Southeast issuers brought $68.5 billion of municipal bonds to market in 2017, a 5.8% year-over-year decrease in volume that wasn’t undone by a huge fourth quarter.

While issuance among the region’s 11 states was down in the first three quarters, the final quarter brought $24 billion of sales, a 49.1% surge over the same period in 2016, according to Thomson Reuters.

While the final Tax Cuts and Jobs Act preserved private activity bonds and banned future advance refundings, PFM Financial Advisors’ Managing Director David Moore said the unknowns facing the market until the bill was signed Dec. 22 made the end of the year “extremely hectic and uncertain.”

“The last 60 days were a sprint to deal with anything related to the tax bill,” said Moore, who manages PFM’s southern region.

For the full year, new money bond issuance increased by 20.4% to $32.2 million, the highest amount of new debt sold in a single year since 2010, records show. Refundings totaled $25.9 billion, down 21%, while combined new money and refundings were $10.5 billion, also down 21%.

Moore said his clients were focused on refundings early last year but the uptick in new money issuance was consistent with bringing infrastructure financings to market that had been placed on the back burner since the recession.

Volatility in the markets plus an upward trajectory for interest rates could depress volume again in 2018, he said, adding that the Trump administration’s infrastructure proposal could be a boost for some issuers.

“I think for issuers that have very well defined material infrastructure needs and are well down the path of developing a plan of finance but have gaps, there’s potential for the plan to help,” he said.

With the yield curve shifting up, Moore said issuers may consider adding variable-rate debt this year.

In 2017, Southeast issuers sold $5.7 billion of variable rate obligations, according to Thomson Reuters, more than doubling 2016 volume.

“The other thing in the market is with the tax bill we expect banks to continue to be actively doing direct placements but we are seeing some banks step back from the municipal market,” he said. “I think demand for bank loans will probably be declining a little bit this year.”

PFM was credited with 129 deals totaling $10.12 billion last year, placing the firm at the top of Thomson Reuters’ league table once again for financial advisors in the Southeast.

Public Resources Advisory Group ranked second with $6.8 billion over 39 issues, while Hilltop Securities was third with $4.8 billion on 41 deals.

Among senior managers, Bank of America Merrill Lynch led the table, credited with $12.1 billion in 108 deals, followed by Citi with $9.96 billion in 115 deals, and Wells Fargo with $6.3 billion over 79 deals.

Kutak Rock was the top bond counsel firm, credited with $4.16 billion in 37 deals. Greenberg Traurig was second with $3.3 billion in 58 deals and McGuireWoods was third with $3.17 billion in 62 deals.

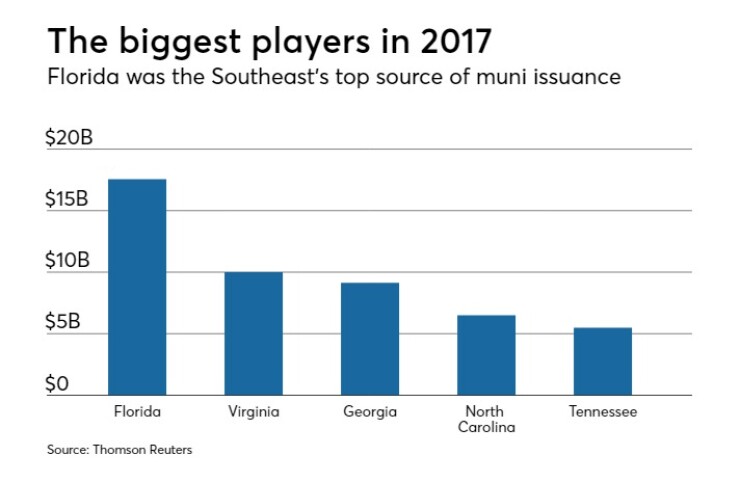

Florida continued to be the region’s top source of municipal issuance with $17.6 billion of bonds, down 6.4%.

