DALLAS — San Antonio will take its gilt-edged credit to a hungry market Tuesday, pricing $330 million of bonds, certificates of obligation and tax notes in a negotiated deal.

The Alamo City should enjoy limited competition for investor interest this week as bond volume is expected to fall to $4.4 billion, down from $6.6 billion last week, according to Thomson Reuters. The calendar includes $3.5 billion of negotiated deals and $932 million of competitive sales.

“It’s not heavy volume this week, and we certainly think this is a lead credit on the calendar,” said Jorge Rodriguez, managing director for the city’s financial advisor, FTN Financial Assets Corp. “There aren’t many natural triple-A’s in the market.”

Rodriguez expects the bulk of the issue to go to institutional investors who are already familiar with the city’s credit history.

JPMorgan vice president Pedro Ramos and executive director Tim Peterson are lead bankers for the book runner.

Siebert Cisneros Shank & Co. is co-senior manager, with six co-managers. The city council chose the team in June from a pool of pre-qualified underwriters.

The deal is made up of four new general obligation limited tax issues, including $155.9 million of general improvement bonds, $136.9 million combination tax and revenue certificates of obligation, $8.6 million of taxable tax and revenue certificates of obligation, and $28.9 million of tax notes.

Voters authorized the debt on May 6, 2017, as six propositions covering 180 projects at a record value of $850 million.

As part of the mass selection of design consultants for the 2017-2022 Bond Program, 107 contracts estimated at $58 million were approved by city council to start the design phase after voters approved the debt.

San Antonio is Texas' oldest city and the largest to carry triple-A credit. While Houston and Dallas suffered downgrades over recent years due to pension crises, San Antonio has escaped that trap, so far.

The city has carried Moody’s Investors Service’s top rating since 2010, though the outlook dimmed to negative in 2011 due to the city’s exposure to the U.S. government through its military bases and federal installations. The turmoil in federal finances and a government shutdown came as Republican members of Congress battled Democratic President Obama over spending priorities and guaranteed medical insurance.

President Trump on Sunday announced through Twitter that he would be "willing" to shut down the government in September unless Congress provides billions of taxpayer dollars for a border wall.

Under Trump, the city’s concerns about the federal government include immigration issues and tariffs on steel, aluminum, and cars that might affect the Toyota truck assembly plant.

At a meeting in June, at which Tuesday's bond sale was approved, the City Council unanimously passed a resolution opposing a Trump plan to ask citizenship status on the 2020 census. With a large Hispanic population, San Antonio officials are concerned over a reduction of federal funding and political representation if residents refuse to answer the citizenship question.

Megan Dodge, head of intergovernmental relations for the city, said that six former census directors have voiced such concerns.

Councilwoman Rebecca Viagran pointed to Japanese internment camps during World War II in nearby Crystal City as an example of why people might not want to share their citizenship status or nationality.

Toyota, which built its U.S. truck plant in San Antonio 15 years ago and moved its U.S. headquarters to suburban Dallas two years ago, has urged Texas members of Congress to oppose Trump’s plan to impose 25% tariffs on imported autos.

The tariffs “will hurt our employees and customers, stifle our investments and damage our state’s growing economy,” Chris Nielsen, Toyota Motor North America executive vice president, wrote in a letter.

A 25% tax on imported vehicles and components would increase the cost of a San Antonio-built Toyota Tundra by at least $2,800, the letter said. Previously, Toyota said that the taxes would boost the cost of a Camry, built in Kentucky, by $1,800.

The tariff issue comes as the future of the North American Free Trade Agreement remains in limbo. Toyota uses suppliers in Mexico for its San Antonio plant.

“Auto companies are united in their opposition, including General Motors which operates a major assembly plant in Arlington,” Nielsen wrote. “Like most global automakers, including Detroit-based companies, Toyota sources most key parts and components locally, but not all are available from U.S. suppliers.”

None of those issues have dented the city’s credit, as analysts have praised a resilient and expanding economy stabilized by a large U.S. military presence and enhanced by a lively tourism sector.

Moody’s stable outlook “reflects the expectation that strong financial management practices, stabilized operating performance, and a growing local economy will continue to support stable credit fundamentals and keep long term liabilities manageable,” said analyst Adebola Kushimo.

Fitch Ratings analyst Jose Acosta said San Antonio’s economy “continues to expand rapidly with continued sector development in high technology, medical and healthcare, higher education and financial services, providing diversity beyond the military presence, which remains a major economic factor.”

Lackland Air Force Base, Randolph Air Force Base and Fort Sam Houston account for nearly 76,000 military and civilian personnel, anchoring the city’s economy for decades.

“These facilities benefited from very large investments and additions to troop strength in past base realignments,” Acosta said. “They also include high-value missions such as the sole medical school for all military medical personnel.”

Large corporations in the city include the Toyota truck plant with more than 17,000 employees, oil refiner and retailer Valero, and information technology firm Rackspace.

San Antonio’s economy remained resilient even after a two-year downturn in oil prices starting in mid-2014 that affected drilling at the nearby Eagle Ford Shale, Acosta said.

“Fitch believes ongoing development of the area's oil shale resources combined with the current oil-price environment will continue to boost the area's energy sector and related sectors in construction/mining and manufacturing through the medium term,” Acosta said.

Celebrating its tri-centennial this year, San Antonio is the nation’s seventh largest city and the second largest in Texas behind Houston, after overtaking Dallas in the 2010 census.

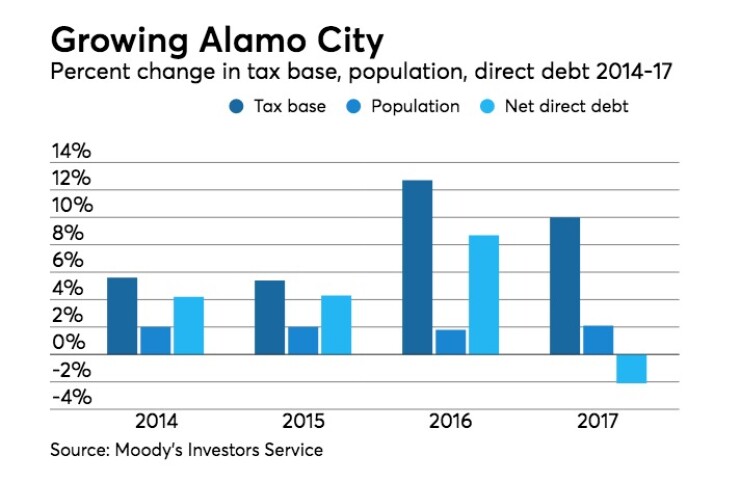

The metro area’s median home prices have grown by a compound annual average of 5.9% from 2012-2017, leading to a 2017 median of $210,229, according to Fitch. Building permit values have exceeded $3 billion (2.7% of fiscal 2018 market value) annually since 2014. Property value appreciation and new construction have resulted in steady assessed valuation gains, averaging 8.5% over the past five years, including a 9.6% increase in fiscal 2018.

“The pace of spending growth absent policy actions is likely to be in line with or marginally above the natural pace of revenue growth as the city expands its service levels to accommodate a rapidly growing population and costly public safety health insurance benefits,” Acosta said.