After gobbling up more than $10 billion in new supply for the week, investors were taking a breather as the municipal market closed on Friday.

“It’s dead and quiet today,” a Charlotte trader said late Friday. Investors were “tired after the absorption of the week’s deals,” he said.

In addition, they were preparing for the new week’s calendar, estimated to be about half of past week’s bounty at around $6 billion, he said.

Ipreo forecasts weekly bond volume will decline to $5.9 billion from a revised total of $10.3 billion in the prior week, according to updated data from Thomson Reuters. The calendar is composed of $4 billion of negotiated deals and $1.9 billion of competitive sales.

The past week's deals were well received, the trader said, including the $1.2 billion Promedica deal in Ohio — the week's largest. Barclays Capital priced the mostly taxable deal for ProMedica Healthcare Obligated Group and Toledo Hospital.

The deal included Lucas, County, Ohio’s $251.61 million of tax-exempt Series 2018A hospital revenue bonds. The tax-exempts were rated Baa1 by Moody’s Investors Service, BBB by S&P Global Ratings and BBB-plus by Fitch Ratings except for the 2042 maturity for $23 million which was insured by Assured Guaranty Municipal and rated A2 by Moody’s and AA by S&P.

Of the taxable portion of the deal, AGM insured $500 million of the 20-year November 2038 bonds. The tax-exempt proceeds issued through Lucas County will finance the system’s Generations of Care Tower at ProMedica Toledo Hospital and other building and equipment projects.

Meanwhile, the North Carolina trader said demand for intermediate bonds was offsetting the noticeable selling pressure in the secondary market stemming from a combination of mutual fund outflows and tax loss swaps.

“With the heightened calendar on the new issue front, the turnover in the secondary market has been a little slower,” he said.

At the same time, he described “pockets of robust demand” from mom and pop retail investors, high net worth individuals, and separately-managed accounts in the 10- to 15-year slope of the yield curve.

“Everything has cheapened up in the last several weeks and that’s made it more attractive,” he said. “With the back-up in yields folks are looking to liquidate, but some folks are willing to buy it as well,” he added, noting that demand is strong for maturities 15 year and under.

Overall, he said the market is entering into a seasonal period where issuers are trying to get their deals priced before year-end and investors want to take advantage of attractive levels.

“Certainly the climb to higher rates is welcome,” he said.

He predicted that even though the new week’s calendar falls to within $6 billion, the demand will still be moderate to heavy.

“The primary market is priced cheaper than the secondary, so people with money to put to work will have a good opportunity to invest,” he said.

Primary market

JPMorgan Securities is set to price the Tarrant County Cultural Educational Facilities Finance Corp., Texas’ $447.32 million of Series 2018AB revenue and refunding bonds for Christus Health on Tuesday.

Also on Tuesday JPMorgan is set to price for Christus Health a $339.02 million taxable corporate CUSIP deal.

The deals are rated A1 by Moody’s Investors Service and A-plus by S&P Global Ratings.

Citigroup is expected to price the Hillsborough County Aviation Authority, Fla.’s $402 million of revenue bonds for the Tampa International Airport.

The deal consists of Series 2018E bonds subject to the alternative minimum tax and Series 2018F non-AMT bonds, rated Aa3 by Moody’s, AA-minus by S&P and Fitch Ratings and AA by Kroll Bond Rating Agency; and Series 2018 subordinate bonds, rated A1 by Moody’s, A-plus by S&P and Fitch and AA-minus by Kroll.

In August, Kroll upgraded the authority’s revenue bonds to AA from AA-minus and subordinated revenue bonds to AA-minus from A-plus and assigned a stable outlook to both.

In the competitive arena on Tuesday, Clark County, Nev., is selling $450 million of general obligation bonds in two sales consisting of $300 million of Series 2018B limited tax transportation improvement bonds and $150 million of Series 2018 limited tax park improvement bonds additionally secured by pledged revenues.

The financial advisors are Hobbs, Ong & Associates and PFM Financial Advisors; the bond counsel is Sherman & Howard.

Proceeds of the 2018B bonds will be used to finance a portion of the costs of certain improvements to transportation facilities within the Strip Resort Corridor; proceeds of the 2018 bonds will be used to finance certain park projects.

The deals are rated Aa1 by Moody’s and AA-plus by S&P.

In the short-term competitive sector, the Chicago Board of Education is selling $200 million of Series 2018A tax anticipation notes on Thursday.

Financial advisors are PFM Financial Advisors and Columbia Capital Management; the bond counsel are Ice Miller and Pugh Jones Johnson.

