LOS ANGELES — Two bills designed to reform the way California issues school district bonds received a mixed reception in the state legislature: one died in Senate committee last week and the other one appears headed for passage.

Assembly Bill 621, by Don Wagner, R-Irvine, a bill aimed at curbing so-called pay-to-play would have blocked financial firms with an interest in debt sales from participating in school bond elections, but it stalled in a Senate committee on July 3.

Assembly Bill 182, which restricts how school bonds are issued, however, looks likely to pass with some Senate amendments after the legislature returns from its month-long summer break that starts next week.

Some version of Wagner's bill has been introduced every year since 2011 and was aimed at tackling the pay-to-play issue.

AB 182 was introduced after media attention brought to light situations where capital appreciation bonds with longer maturities had been issued by California school districts with repayments at a 10 to 1 ratio of debt to payments and sometimes as high as 20 to 1.

Assemblywoman Joan Buchanan, Treasurer Bill Lockyer and Sen. Ben Hueso had discussions in October-November 2012 about ways to minimize the abuses and looking at just how widespread the problem was, Buchanan said.

"We wanted to see if it was just one or two districts that had used this kind of financing," Buchanan said.

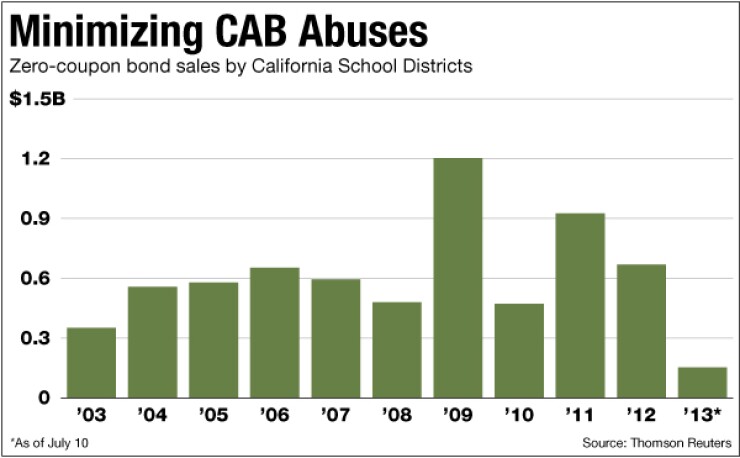

They found after meeting with county treasurers across the state that the use of CABs accelerated in 2006, and that 98% of the bonds that raised concerns were issued by school districts and community colleges.

"After looking at it, we decided that we needed parameters around what kind of deals could be made," Buchanan said.

The treasurer also pushed for legislation to curb high-cost capital appreciation bond sales by school districts, which are typically tied to the voter bond authorizations. CABs sales and their perceived shortcomings drew media attention last year precipitating the legislation.

The CAB limit bill, AB 182, unanimously passed out of the Assembly in April and was approved by the Senate Governance and Finance Committee on July 3.

"We strongly supported the bill from the beginning; and that remains our position," Dresslar said. "As amended, AB 182 effectively and reasonably fights a widespread abuse of taxpayers."

At the same time, "it provides adequate flexibility for school districts to build the facilities needed by the kids and their communities," Dresslar said.

Under existing laws, school districts will be able to issue bonds in two ways, through the Education Code, which limits any school bond to a term of 25 years and 8%, non-taxable interest, or through the more lenient Government Code, which permits bonds of up to 40 years and 12% interest. In the past, school districts mainly used the government code to issue CABs.

The new legislation would require, however, that all CABs for school districts would go through the Education Code, be subject to the 25-year limit and 8% maximum interest rate. Districts could continue to use the government code to issue standard bonds, but the maximum term for school construction bonds would be 30 years, down from 40.

The repayment ratio — the combination of total interest and principal payments in proportion to the bond's face value — would be limited to a maximum of 4 to 1.

The amendments grandfathered in a caveat that would allow school districts and community colleges to issue current interest bonds up to 40 years under the government code for the next five years, but projects financed by the bonds have to have a lifespan equal to the bond maturities.

