A court ruling that restricted Scranton, Pa., from collecting certain taxes under a state law is a credit negative for the distressed city, said Moody’s Investors Service.

“It may reduce tax revenue, which is a vital funding source for the city's operations,” Moody’s said in a commentary on Monday.

Judge James Gibbons of the Lackawanna County Court of Common Pleas issued a preliminary ruling Aug. 3 against the city after a group of eight taxpayers, led by mayoral candidate Gary St. Fleur,

The ruling affects whether the Home Rule Charter law supersedes the statutory cap contained in Act 511.

The city has filed a motion for reconsideration and this week asked the court to enable it to appeal to the Commonwealth Court of Pennsylvania.

A message seeking comment was left with Kevin Conaboy, the attorney representing Scranton.

Scranton, the 77,000-population county seat, is working toward exiting state oversight under Pennsylvania’s Act 47 workout program for distressed communities, under which it has operated since 1992.

Moody’s does not rate Scranton. S&P three weeks ago

S&P, which assigned a stable outlook, cited the city’s improved budget flexibility and liquidity, stemming largely from a sewer-system sale that enabled it to retire more than $40 million of high-coupon debt.

The city also suspended its cost-of-living-adjustments and intends to apply a portion of sewer system sale proceeds to pension funding.

"These positive steps have been important for paying off high interest debt and funding the city's distressed pension plans,” Moody’s said. “While these one-off revenue infusions have been positive, Scranton faces an elevated fixed cost burden of over 40% of general fund revenues.

“Act 511 tax revenues are an important revenue source for achieving ongoing, balanced operations, particularly as double-digit property tax increases have been met with significant discontent from city residents. The potential loss of Act 511 tax revenues comes at a time when revenues for the city are projected to be stagnant through 2020.”

Scranton has struggled in the capital markets since 2012, when its City Council skipped a $1 million bond payment during a political dispute. The city has since repaid the debt.

“If the city cannot balance its budget without illegally taxing the Scranton people, it is absolute proof that the budget is not sustainable,” St. Fleur said. “Scranton has sold off all its public assets and raised taxes excessively with the result being a declining tax base and unfriendly business environment.

“The city needs to come to terms with present economic realities by cutting spending and lowering taxes. This is the only option for the city.”

St. Fleur has said the city should file Chapter 9 bankruptcy and has pushed for a related ballot measure.

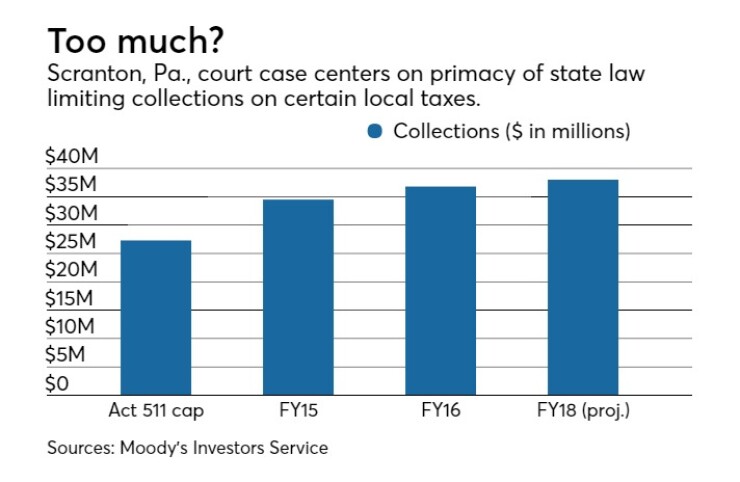

Combined taxes collected under Act 511, including a local services tax that Scranton recently tripled, cannot exceed 1.2% of Scranton's total market value.

Based on 2015 market values, according to Moody’s, Scranton's “511 cap” totals $27.3 million. In fiscal 2015 and 2016, the city collected $34.5 million and $36.8 million, respectively, and for 2018, the city has budgeted to receive $38 million.

The city, said Moody’s, relied on those revenues for 37.7% of fiscal 2015 and 35.9% of fiscal 2016 total governmental revenues.

“A significant reduction in these tax revenues would leave the city a significant revenue gap if total Act 511 tax revenues were decline by nearly 25%,” Moody’s said.