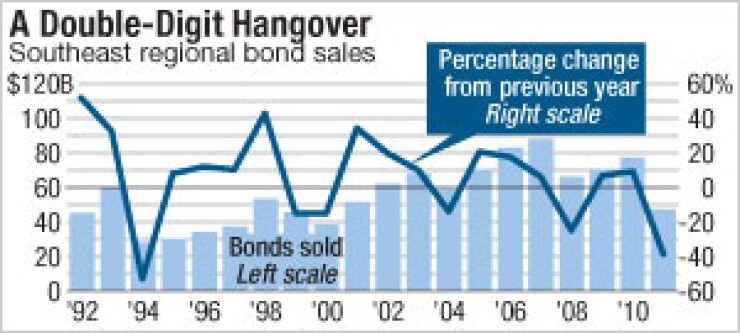

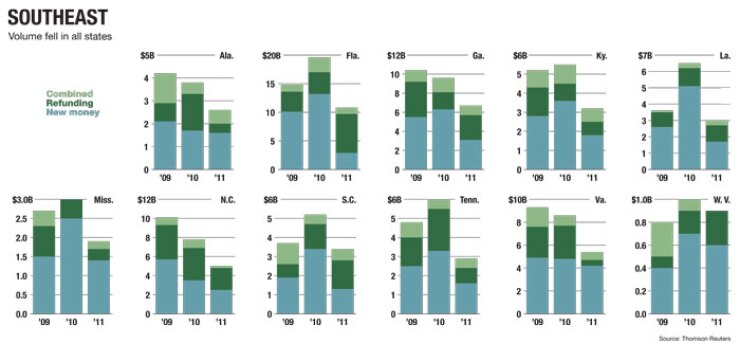

BRADENTON, Fla. – Municipal bond issuance declined in every Southeast state in 2011, with total sales volume dropping to an 11-year low.

With new-money supply off by more than half, total bond issuance fell to $47.3 billion in 1,341 issues, a 38.6% decline, according to Thomson Reuters. That’s the biggest year-over-year percentage drop for the Southeast since 1994.

As was the case around the country, the region’s biggest volume drop came in the first-quarter hangover that followed a surge in new-money deals in 2010. They were pumped up by the sale of $15.3 billion of taxable Build America Bonds, a federal stimulus program that expired at the end of 2010.

New-money bond volume plummeted 52% to $23.4 billion. Refundings were down 9.1% to $18 billion, while combined refundings and new-money offerings were $6 billion, a drop of 30.7%.

State agencies, counties, cities and parishes, special districts, and educational institutions all saw double-digit declines in bond volume last year. Only state governments turned out on the plus side with $5.2 billion in sales, an 11.1% increase.

Fewer bonds were sold for every purpose except housing, which saw a 44.5% increase in sales with par volume of $1.9 billion. Other categories experienced double-digit declines in sales.

Southeast issuers sold the most bonds for educational purposes, though the $12.2 billion supply was down 12.3% over 2010. The category got a boost from three sizeable student loan refundings: the North Carolina State Education Assistance Authority issued $961 million in two offerings while the Louisiana Public Facilities Authority sold $509 million in one deal.

The second-largest amount of debt was sold for general purposes with sales of $12.2 billion in 361 deals, a decline of 37.4%. Issuance for public facilities saw the largest percentage decline, 60.4%, on volume of just over $1 billion.

Following the expiration of the taxable BAB program, taxable sales declined 73.1% in the Southeast. Tax-exempts were down 27%. The amount of bonds subject to the alternative-minimum tax spiked with an increase of 68.7% in sales, or $1.3 billion in 29 transactions.

Bond issues backed by letters of credit dropped by 43.3% to $1.6 billion, while no bonds were issued with standby bond purchase agreements. Other guarantees slid by 7.9% to $3.7 billion. Issuers insured under $3.5 billion of bonds, 41.2% less than in 2010.

Negotiated offerings fell 46.8% on sales of $30.9 billion, while transactions by competitive bid dropped 18.7% to $15 billion. Private placements saw a big uptick with $1.5 billion in 70 issues, or an increase of 136.8% over 2010, when Thomson Reuters recorded 33 privately placed deals for $618 million.

Of the Southeast’s total issuance, $41.4 billion was fixed-rate debt compared to $2.7 billion in short-put variable-rate bond sales and $356 million in long-dated variable-rate debt. Revenue bonds represented $33.6 billion of the volume, a 43.4% decline, while $13.8 billion of general obligation bonds sales were down 22.5%.

