DALLAS -- The Texas Water Development Board expects strong demand next week for a $1.63 billion revenue bond deal designed to protect the state’s growing population from drought.

“This is definitely the biggest transaction for the board in our very long history,” said TWDB Chairman Peter Lake. “We’d like to think that water infrastructure is so important to Texas that the size reflects that.”

The bonds come to market under a program known as SWIFT for State Water Implementation Fund for Texas. Proceeds flow to a fund called SWIRFT for State Water Implementation Revenue Fund for Texas. From there, the funds go toward local and regional borrowers that have qualified for the program and placed their own bonds with the TWDB.

Through the first five years of the SWIRFT program, the agency has committed roughly $8.2 billion for state water plan projects. The projects include reservoirs, pipelines, conservation and other measures to protect the state from the effects of drought. The TWDB was created in 1957 during the worst Texas drought in modern history and has helped spare the state from a repeat of the crisis.

SWIRFT and SWIFT were established by the Texas Legislature and voters in 2013, authorizing the transfer of $2 billion from the state’s Rainy Day Fund and subsequent bond issues. The $2 billion will be leveraged with revenue bonds to finance about $27 billion in water supply projects over the next 50 years.

“This is a multi-year program, so right now SWIRFT has about $3.3 billion of debt outstanding,” said Georgia Sanchez, debt portfolio manager for the board. “This issue will take that to about $4.9 billion.”

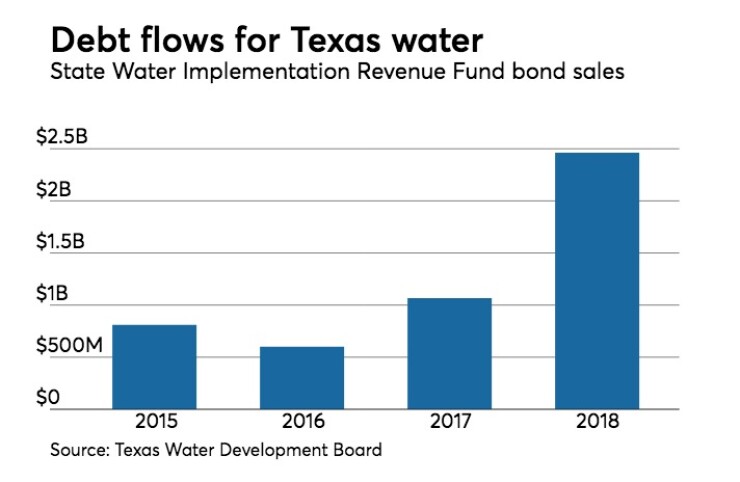

With this deal and $832 million issued earlier in the year, the board's volume for 2018 will come to $2.46 billion, more than double the issuance of 2017.

With triple-A ratings and stable outlooks from S&P Global Ratings and Fitch Ratings, the bonds are expected to attract heavy interest from institutional investors. A retail order period is set for Sept. 17, followed by institutional pricing the next day.

“Given the size of the transaction, the term, the annual and semi-annual maturities, and anticipated couponing structure, we believe this offering will be attractive to many different types of investors,” Lake said.

In addition to an online roadshow, Lake and the finance team are traveling to Chicago and New York for live investor presentations.

“We’re doing everything we can to educate investors,” Lake said. “We think we’ve got a great story to tell.”

Anne Burger Entrekin, managing director at Hilltop Securities, is the board’s financial advisor.

At book runner Citi, directors Tatianna Troutman-Yale and Rob Mellinger are lead bankers with 13 co-managers in the syndicate.

The bonds are coming in two series. Series B is made up of $1.59 billion of tax-exempt bonds maturing through 2053, while Series C consists of $35.6 million of taxable bonds reaching final maturity in 2048.

Bonds expected in subsequent years will not be on parity with these, or with any previously issued, bonds. Each bond series is supported by a specific revenue stream, although that stream will always include repayments from local utilities and the related transfer from the SWIFT to the SWIRFT assistance account under that specific bond-enhancement agreement.

With each issuance of bonds, a bond-enhancement agreement is executed and funds are transferred from the SWIFT to the SWIRFT. The transfer is sized to provide for the targeted subsidy amount determined by the TWDB. The transfer, combined with projected interest earnings and the scheduled repayments of the local borrowers, is designed to provide 1x annual debt service coverage for each series of bonds.

The TWDB is authorized to provide no more than two bond-enhancement agreements each fiscal year.

“The ratings reflect the combination of a very strong enterprise risk profile and an extremely strong financial risk profile,” S&P analyst James Breeding wrote. “Certain overriding factors have also been applied, including the extremely strong repayment history regarding payments to the TWDB through other financial-assistance programs, and the ability for the sizable over-collateralization to address extraordinarily high default or delinquency rates.”

Fitch Ratings’ cash flow model indicates that SWIRFT program resources are sufficient to protect bondholders from losses under various default scenarios, wrote analyst Major Parkhurst.

The pool of borrowers is backed by “highly rated entities but, at only 45 individual obligors, is also small and thus highly concentrated,” Parkhurst said. The top 10 borrowers make up 90% of the pool.

“Concentration is expected to improve over time to coincide with the growth of the SWIRFT program,” Parkhurst said.

The SWIRFT funding is available to projects that are included in the 2017 State Water Plan. Projects recommended July 26 included new wells, transmission lines, and a large regional water supply project, all of which are recommended water management strategies in that plan.

The largest share of funding from this issue – about $1.4 billion -- will go toward a regional water supply project for the Houston area.

Those involved in the project include the Central Harris County Regional Water Authority, the city of Houston, the North Fort Bend Water Authority, the North Harris County Regional Water Authority and the West Harris County Regional Water Authority.

The Houston area project is designed to reduce the booming metro area’s use of groundwater, thereby reducing subsidence that can lead to flooding in times of heavy rain. The goal of the regional project is to reduce by 80% the area’s use of groundwater by 2035. So far, the projects have reduced groundwater use by about 36%.

To make such massive projects more affordable, the SWIRFT lowers interest costs by using Texas’ gilt-edged credit that is generally stronger than that of the local borrowers.

The Brushy Creek Regional Utility Authority near Austin expects to save nearly $1 million in finance cost on a $15.7 million water supply project. The district created by the cities of Cedar Park, Round Rock, and Leander is designed to meet the fast-growing area’s needs.

Of the SWIRFT portfolio’s 45 individual borrowers, about 96% are rated investment grade and 57% are rated at or above AA-minus, according to Fitch.

This transaction will fund more than $1.85 billion in projects, with an estimated interest savings to program participants of nearly $290 million, according to TWDB.

Texas’ population is expected to double to more than 50 million people by 2070. The State Water Plan anticipates a potential water shortage of 4.8 million acre-feet per year in 2020 and 8.9 million acre-feet per year in 2070 in drought conditions. About 5,500 water management strategies recommended in the current State Water Plan that would provide 3.4 million acre-feet per year in additional water supplies in 2020 and 8.5 million acre-feet per year in 2070.

The estimated capital cost to design, build and operate the approximately 2,500 recommended projects in 5,500 water management strategies by 2070 is $63 billion, according to TWDB documents.