Competitive sales from the states of Washington and Wisconsin and negotiated deals from New York and Illinois issuers dominated Tuesday’s new issue slate.

In secondary trading, municipals bonds weakened slightly at mid-session.

Primary market

In the competitive arena, Washington state sold $742.59 million of Series R-2018C various purpose general obligation refunding bonds on Tuesday. Bank of America Merrill Lynch won the bonds with a true interest cost of 2.75%.

The issue was priced as 5s to yield from 1.05% in 2018 to 2.72% in 2035. The deal is rated Aa1 by Moody’s Investors Service and AA-plus by S&P Global Ratings and Fitch Ratings.

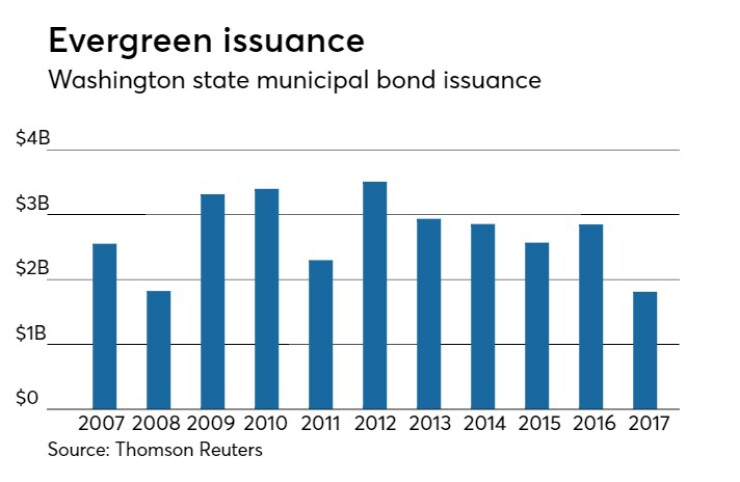

Since 2007, the Evergreen State has issued almost $30 billion of bonds, with the most issuance occurring in 2012 when it sold $3.51 billion of debt. Prior to this year, the state sold the least amount of bonds in 2008, when it issued $1.83 billion.

Wisconsin sold $277.71 million of Series 2017B GOs. Wells Fargo Securities won the bonds with a TIC of 3.446%.

The issue was priced to yield from 1.25% with a 5% coupon in 2019 to 2.43% with a 5% coupon in 2038. The deal is rated AA by S&P and AA-plus by Fitch.

Citigroup priced the Metropolitan Pier and Exposition Authority’s $496 million of McCormick Place expansion project and expansion project refunding bonds.

The $248.16 million of Series 2017A bonds consisted of $190 million of bonds priced as 5s to yield 4.50% in 2057 and $58.16 million of zeros coupon capital appreciation bonds priced to yield 5.25% in 2056.

The $247.85 million of Series 2017B refunding bonds were priced as 5s to yield from 3.40% in 2025 to 4.19% in 2034. They were also structured as zero coupon CABs to yield 4.75% in 2037, 4.875% in 2042, 5% in 2048, 5.25% in 2053, 5.50% in 2054, and 4.60% in 2056.

The deal is rated BB-plus by S&P and BBB-minus by Fitch except for the Series 2017B CABs 2056 maturity which is insured by Assured Guaranty Municipal and rated AA by S&P.

Barclays Capital priced the New York City Municipal Water Finance Authority’s $392.48 million of Fiscal 2018 Series CC water and sewer system second general resolution revenue bonds for institutions after holding a one-day retail order period.

The $332.95 million of Subseries CC-1 bonds were priced as 3s to yield approximately 3.103% and as 4s to yield 3.06% in a split 2037 maturity and as 4s to yield 3.19% and as 5s to yield 2.92% in a split 2048 maturity. The $59.53 million of Subseries CC-2 bonds were priced as 5s to yield 1.55% in 2024 and 1.65% in 2025.

The deal is rated Aa1 by Moody’s and AA-plus by S&P and Fitch.

JPMorgan Securities priced Norfolk, Va.’s $162.73 million of general obligation capital improvement and refunding bonds.

The $103.54 million of Series 2017A tax-exempt GO CIBs were priced to yield from 1.24% with a 3% coupon in 2019 to 2.41% with a 5% coupon in 2037. The $59.19 million of Series 2017C tax-exempt GO refunding bonds were priced to yield from 1.12% with a 2% coupon in 2018 to 2.91% with a 4% coupon in 2036; a 2042 maturity was priced as 5s to yield 2.78%.

The deal is rated Aa2 by Moody’s and AA-plus by S&P and Fitch.

Siebert Cisneros Shank priced Tallahassee, Fla.’s $115.41 million of Series 2017 consolidated utility systems refunding bonds on Tuesday.

The issue was priced as 5s to yield from 1.26% in 2019 to 2.49% in 2037; a 2018 maturity was offered as a sealed bid. The deal is rated AA by S&P and AA-plus by Fitch.

Morgan Stanley priced the New Jersey Educational Facilities Authority’s $183.84 million of Series 2017C taxable revenue refunding bonds.

The issue was priced at par to yield from about 45 basis points over the comparable Treasury security in 2020 to about 140 basis points over the comparable Treasury security in 2032 and about 110 basis points over the comparable Treasury security in 2036. The deal is rated A2 by Moody’s and A-minus by S&P.

Bond Buyer reports 30-day visible supply

The Bond Buyer's 30-day visible supply calendar increased $978.0 million to $10.38 billion on Tuesday. The total is comprised of $3.52 billion of competitive sales and $6.85 billion of negotiated deals.

Secondary market

The yield on the 10-year benchmark muni general obligation rose as much as one basis point from 1.99% on Monday, while the 30-year GO yield gained as much as one basis point from 2.69%, according to a read of Municipal Market Data’s triple-A scale.

U.S. Treasuries were mixed on Tuesday. The yield on the two-year Treasury was unchanged from 1.69%, the 10-year Treasury yield declined to 2.38% from 2.40% and the yield on the 30-year Treasury decreased to 2.84% from 2.87%.

On Monday, the 10-year muni-to-Treasury ratio was calculated at 80.6% compared with 82.6% on Friday, while the 30-year muni-to-Treasury ratio stood at 92.6% versus 93.1%, according to MMD.

AP-MBIS 10-year muni at 2.296%, 30-year at 2.808%

The Associated Press-MBIS municipal non-callable 5% GO benchmark scale was mixed in late morning trading.

The 10-year muni benchmark yield rose to 2.296% on Tuesday from the final read of 2.290% on Monday, according to

The AP-MBIS benchmark index is a yield curve built on market data aggregated from MBIS member firms and is updated hourly on the

MSRB: Previous session`s activity

The Municipal Securities Rulemaking Board reported 34,488 trades on Monday on volume of $7.62 billion.