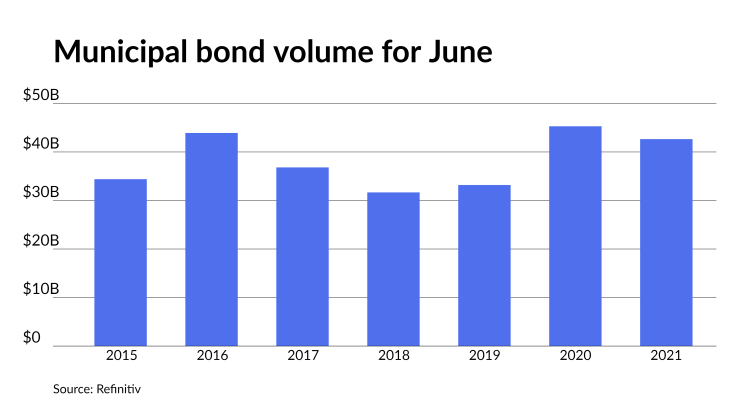

June volume came in more than 18% lower than the same month a year prior and second quarter volume dropped 2.5% year-over-year, but issuance was still $20 billion higher in the first half of 2021 than in 2020.

Total volume fell 18.6% to $42.625 billion in June 2021 from $52.387 billion in 2020, though the first half of the year has reached $222.975 billion, up from $210.4 billion in 2020, according to data from Refinitiv. Last year

Last year's data for the first half was largely distorted by the March/April selloff and there was some issuance that would have come earlier than June, but did not because of the pandemic.

“The month-over-month comparison looks odd because of last year's disruption, but year-over-year, issuance is up," said Pat Luby, senior municipal strategist at CreditSights. "At the top level it’s encouraging for investors looking for paper. The change in tax-exempt issuance is less drastic than I expected at the start of the year.”

Tax-exempt issuance in the month fell 5.8% to $30.057 billion from $32.725 billion, while taxables fell 47% to $9.901 billion, and refundings fell 53.1% to $7.991 billion.

“The fact that taxables are down is because a lot of the financing has been shifting to tax-exempt," Luby said.

Competitive loans were one of the few areas to increase in June, up 53.1% to $10.466 billion from $6.836 billion, which is “probably a function of new-money. Refunding percentages are down and it makes a lot more sense for an issuer to negotiate with a refunding," Luby noted. "So the decline in refundings again probably shifts some of that primary from negotiated to competitive."

Negotiated loans dropped 23% to $32.003 billion. Revenue bonds had the larger share again at $25.384 billion, but fell 21.7% from $32.407 billion in June 2020. General obligation bonds landed at $17.268 billion, or 13.6% less, from $19.979 billion in 2020.

"We’ve got significant amounts of redemptions in July and August, fund flows have been steady, not off the charts, but they are steady. There is demand out there," Luby said. "The wild card is redemptions are huge, but the munis that are being redeemed from banks and insurance companies are tax-exempt. Tax-exempts that are redeemed are unlikely to result in reinvestment in tax-exempts because the yields make zero sense to them right now when compared to taxable yields. I don’t think that 100% of the principle goes back into the exempt market."

That drives the need for taxable munis. Banks and property and casualty insurance companies like the diversification that it adds to an investment-grade portfolio and the taxable yields are more competitive to them.

Sector updates

Sectors that grew in June include transportation at $5.529 billion, a 37.7% increase from $4.016 billion a year ago. Transportation credits have tightened in secondary trading and new-issues have seen strong demand as this sector has improved as reopenings were in full force in June and travel has picked up as a result.

Electric power came in at $2.119 billion, a 138.4% increase from $889 million in June 2020.

Healthcare dropped 54.5% to $1.784 billion from $3.918 billion, this was likely due to more corporate CUSIP debt being issued in the sector.

Colleges and universities also fell 68% to $850 million from $2.656 billion a year prior, for the same reasons as healthcare.

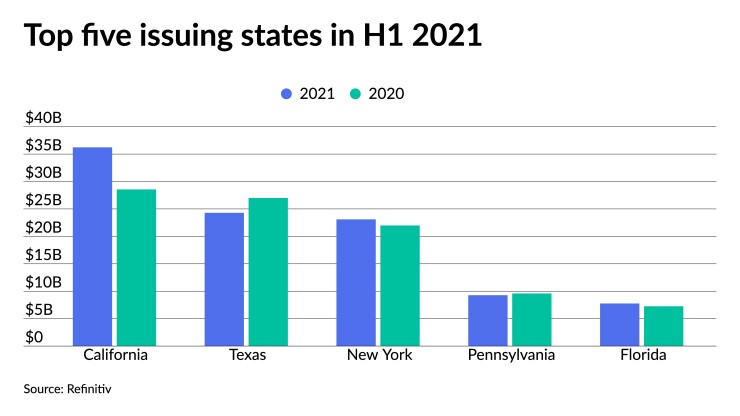

The top five issuers in the first half of 2021 were California with $36.229 billion, a 26.9% increase year-over-year. Texas issuers sold $24.239 billion, a 10% decrease. New York was at $23.095 billion, a 5.1% increase from 2020. Pennsylvania rose to fourth from sixth with $9.273 billion, but issued 3.2% less than a year prior. Florida rounded out the top five with $7.507 billion, a 3.6% increase.

While on the rise for the past year and half, bond insurance fell 32.5% in the month to $2.976 billion in 185 deals from $4.409 billion in 259 deals.

June bank-qualified issuance dropped 36.8% to $1.221 billion from $1.931 billion in 2020.

Private placements fell a whopping 97.4% in June to just $102.3 million in eight issues from $3.902 billion in 172 in June 2020.

Second half 2021 issuance

From 2015-2019, July volume on average has dropped from June. And that makes sense because so many states have fiscal years that begin July 1, and often they complete financings at the end of the prior fiscal year.

“There probably is not as much urgency to get deals done in July, from a historical perspective,” Luby said.

But volume does tend to pick up in August and averages more than September.

Can issuers hit another record year in 2021? Certain factors outside the norm this year complicate that answer, Luby and others say.

The first is the unprecedented federal aid flowing into states and localities. There are still many issuers figuring out what to do with the dollars.

Most issuers likely do not need to worry about borrowing to “get through the other side,” Luby said. “That was the conversation last year, ‘How do we get our finances to the other side of the pandemic?’“

"But we’re approaching the other side of that chasm," he added. "Federal aid has been tremendously helpful. Sales tax collections,

Does that potentially mean traditional municipal bond issuers are not going to need to borrow as much since they already identified what they want to build?, Luby asked, adding, "there probably is not as much urgency to get deals done in July, from a historical perspective."

As the infrastructure debate unfold in Washington, how issuers factor it into their second half 2021 plans will be key.

"Details are very scarce," Luby noted. "For capital improvement plans, most issuers are proceeding with the way things are currently and if something specific comes out of Washington, that could change."

If a program such as a direct-pay taxable bond program makes its way into law, the big question for issuers is can they be structured in such a way that sequestration is not a risk, Luby noted.

"If that turns out to be the case … then yes, there is absolutely demand for it on the investor side," Luby said.