Bond Buyer 30-day visible supply at $7.34B

The Bond Buyer's 30-day visible supply calendar increased $1.84 billion to $7.34 billion for Friday. The total is comprised of $2.71 billion of competitive sales and $4.63 billion of negotiated deals.

Secondary market

Municipal bonds were weaker on Friday, according to a late read of the MBIS benchmark scale. Benchmark muni yields rose less than one basis point in the one- to 30-year maturities.

High-grade munis were also weaker, with yields calculated on MBIS' AAA scale rising less than one basis point across the curve.

Municipals were steady on Municipal Market Data’s AAA benchmark scale, which showed the yield on both the 10-year muni general obligation and the yield on 30-year muni maturity remaining unchanged.

Treasury bonds were weaker as stocks traded mixed.

On Friday, the 10-year muni-to-Treasury ratio was calculated at 85.6% while the 30-year muni-to-Treasury ratio stood at 100.9%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

"Taxable municipals are up in yield about 2 basis points from the two-year through the end of the curve," ICE Data Services said in a late day comment on Friday. "The high yield market is 0.01basis points higher in yield. The broader market is up 1 basis point from 2040 maturities and longer."

Previous session's activity

The Municipal Securities Rulemaking Board reported 45,902 trades on Thursday on volume of $17.25 billion.

New York, California and Texas were the municipalities with the most trades, with the Empire State taking 17.406% of the market, the Golden State taking 13.409% and the Lone Star State taking 9.455%.

Week's actively traded issues

Some of the most actively traded munis by type in the week ended Oct. 19 were from New York, Utah and Puerto Rico issuers, according to

In the GO bond sector, the New York City zeros of 2042 traded 24 times. In the revenue bond sector, the Salt Lake City Airport 5s of 2048 traded 64 times. And in the taxable bond sector, the Puerto Rico Government Development Bank 5s of 2023 traded 11 times.

Week's actively quoted issues

Puerto Rico, New York and California names were among the most actively quoted bonds in the week ended Oct. 19, according to Markit.

On the bid side, the Puerto Rico Commonwealth GO 5s of 2041 were quoted by 35 unique dealers. On the ask side, the New York City Municipal Water Finance Authority 4s of 2047 were quoted by 169 dealers. And among two-sided quotes, the Los Angeles Unified School District 5.75s of 2034 were quoted by 22 dealers.

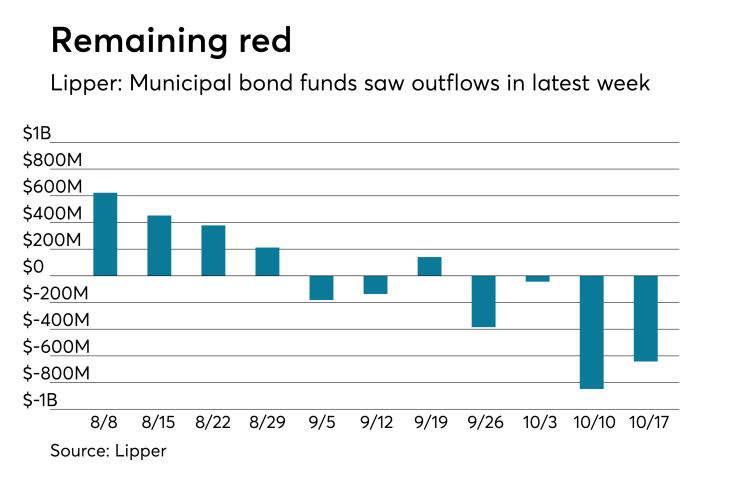

Lipper: Muni bond funds report outflows

Investors in municipal bond funds remained cautious and once again pulled cash out of the funds during the latest reporting week, according to Lipper data released on Thursday.

The weekly reporters saw $642.032 million of outflows in the week ended Oct. 17 after outflows of $847.858 million in the previous week.

Exchange traded funds reported inflows of $155.595 million, after outflows of $211.389 million in the previous week. Ex-ETFs, muni funds saw $797.628 million of outflows, after outflows of $636.468 million in the previous week.

The four-week moving average remained negative at -$479.578 million, after being in the red at $283.857 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds had outflows of $659.499 million in the latest week after outflows of $933.968 million in the previous week. Intermediate-term funds had outflows of $80.325 million after outflows of $72.567 million in the prior week.

National funds had outflows of $487.127 million after outflows of $704.697 million in the previous week. High-yield muni funds reported outflows of $604.919 million in the latest week, after outflows of $500.423 million the previous week.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.