Top-quality municipal bonds finished weaker on Thursday, according to traders, as competitive bond sales from issuers in South Carolina, North Carolina and Florida dominated an unusually skimpy supply slate.

The South Carolina Transportation Infrastructure Bank competitively sold $213.6 million of Series 2016A revenue refunding bonds. Wells Fargo Securities won the bonds with a true interest cost of 2.66%.

The issue was priced to yield from 0.70% with a 5% coupon in 2017 to 2.95% with a 3% coupon in 2037. The deal is rated A1 by Moody's Investors Service and A by Fitch Ratings.

The South Carolina TIB previously competitively sold comparable bonds on June 18, 2015, when Wells Fargo won $157.1 million of Series 2015A revenue refunding bonds with a TIC of 2.498%.

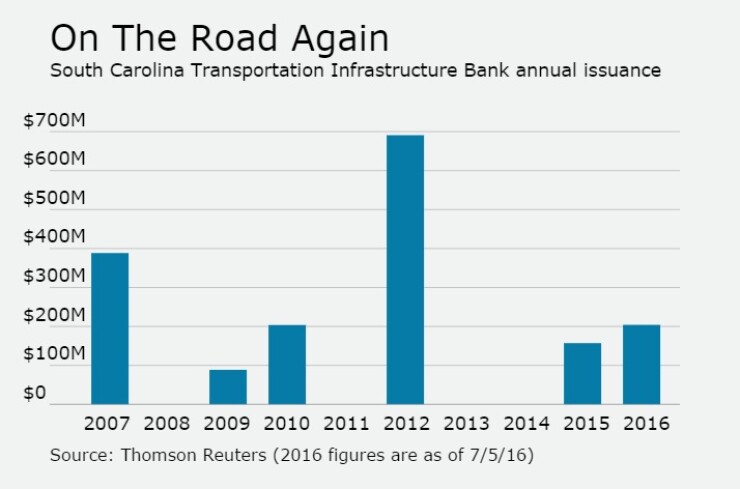

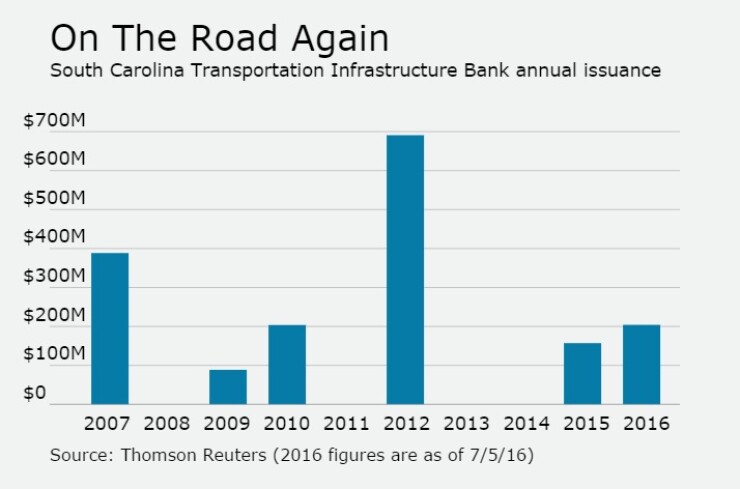

Since 2007, S.C. TIB has issued about $1.7 billion of debt, with the largest issuance occurring in 2012 when it sold $691 million of securities. This deal marks the first time since 2009 and 2010 when it issued debt in back-to-back years. The S.C. TIB did not come to market at all in 2008, 2011, 2013 or 2014.

The South Carolina Transportation Infrastructure Bank Act was signed on June 26, 1997, to focus greater attention on larger transportation projects, and thereby allow the South Carolina Department of Transportation to devote resources to other projects, according to the S.C. TIB website.

The Florida Board of Education competitively sold $216.18 million of Series 2016D full faith and credit public education capital outlay refunding bonds.

Morgan Stanley won the issue with a TIC of 2.31%. The issue was priced to yield from 0.62% with a 5% coupon in 2018 to 2.63% with a 3% coupon in 2037.

The deal is rated Aa1 by Moody's and triple-A by S&P Global Ratings and Fitch.

In the negotiated sector, Wells Fargo priced the North Carolina Capital Facilities Finance Authority's $159.1 million of Series 2016 educational facilities revenue and revenue refunding bonds for Wake Forest University.

The issue was priced to yield from 0.86% with a 5% coupon in 2021 to 2.30% with a 4% coupon in 2039; a 2041 maturity was priced as 2 3/4s to yield 2.93% and a 2046 term bond was priced at par to yield 3%.

