The trustee for $32 million of defaulted bonds that carry Platte County, Missouri's appropriation pledge wants the Missouri Supreme Court to have the last word on whether the county bears legal responsibility for repayment.

UMB Bank NA has so failed to persuade courts of its position that the financing agreement tied to the bonds require the county to make up pledged revenue shortfalls.

The trustee on Wednesday filed a motion seeking a rehearing with the Court of Appeals and also asked for transfer of the case to state’s high court, according to court filings.

An appellate court panel on Aug. 25

Platte County leaders

“The trustee filed those requests with the Court of Appeals on September 9, 2020. If those requests are denied by the Court of Appeals, the trustee can file a request for transfer with the Missouri Supreme Court. The trustee plans to file such a request with the Missouri Supreme Court if the Court of Appeals denies the pending request,” UMB reports in a bondholder

The trustee also reminded bondholders of the existence of an Ad Hoc Committee that all are welcome to join. It allows holders to receive non-public information but the trading of bonds held by any committee members is limited.

"At this point, two courts have found that the trustee’s position is without merit. Both opinions are well founded and are based on the plain language of the Financing Agreement. This is not a situation that warrants rehearing or discretionary transfer to the Supreme Court of Missouri," said Dane Martin, an attorney representing the county.

The litigation dates to November 2018. The county’s lawyers said it sued in the face of UMB’s demand that the shortfall be covered amid a threats of a lawsuit.

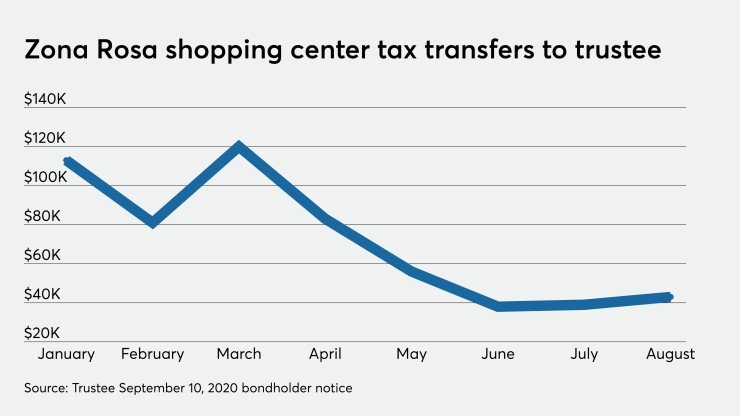

Though the county won't accept legal responsibility to honor the appropriation pledge, the shopping center district does continue to generate revenues pledged to repayment and so bondholders continue to see some payments.

The district has transferred about $563,000 from a total of nearly $700,000 revenues collected monthly between January and August. The highest monthly total came in March with $120,000 revenues transferred from $159,000 collected that month. The lowest total was $38,000 transferred in June from $45,000 collected.

A debt service payment of $724,750 in interest was paid in full June 1. No principal was due. The payment was made up of funds received from the district, but also a draw of $171,189.10 from the debt service reserve, the trustee reported in a June 5 notice. The bonds traded last month at 48 cents on the dollar.

While appropriation pledges are subject to an annual decision by the sponsoring government, the trustee unsuccessfully argued the financing agreement supporting the bond issue represented a legally enforceable promise to pay.

Platte County Circuit Court Judge James Van Amburg in a May 2019

“We find that the plain language of the Financing Agreement does not contain a promise by the County to pay for the shortfalls for the Zona Rosa Bonds. We affirm,” reads the opinion authored by Judge W. Douglas Thomson. The panel also included Judge Karen King Mitchell and Judge Anthony Rex Gabbert.

The commission never approved making a payment because it was not required to, and doing so would deplete the county’s reserve fund and require either a material reduction in core governmental services or a raise in taxes, county attorneys Martin and Todd Graves of Graves Garrett LLC said in a statement after the Aug. 25 opinion was distributed.

The trustee is represented by Spencer Fane LLP attorneys Scott Goldstein and Kersten Holzhueter represent the trustee. The trustee’s lawyers had argued in appellate court filings the lower court erred by ruling the financing agreement imposed only a moral obligation and argued the finance agreement pledge was legally enforceable after a review of county finances.

Moody’s Investors Service cut the county’s rating — then at Aa2 — to junk in September 2018 after learning of the commissioners’ comments and after the May ruling. Moody’s rates the county Ba3 with a negative outlook.

The financing agreement that outlined repayment of the bonds issued in 2007 to refund 2003 debt sold to finance parking facilities at the Zona Rosa retail complex required the county to submit in its annual budget a debt service appropriation. The county warned it could not afford the expense that could reach $40 million when the bonds mature in 2032.

S&P Global Ratings stripped the Zona Rosa bonds of their investment-grade rating in September 2018 after county commissioners discussed at a public meeting their opposition to making up future shortfalls absent a long-term solution.

While market participants thought the trustee's financing agreement requirement argument was a longshot, the county still faces theoretical market consequences because of its willingness to renege on the pledge given the consequence that it lost its investment grade. The bonds are not secured by a deed or mortgage and remedies in the event of a default are heavily influenced by judicial actions should a restructuring or bankruptcy be sought.