Miami-Dade County issued the most bonds in the region with $1.96 billion in seven deals. Its $929 million deal in December was the region’s second-biggest of the year.

The third-largest deal was sold by the Greater Orlando Aviation Authority, which issued $923 million of AMT revenue bonds Aug. 29 to finance a three-story terminal at Orlando International Airport.

Volume was up in Virginia for a second year running, growing 10.2% to $9.99 billion.

The Virginia College Building Authority was the second-most prolific issuer in Southeast with 12 deals totaling $1.5 billion. The Virginia Commonwealth Transportation Board was third with $1.4 billion in four issues.

Georgia issuers brought $9.13 billion to market, an increase of 18.3%.

The state government of Georgia was the fourth-busiest issuer in the region with $1.39 billion. It all came on a June 20 competitive sale that was the region’s largest of the year, according to Thomson Reuters.

Issuers in North Carolina brought $6.5 billion of bonds to market, down 14.4%. The North Carolina state government issued $949 million of bonds in three deals throughout the year, making it the region’s eighth-largest issuer.

In Tennessee, issuers ramped up deals to bring $5.5 billion, up 8.7%.

They included the Nashville-Davidson County Metropolitan government, which issued $912.1 million in five deals. The Tennessee Energy Acquisition Corp. issued $678.3 million on Oct. 27.

Louisiana also stepped up issuance with market participants selling $5.3 billion for an upswing of 55% over the previous year.

The New Orleans Aviation Board sold $420.7 million of bonds subject to the AMT on May 11 to complete financing on the new terminal at the Louis Armstrong New Orleans International Airport.

In Alabama, issuers across the state sold $3.9 billion, a drop of 38.7%. The Alabama Federal Aid Highway Finance Authority issued $556.6 million on June 26, making it the state’s largest deal and the state’s biggest issuer.

South Carolina issuers brought $3.9 billion of bonds to market, a decrease of 38.4%.

Issuers in Kentucky sold $3.6 billion of bonds, a drop of 40.2%.

In Mississippi, issuers increased sales by 35.3% to $2.2 billion.

West Virginia issuers brought $1.02 billion of deals, an upswing of 12.1%.

Tax-exempt issuance throughout the region was down 6% to $60.3 billion. Taxable bond issuance was $4.2 billion, down 43.7%. Volume of bonds subject to the alternative minimum tax more than tripled to $4.04 billion.

Negotiated deals were down 4.6% to $43 billion. Some $17.8 billion of competitive bonds were sold, a drop of 16.7%. Private placements totaled $7.74 billion, an increase of 22.3%.

Some $52 billion of bonds were classified as revenue bonds, a 3.5% decrease, compared with $16.6 billion of general obligation bonds, a decrease of 12.6%.

Education was once again the highest-volume sector in 2017 with issuers selling $15.3 billion, down 3.5%. Bonds issued for general purposes came in second with $12.6 billion, a decrease of 35.2%. Healthcare was down 3.6% to $10.34 billion.

The transportation sector was up 70% to $11.5 billion. The fourth-quarter rush to market included $600 million of tax-exempt private activity bonds from the Florida Development Finance Corp. on behalf of All Aboard Florida’s Brightline passenger train project. The Nov. 30 deal financed portions of the new system between Miami and West Palm Beach, and was the region’s 10th largest of 2017.

Fixed-rate bond issuance was down 11.3% to $61.5 billion.

Debt wrapped with bond insurance increased 27% to $3.83 billion and the use of letters of credit was down 19.7% to $73.1 million. For a second year, there were no standby-bond purchase agreements.

Bank-qualified bonds were down 42% to $1.35 billion.

State agencies once again were classified as having issued the most debt at $19.4 billion, up 2.1%, while local authorities stepped up issuance with $15.8 billion, an increase of 7.1%.

Counties and parishes also saw an uptick with $9.8 billion, a 9.5% increase, while issuance by cities and towns dropped 19.4% to $8.6 billion.