The deal is rated Aa3 by Moody's and AA by S&P.

Secondary Market

The yield on the 10-year benchmark muni general obligation rose two basis points to 1.31% from 1.29% on Wednesday, while the 30-year muni yield increased two basis points to 1.95% from its record low level of 1.93%, according to the final read of Municipal Market Data's triple-A scale.

Traders said the day was quiet ahead of Friday's release of the employment report for June.

"You could hear a pin drop today, but in general things are still fairly firm," one New York trader said on Thursday. "There wasn't enough supply to really test the market."

U.S. Treasuries were weaker on Thursday. The yield on the two-year Treasury rose to 0.59% from 0.58% on Wednesday. The 10-year Treasury yield gained to 1.39% from 1.37% on Wednesday while the yield on the 30-year Treasury bond increased to 2.15% from 2.14%.

"With the run we've had and the Treasury rally running into some resistance there's some hesitancy to push it much, especially ahead of the [Non-Farm Payroll] release," the trader said.

The 10-year muni to Treasury ratio was calculated at 94.2% on Thursday compared with 93.3% on Wednesday, while the 30-year muni to Treasury ratio stood at 91.1% versus 89.7%, according to MMD.

MSRB: Previous Session's Activity

The Municipal Securities Rulemaking Board reported 39,022 trades on Wednesday on volume of $9.47 billion.

Tax-Exempt Money Market Funds See Outflows

Tax-exempt money market funds experienced outflows of $945.1 million, bringing total net assets to $193.96 billion in the week ended July 4, according to The Money Fund Report, a service of iMoneyNet.com. This followed an outflow of $7.56 million to $194.91 billion in the previous week.

The average, seven-day simple yield for the 285 weekly reporting tax-exempt funds was unchanged at 0.07%.

The total net assets of the 888 weekly reporting taxable money funds decreased $24.83 billion to $2.488 trillion in the week ended July 5, after an inflow of $25.59 billion to $2.513 trillion the week before.

The average, seven-day simple yield for the taxable money funds was unchanged at 0.12%.

Overall, the combined total net assets of the 1,173 weekly reporting money funds decreased $25.77 billion to $2.682 trillion in the period ended June 28, which followed an inflow of $18.02 billion to $2.708 trillion.

Loop Raises Volume Forecast

Loop Capital Markets increased its 2016 municipal volume forecast to $420 billion from $358 billion.

Chris Mier, a managing director at Loop, said that last December when the firm gave its forecast for 2016, it was the second highest of the five firms that had publicly issued predictions, the highest of which was $413 billion.

"In the first half of 2016 new issue volume stayed on course to reach the volume anticipated in our original forecast," said the release issued on Tuesday. "New money issuance is running 13% higher than in 2015, while refundings are down 11%. From September 2015 through April 2016 muni issuance was lower compared to the same month a year ago, largely due to disappointing refunding volume."

The release pointed to a turnaround in volume in the second quarter. The European Central Bank's aggressive asset purchases, the flight to quality in the aftermath of Brexit referendum and renewed concerns over the stability of Italian and other European banks have driven the yield on 10-year German bunds to negative 17 basis points.

"High credit quality of muni bonds has attracted interest from overseas investors who are hungry for any kind of yield, including tax-exempt," Loop said. "The protracted period of uncertainty supports investor demand for high-quality bonds. There may be a pickup in taxable muni issuance to satisfy foreign demand."

According to Loop, since March the 30-year MMD declined by 76 basis points and the 10-year and 30-year Treasuries are at multi-decade lows. On the other hand, Loop said, the spread between 20-year MMD and five-year Treasury yield, a proxy for negative arbitrage, is the tightest it has been in several years.

"This dynamic and muni curve flattening create a favorable environment for advance refunding. While we recognize that the sensitivity of refunding volume to interest rate changes may be different in today's interest rate environment, there is no doubt that record low rates will accelerate issuance beyond what we were expecting last December."

Loop also that that this dynamic was reflected in May and June, when volume grew about 10% from the same months in 2015.

The firm mentioned that unrelated to market developments, California voters approved more than $5.7 billion in aggregate bonding authority in the recent election, with approval rates close to record levels. In Illinois, an anticipated $2 billion in refinancing of outstanding debt was facilitated through the suspension of several provisions of the state's general obligation rules.

"While increased issuance from two states does not indicate a trend (particularly since much of this issuance will not occur in 2016), it does suggest that there are potential sources of incremental volume out there."