BRADENTON, Fla. - Tallahassee, Fla., plans to price $150.3 million of energy system refunding bonds Tuesday.

Bond proceeds will be used to currently refund all or a portion of the city’s energy system revenue bonds issued in 2007.

JPMorgan, the book-runner, is underwriting the deal with Loop Capital Markets and RBC Capital Markets.

The deal is structured with serial bonds maturing between 2018 and 2037, according to bond documents.

There will be no extension of maturity.

The refunding is estimated to result in present value savings of $31 million or 17.65% of refunded bonds, according to Deputy Treasurer-Clerk Kent Olson.

“Our underwriters are expecting the deal to be fairly well received, given expected redemptions and relatively limited supply of new paper,” he said.

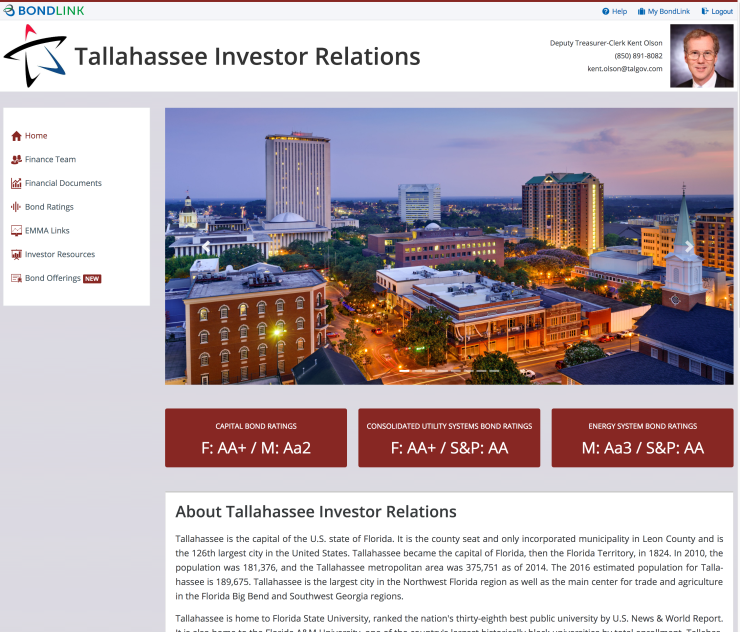

Tallahassee is using the refunding to launch a new investor

“We anticipate the website will result in greater investor interest in the energy system’s bond offering and help us lower our borrowing costs,” he said.

The bonds are rated AA by S&P Global Ratings and Aa3 by Moody's Investors Service. Both have stable outlooks.

Tallahassee draws economic and employment strength from the fact that it is Florida’s capital, analysts said. The city also is home to large employers such as Florida State University and Florida A&M University.

The utility system has competitive electric rates and a history of adjusting rates to ensure debt service coverage remains stable, coupled with a consistently strong cash position, according to Moody’s.

The system is also supported by automatic annual base rate increases linked to the consumer price index and good financial metrics.

“We believe that offsetting these strengths is Tallahassee's substantial dependence on gas-fired generation that, while mitigated by hedging activities and an energy cost recovery charge, can result in what we view as uncompetitive rates when natural gas prices rise,” S&P said.

Public Financial Management Inc. is the city’s financial advisor. Bryant Miller Olive PA is bond counsel for the refunding. Nabors, Giblin & Nickerson PA is disclosure counsel.