Two deals from state issuers came to market on Wednesday as municipal bond buyers were treated to a large negotiated deal from Massachusetts and three big competitive sales from Washington state.

Primary market

Morgan Stanley priced and repriced Massachusetts’ $726.57 million of general obligation and GO refunding bonds for institutional investors after holding a one-day retail order period.

The deal is rated Aa1 by Moody’s Investors Service, AA by S&P Global Ratings and AA-plus by Fitch Ratings.

"We are very happy with the results of the sale, as both the retail and institutional periods yielded positive results,” said Sue Perez, Massachusetts Deputy Treasurer for Debt Management. "We achieved over $44 million in savings from the refunding portion of the deal.”

The deal received $275 million in total retail participation with over $28 million from individual investors, according to Perez. “We were pleased to have broad participation from over 70 different accounts, including some new ones. We were able to be flexible with the structuring , offering a variety of coupons and maturities to respond to investor inquiries and interest.”

She also added that this $727 million transaction marked the final transaction of three over the past week for the Commonwealth, which included a $1.5 billion revenue anticipation note sales last week and a $163 million negotiated issue of Massachusetts Clean Water Trust bonds earlier this week.

In the competitive arena, Washington state sold $502.13 million of GOs in three offerings.

Citigroup won the $262.915 million of Series 2019A various purpose GOs with a true interest cost of 3.8175% Citi also won the $145.78 million of Series 2019T taxable GOs with a TIC of 3.3357%

Morgan Stanley won the $93.435 million of Series 2019B motor vehicle fuel tax GOs with a TIC of 3.6141%.

Montague DeRose & Associates and Piper Jaffray are the financial advisors and Foster Pepper is the bond counsel.

The deals are rated Aa1 by Moody’s and AA-plus by S&P and Fitch.

Dallas competitively sold $155.66 million of Series 2018C waterworks and sewer system revenue refunding bonds.

Morgan Stanley won the bonds with a TIC of 3.5685%. Hilltop Securities and Estrada Hinojosa are the financial advisors and McCall Parkhurst and Escamilla & Poneck are the bond counsel.

The deal is rated AAA by S&P and AA-plus by Fitch.

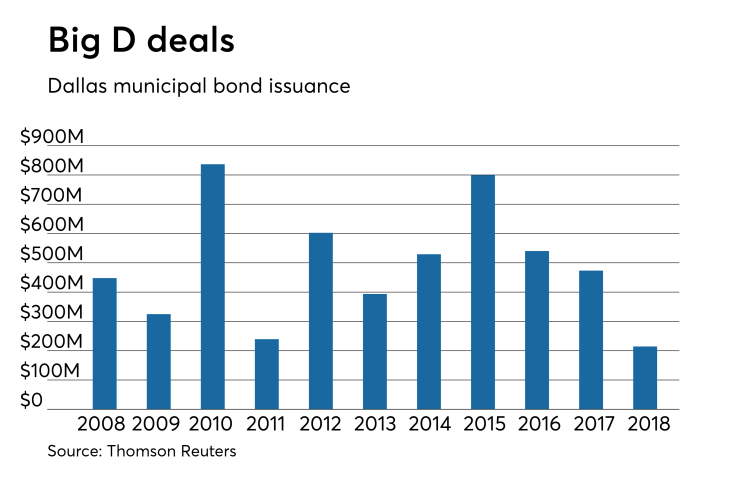

Since 2008, Dallas has sold over $5 billion of debt, with the most issuance occurring in 2010 when it sold $836.7 million of bonds. Prior to this year, it sold the least amount of debt in 2011, when it issued $239.4 million of bonds.

Bank of America Merrill Lynch priced and repriced the National Finance Authority, N.H.’s $169.595 million of resource recovery refunding revenue bonds for the Covanta project consisting of Series 2018A bonds subject to the alternative minimum tax, Series 2018B non-AMT bonds and Series 2018C AMT bonds.

The deal is expected to be rated B1 by Moody’s and B by S&P.

BAML priced and repriced the Niagara Area Development Corp., N.Y.’s $165.01 million of solid waste disposal facility refunding revenue bonds for the Covanta project consisting of Series 2018A AMT bonds and Series 2018B non-AMT bonds.

The deal is expected to be rated B1 by Moody’s and B by S&P.

JPMorgan Securities received the official award on the West Virginia Hospital Finance Authority’s $271.575 million of Series 2018A tax-exempt and Series 2018B taxable hospital refunding and improvement revenue bonds for the Cabell Huntington Hospital Obligated Group.

The deal is rated Baa1 by Moody’s and BBB-plus by S&P.

Wednesday’s bond sales

Massachusetts

Washington

New Hampshire

New York

West Virginia

Bond Buyer 30-day visible supply at $6.7B

The Bond Buyer's 30-day visible supply calendar decreased $2.2 billion to $6.70 billion for Thursday. The total is comprised of $3.75 billion of competitive sales and $2.95 billion of negotiated deals.

Secondary market

Municipal bonds were mostly weaker on Wednesday, according to a late read of the MBIS benchmark scale. Benchmark muni yields increased as much as one basis point in the one- to 26-year and 29-year maturities and remained unchanged in the 27- and 28-year and 30-year maturities.

High-grade munis were mixed, with yields calculated on MBIS’ AAA scale rising less than one basis point in one- to 18-year maturities, falling less than a basis point in the 20- to 30-year maturities and remaining unchanged in the 19-year maturity.

Municipals were weaker on Municipal Market Data’s AAA benchmark scale, which showed the yield on the 10-year muni general obligation rising by one basis point and the yield on 30-year muni maturity increasing by two basis points.

Treasury bonds were stronger as stock prices traded higher.

“Both equities and bonds are treading water today as markets await some hard news regarding the U.S.-Canada trade negotiations. Major indices are unchanged, holding their recent gains, but unable to find direction one way or the other,” ICE Data Services said in a late Wednesday market comment. “Likewise, Treasuries are lingering around their recent levels. The 10 year yield is a 2.888%, off the lows of last week but still solidly in the middle of the range it has been all year; same with the long bond at a 3.03% yield. The front end is higher, pushed and compressed by Fed rate hikes, but today the shape of the yield curve is little changed.”

On Wednesday, the 10-year muni-to-Treasury ratio was calculated at 84.7% while the 30-year muni-to-Treasury ratio stood at 100.4%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Previous session's activity

The Municipal Securities Rulemaking Board reported 39,557 trades on Tuesday on volume of $9.87 billion.

California, New York and Texas were the municipalities with the most trades, with Golden State taking 15.119% of the market, Empire State taking 13.665% and the Lone Star State taking 10.65%.

Treasury sells $17B reopened 2-year notes

The Treasury Department Wednesday auctioned $17 billion of one-year 11-month floating rate notes with a high discount margin of 0.047%, at a 0.043% spread, a price of 99.991756.

The bid-to-cover ratio was 2.94. Tenders at the high margin were allotted 66.65%. The median discount margin was 0.040%. The low discount margin was 0.020%.

The index determination date is Aug. 27 and the index determination rate is 2.080%.

Treasury auctions $31B 7-year notes

The Treasury Department Wednesday auctioned $31 billion of seven-year notes, with a 2 3/4% coupon and a 2.844% high yield, a price of 99.407159. The bid-to-cover ratio was 2.65.

Tenders at the high yield were allotted 49.68%. All competitive tenders at lower yields were accepted in full. The median yield was 2.807%. The low yield was 2.700%.

Gary Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.