Municipal bond volume will dip to a more average 2018 level next week. Ipreo estimates weekly bond volume at $5.3 billion, down from a revised total of $8.1 million this week, according to updated data from Thomson Reuters. The calendar is composed of $3.45 billion of negotiated deals and $1.85 billion of competitive sales.

Positive inflows into municipal mutual funds as well as support for new issues continued to drive market activity on Friday morning — despite the fact that increasing prices on the short end of the yield curve gave some investors pause on Thursday, according to a New York trader.

Primary

New York issues dominate next week’s bond calendar.

On Wednesday, the New York City Transitional Finance Authority is coming to market with $1.15 billion of bonds.

JPMorgan Securities is set to price the TFA’s Fiscal 2019 Series A Subseries A1 tax-exempt future tax secured subordinate bonds.

The deal is rated Aa1 by Moody’s Investors Service and AAA by S&P Global Ratings and Fitch Ratings.

Also Wednesday, the TFA is competitively selling $300 million of taxable bonds in two sales consisting of $165.5 million of Fiscal 2019 Series A Subseries A3 future tax secured subordinate bonds and $134.5 million of Fiscal 2019 Series A Subseries A2 future tax secured subordinate bonds.

Bank of America Merrill Lynch is set to price the Dormitory Authority of the State of New York’s $559 million of Series 2018A tax-exempt and Series 2018B taxable revenue bonds for the Montefiore Obligated Group.

The DASNY deal is rated Baa2 by Moody’s and BBB by S&P.

JPMorgan is expected to price the Idaho Health Facilities Authority’s $315.85 million of Series 2018B revenue bonds for St. Luke’s Health System on Wednesday.

The deal is rated A3 by Moody’s and A-minus by S&P.

Wells Fargo Securities is set to price the California Infrastructure and Economic Development Bank’s Series 2018A, B, C and D revenue bonds in index mode of LIBOR floating-rate notes on Tuesday.

The IBank issue, for the California Academy of Sciences in San Francisco, is rated A2 by Moody’s.

Bond Buyer 30-day visible supply at $7.83B

The Bond Buyer's 30-day visible supply calendar increased $243.6 million to $7.83 billion on Friday. The total is comprised of $3.63 billion of competitive sales and $4.20 billion of negotiated deals.

Secondary market

Municipal bonds were mostly stronger on Friday, according to a midday read of the MBIS benchmark scale. Benchmark muni yields fell as much as one basis point in the five- to 30-year maturities while rising less than a basis point in the one- to four-year maturities.

High-grade munis were also mostly stronger, with yields calculated on MBIS’ AAA scale falling as much as a basis point in the five- to 30-year maturities while rising less than a basis point in the one- to four-year maturities.

Municipals were mixed on Municipal Market Data’s AAA benchmark scale, which showed the 10-year muni general obligation yield rising as much as one basis point while the yield on the 30-year muni maturity was unchanged.

Treasury bonds were weaker as stocks traded higher.

On Thursday, the 10-year muni-to-Treasury ratio was calculated at 84.1% while the 30-year muni-to-Treasury ratio stood at 98.2%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

For the first time in months, investors broke pattern and noticeably shied away from the front end of the yield curve five years and under — which has become too expensive for their taste, the New York trader said just before the close of trading Thursday.

After spending loads of cash on the short end of the curve for months, some investors put the brakes on as rich yields plateaued while new deals were being priced throughout the day. “They kind of hit a wall today,” he said on Thursday. “The money has been coming in, but it’s the first time in a while after the constant lowering of rates inside of five years that accounts are taking a breather at the new levels.”

Fund flows as measured by ICI, meanwhile, have also been supportive of the municipal market as they have been positive for the last 10 weeks in a row, adding over $900 million into the municipal market, the trader noted. “You’re inflows continue to be positive, which is supporting the market,” he said.

The July reinvestment season has heightened demand for new issues — which should begin to offset the richness on the short end of the curve as new deals get repriced from their original retail or institutional order periods.

“There’s not a shortage of cash in the market,” he said. “If the market hangs in there, you will continue to see solid support for new issues.”

Previous session's activity

The Municipal Securities Rulemaking Board reported 40,122 trades on Thursday on volume of $15.43 billion.

California, New York and Texas were the states with the most trades, with the Golden State taking 15.776% of the market, the Empire State taking 13.931% and the Lone Star State taking 9.914%.

Week's actively traded issues

Some of the most actively traded munis by type in the week ended July 20 were from New Jersey, Virginia and Illinois issuers, according to

In the GO bond sector, the N.J. Transportation Trust Fund Authority 5s of 2031 traded 77 times. In the revenue bond sector, the Fairfax County Industrial Development Authority, Va., 4s of 2048 traded 59 times. And in the taxable bond sector, the Illinois 5.1s of 2033 traded 27 times.

Week's actively quoted issues

Puerto Rico and California names were among the most actively quoted bonds in the week ended July 20, according to Markit.

On the bid side, the Puerto Rico Sales Tax Financing Corp. taxable 6.05s of 2036 were quoted by 49 unique dealers. On the ask side, the California taxable 7.625s of 2040 were quoted by 97 dealers. And among two-sided quotes, the California taxable 7.55s of 2039 were quoted by 30 dealers.

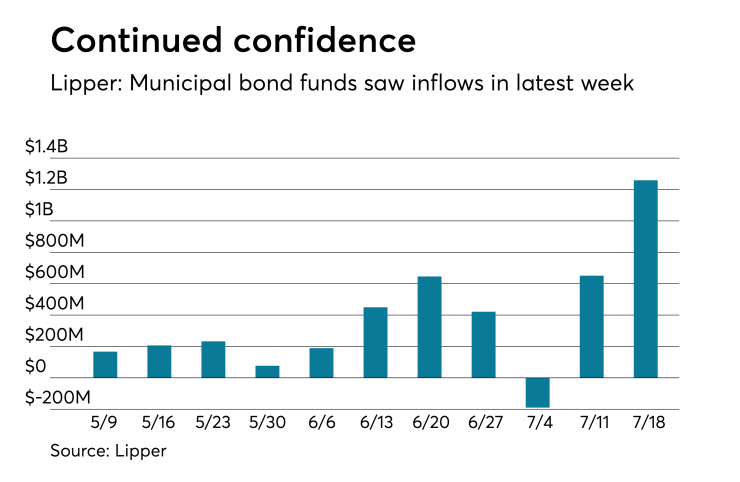

Lipper: Muni bond funds saw inflows

Investors in municipal bond funds showed continued confidence and once again put cash back into the funds during the latest reporting week, according to Lipper data released on Thursday.

The weekly reporters saw $1.26 billion of inflows in the week ended July 18, after inflows of $650.966 million in the previous week.

Exchange traded funds reported inflows of $74.167 million, after inflows of $22.877 million in the previous week. Ex-ETFs, muni funds saw $1.18 billion of inflows, after inflows of $628.089 million in the previous week.

The four-week moving average remained positive at $535.401 million, after being in the green at $382.277 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds had inflows of $583.602 million in the latest week after inflows of $438.059 million in the previous week. Intermediate-term funds had inflows of $530.958 million after inflows of $168.848 million in the prior week.

National funds had inflows of $1.17 billion after inflows of $621.558 million in the previous week. High-yield muni funds reported inflows of $313.810 million in the latest week, after inflows of $313.919 million the previous week.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.