There are signs of improvement this year, according to Bank of America Merrill Lynch municipal research strategist John Hallacy, whose firm remained the No. 1 senior manager for the third straight year with $6.67 billion in 80 issues.

“Florida and the Carolinas are always high-demand states for us,” Hallacy said. “We have a large investor base in various states. Retail is very vibrant and people are always looking for supply.”

There are indicators of an uptick in the Southeast’s economy this year, with auto sales trending up and growth in the region’s diversified manufacturing sector, he said.

“One would expect tourism to pick up if jobs grow and people have a little more disposable income,” Hallacy said. “It is a good subset of all those states, including Florida.”

After curtailed issuance last year, Hallacy said some Southeast states may need to come to the bond market this year to finance general needs.

Citi maintained the second position with $6.53 billion in 78 deals, while JPMorgan moved up to third place from fourth last year with 70 deals worth $6.52 billion.

David Moore, a managing director in the Orlando office of Public Financial Management Inc., said he also expects bond volume to pick up this year, particularly as refundings are brought to take advantage of lower interest rates over the next five or six months.

Some issuers need to address financing critical needs, such water and sewer systems, while others will address pent-up needs from deferred projects, he said.

“Between adjusting operating expenses down, and in some cases seeing a slight increase in revenues, they are now in position where critical projects can start moving ahead,” Moore said.

PFM maintained its long-time position as the Southeast’s top financial advisor with 102 transactions valued at $8.22 billion. Rising to second place from third the year before was Public Resources Advisory Group working on a par amount just over $4 billion in 32 deals. First Southwest Co. dropped to third place from second working on 35 offerings worth $2.9 billion.

Moore said 2011 “was a challenging year for everybody. There were some refundings but it was really slower across most sectors.”

Since the financial crisis erupted, Moore said PFM has focused on analyzing market factors and being ready to quickly implement an issuer’s needs – a strategy that helped the firm pick up new clients.

During the past few years, issuers had to make significant changes in operations, services and adjustments to recurring expenses, and some of them can begin to pick up new projects this year, he said, albeit at a slower pace than pre-recession levels.

“We really do expect a better year in 2012,” Moore said.

Squire Sanders & Dempsey LLP remained the top bond counsel in the Southeast last year, advising on 27 issues worth $3.2 billion. Hunton & Williams LLP rose to second place from eighth, credited with $2.6 billion over 40 deals. McGuireWoods LLP maintained third place with 49 issues and a par amount of $2.4 billion.

In 2011, Florida issuers again sold the most debt of any state, though volume of $11.5 billion was off 41.7%. The Florida State Board of Education was the most prolific issuer with $1.9 billion in 11 transactions. Of that amount, only about $300 million was new money, with the remainder refundings.

Georgia had the second-highest bond volume with $6.9 billion, a decline of 28.2%. The state brought the largest single deal in the Southeast to market, and its largest-ever single offering, with a $996.5 general obligation sale in June.

Virginia saw the third-highest issuance with $5.7 billion in 100 deals, a drop of 34.3%. Sales were augmented by a $600 million mass transit deal brought by the Virginia Transportation Board.

Issuers in North Carolina brought $5.2 billion to market bolstered by student loan refundings.

Issuers in South Carolina sold $3.3 billion in 95 transactions, highlighted by four deals totaling $761 million sold on behalf of Santee Cooper by the South Carolina Public Service Authority.

Kentucky bond volume dropped 40.2% to $3.2 billion. The Kentucky State Property and Building Commission was the state’s top issuer, with $484.9 million.

Debt sales in Louisiana plummeted in 2011, as the volume fell more than half to $3 billion from $6.5 billion in 2010. The 54% decline was the largest of any state in the region. The top issuer was the Louisiana Public Facilities Authority with $827.2 million in seven transactions.

Tennessee had the second-largest decline in overall sales last year, 51.3%, resulting in volume of $2.9 billion on 99 bond issues. The Tennessee state government was the top issuer, credited with three transactions for $546.7 million.

In Alabama, issuance fell 33% to $2.7 billion.

In Mississippi, issuers sold $1.8 billion in municipal bonds, a decline of 41.2%. Sales were highlighted by the Mississippi Business Finance Corp.’s $373.2 million offering for industrial development in November, and the state’s $353.7 million GO deal in October.

In West Virginia, issuers sold the least amount of any state in the region with $991.9 million in 33 issues, a decline of only 1.3%, the smallest such decline in the Southeast.