Economists polled expected 975,000 sales in the month.

Year-over-year sales are up 48.3%.

“We doubt the lower April sales figure marks a major deceleration for new home sales,” said Mark Vitner, senior economist at Wells Fargo Securities, “though the latest round of price increases may be giving some would-be buyers pause.”

The median sales price gained to $372,400 in April from $334,200 in March, while the average price rose to $435,400 from $400,500.

“Record-low mortgage rates are not enough to overcome the supply shortfall and erosion in affordability,” said Yelena Maleyev, economist at Grant Thornton. “Look for home sales to remain constrained, competition among buyers intense and the upward pressure on inflation to compound as we move into the summer.”

Moya said, “The housing market is poised to cool down as inventories are tight, home builders are dealing with surging prices of lumber and concrete, and lastly while many Americans embrace the return of pre-pandemic life in the big cities.”

Another read of home prices, the S&P CoreLogic Case-Shiller index showed a 13.2% rise in March from a year ago, after a 12.0% jump in the 12 months ending in February.

In the month, prices rose 2.0% across the nation.

Economists anticipated annual growth of 12.3% and a monthly gain of 1.3%.

The 13.2% gain was the highest since December 2005, according to the release.

The 10-city composite grew 12.8% year-over-year in March after rising 11.7% the month before, while the 20-city composite jumped 13.3% year-over-year after 12.0% growth reported a month earlier.

The 10-city composite increased 2.0% in the month and the 20-city grew 2.2%.

Also, non-manufacturing activity in the Philadelphia region suggested continued expansion, as business activity at the firm level increased to 36.9 in May from 36.3 in April, while at the firm level, activity climbed to 22.1 from 21.5.

The prices paid index soared to an all-time high of 49.1 from 32.9, while prices received rose to 16.6 from 14.5..

Also released Tuesday, manufacturing activity strengthened in the Richmond Federal Reserve district in May, with the manufacturing index increasing to 18 from 17 the prior month.

The prices paid index climbed to 9.82 from 7.11 and the prices received index gained to 5.41 from 4.83.

Activity in the Richmond district’s service sector improved in May, as the revenues index increased to 29 in May from 22 in April.

The demand index reached an all-time high of 43, besting the previous high of 32 last month.

The prices paid index gained to 5.34 from 4.79 and the prices received index rose to 3.37 from 2.78.

The survey noted the “Growth of prices paid outpaced that of prices received, but participants expected that gap to narrow in the near future.”

Primary market to come

Main Street Natural Gas, Inc. (//AA/) is on the day-to-day calendar with $771.6 million of gas supply revenue bonds, Series 2021A, serials 2022-2028, term 2051, puts due 12/01/2028. RBC Capital Markets is head underwriter.

The University of Nebraska Facilities Corp. (Aa1/AA//) is set to price on Wednesday $344.79 million of university facilities program bonds, $260.6 million of series 2021A, and $84.2 million of green Series 2021B. BofA Securities is lead underwriter.

The California Public Finance Authority (////) is set to price on Wednesday $307.9 million of Enso Village Project senior living revenue and refunding green bonds, Series 2021A,B-1,B-2,B-3&C. Ziegler will run the books.

Houston Combined Utility System (/AA/AA/) is set to price on Wednesday $259.5 million of first lien revenue refunding bonds, serials 2022-2041, terms 2046, 2051. UBS Financial Services Inc. is lead underwriter.

The System is also set to price on Wednesday $100.3 million of taxable first lien revenue refunding bonds, Series 2021B, serials 2021-2038. UBS Financial Services Inc. is head underwriter.

The CSCDA Community Improvement Authority (////) is set to price on Wednesday $216.9 million of essential housing revenue bonds, (Union South Bay) Series 2021 A-1 & A-2 (social bonds) consisting of $35 million Series A-1, serial 2045 and $181.9 million of Series A-2, serial 2056. Stifel, Nicolaus & Company, Inc. is head underwriter.

The Alaska Municipal Bond Bank (A1/A+//) is set to price $201.7 million of general obligation and refunding taxable bonds on Wednesday. BofA Securities is bookrunner.

The North Carolina Medical Care Commission (////) is set to price $149.8 million of health care facilities first mortgage revenue bonds (Lutheran Services for the Aging), Series 2021 A&C, consisting of $114.2 million of Series A, serials 2022-2031, terms 2036, 2041, 2051. The second, $35.6 million of Series C, serials 2022-2031, terms 2036, 2042. Truist Securities Inc. is lead underwriter.

Hawaii (Aa2/AA+//) is set to price on Thursday $145.7 million of highway revenue bonds. Morgan Stanley & Co. LLC is bookrunner.

The City of El Segundo, Los Angeles County, (/AA+//) is set to price on Wednesday $144.1 million of taxable pension obligation bonds. J.P. Morgan Securities LLC is head underwriter.

The Wisconsin Housing and Economic Development Authority (Aa2/AA//) is set to price $128.1 million of home ownership revenue bonds, 2021 Series A (non-AMT social bonds), serials, 2021-2032, term 2052. RBC Capital Markets is lead underwriter.

The South San Francisco Public Facilities Financing Authority (/AA+//) is set to price on Wednesday $100 million of lease revenue bonds, Series 2021A. Stifel, Nicolaus & Company, Inc. is lead underwriter.