DALLAS — Wayne County, Michigan's fiscal progress landed it a positive ratings credit outlook that brings it closer to returning to investment grade.

S&P Global Ratings revised the outlook on the county's limited-tax general obligation debt to positive from negative Thursday and affirmed its BB-plus rating, one notch into junk territory. The review comes ahead the county's upcoming sale of $173 million of limited-tax general obligation delinquent tax notes.

S&P assigned the notes its short-term rating of SP-1.

The outlook change recognizes the county's recent significant cost savings and reductions in long-term liabilities.

"We feel that the approved adjustments are helping the county return to structural balance, and that they will likely lead to the county maintaining a structural balance with positive operating reserves," said S&P analyst John Sauter. "If the county remains on course with its recovery plan and executes the structural changes, thereby fully returning to and maintaining structural balance, we may consider raising the rating."

The county, which has been working under a state consent agreement since 2015, has eliminated a nearly $100 million accumulated deficit and a yearly structural deficit of approximately $52 million.

The county is still challenged by unfunded pension liabilities, tallied at $840.5 million in its most recent pension audit in 2014.

It is required to make a $63 million payment this year as part of its annual obligation to the pension fund. Earlier this month, Wayne County Executive Warren C. Evans announced plans to make $71.5 million of supplemental pension payments.

The county would use $57.5 million from its tentative agreement to sell a county-owned sewer system to Downriver Utility Wastewater Authority to cover part of the payment. The county also anticipates making a $14 million payment from fund balances.

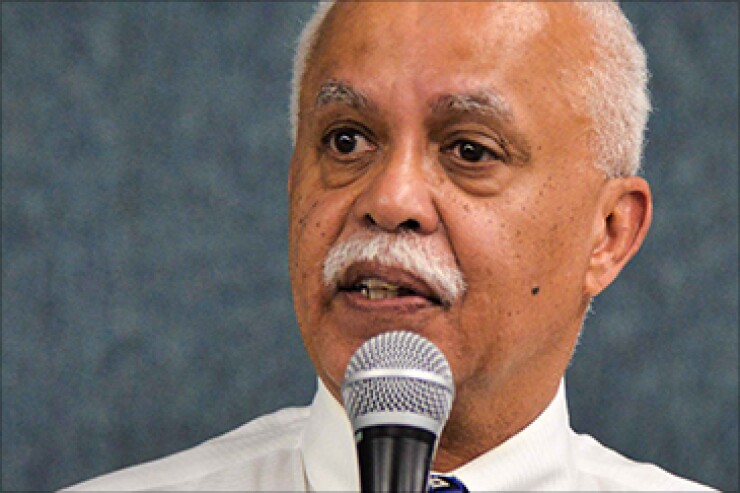

"Our commitment to carry out the recovery plan has put Wayne County on the path to financial stability," Evans said. "We still have a long road to travel before we reach our final destination, but this Standard and Poor's outlook is proof that we're headed in the right direction."

The county is expected to request release from the consent agreement this year.

"The S&P outlook further proves that Wayne County is headed in the right direction," said county spokesman James Canning.

The county is not yet out of the woods, S&P warned.

"If management conditions weaken and the recovery plan is not executed as expected, or there is another delay in returning to structural balance, we could revise the outlook back to stable or potentially even take negative rating action," analysts wrote. "The ongoing issues with the county jail project also have potential to cause rating pressure if not cured."

In 2010 the county sold $200 million of taxable recovery zone economic development bonds through the Wayne County Building Authority to fund a new jail in downtown Detroit. The county has spent about $157 million so far but the jail remains unfinished and costs Wayne County an average of $1.2 million every month from its general fund for bond payments.

The upcoming borrowing is secured by 2015 property taxes due to the county and to its underlying taxing units. Interest charges and administration fees on delinquent taxes are also pledged to the notes.

The county intends to use proceeds to purchase delinquent real property taxes for levy year 2015 taxes from its underlying taxing units. Total delinquencies, which will secure the notes, amount to $204.2 million. The notes carry a final maturity of Dec. 1, 2018.

In February, Moody's Investors Service revised the outlook on its Ba3 GO limited tax bond rating upward to stable from negative. The county has $518 million of long-term GOLT debt outstanding.