As Buchanan said, you wouldn't finance a car out 10 years, because if it broke down in five years, you could end up having to finance a new car and end up making payments on both the old and new car.

A central issue for both Buchanan and the treasurer is that the CABs that came under fire push the debt burden for school infrastructure being constructed now on future generations. The end result, they said, could be that future generations are so overloaded with debt that the district would not be able to afford to build new schools or to do modernization projects when existing schools reach the end of their lifespan.

The bill also requires additional transparency in the financial documents, three public hearings, and a vote at a fourth meeting.

"We need to not only be good stewards of the schools' money, but good stewards of taxpayers' money," Buchanan said.

She doesn't think the new regulations would limit school districts' ability to issue debt to fund projects.

"CABs are like a negative amortized mortgage," Buchanan said. "I can't understand how a negative amortized mortgage is a good deal in good financial times or bad financial times."

The new legislation also requires that all school district bonds be callable.

Of the school districts that issued bonds at 10 to 1 or 20 to 1 ratios, none are callable.

Those districts will have to pay the debt back, but they may not be able to issue bonds in the future, she said.

Of all the CABs, Buchanan reviewed, almost none had callable provisions, she said.

"Even if the debt value increases dramatically, they are locked into that deal for 40 years," she said.

Is the Legislation Too Limiting?

Jeffrey Vaca, deputy executive director of the California Association of School Business Officials, said the legislative committee for an alliance of school groups has not met, but he imagines they will continue to oppose the bill unless the ratio is tied to a 30-year bond market index, giving districts leeway when rates rise.

CASBA isn't opposed to the restrictions on CABs, but they don't think the restrictions on current interest bonds are necessary, Vaca said.

"There weren't issues on CIBs that led to the introduction of this bill in the first place," Vaca said. "We never had an issue with the restrictions on CABs. We understood the need for a bill related to CABs."

Vaca, like other detractors, questions if it's wise to lock in stringent requirements as to how current interest bonds can be issued though.

He pointed to the state's sale last year of 100-year bonds for the University of California to lock in the historically low interest rates.

"Obviously UC is much larger than nearly all of the state's school districts, but in our view this supports our contention that every agency, whether state or local, needs to make what they believe are the right fiscal decisions for them," Vaca said.

In response to the proponents argument that issuing 40-year bonds creates cross-generational debt, Vaca questions why then these new rules don't apply to all issuers in the state.

"If this is sound policy for school districts, it should be applied to all public agencies in the state," Vaca said. "We certainly wouldn't advocate limiting other agency debt to 30-year terms; however, a consistent policy should apply to all public agencies. Proposed law should be proffered to enhance parity, not create disparities."

Critics have also questioned what kind of rates districts will get if all bonds issued have callable provisions.

But Dresslar said "with regard to callability, there is no question that that requirement would generate some premium, but it would not be a killer burden on school districts. We know for sure that any premium they would have to pay would be far outweighed by the continued use of these egregious deals to finance school districts."

The legislation has not lost a vote as it has winded its through committee on the Assembly side and to passage, or by the Senate committees who reviewed the legislation and passed it with amendments.

The bill is currently undergoing revisions as a result of amendments proposed in the Senate Governance and Finance Committee and the Senate Education Committee, where it was approved the last week of June.

The revisions to the bill aren't expected to be completed before the legislature's summer break, which begins next week and lasts until Aug. 12 when the session resumes.

As a result, the bill is not expected to come before the Senate for a vote until after the session resumes in mid-August. If the Senate approves the bill, it will have to return to the Assembly for concurrence on the Senate amendments before it will head to the governor for his signature.

Buchanan is confident the bill will not only pass the Senate, but be signed by the governor, who she characterized as a fiscal conservative likely to sign even though he hasn't voiced an opinion on the subject.

Pay to Play Bill Stalled

Lockyer also supported AB 621, which was a narrowly-crafted approach to deal with the pay-to-play issue, Dresslar said.

The state treasurer sent letters to Attorney General Kamala Harris in March asking her to give an opinion on the roles of underwriters, financial advisors and bond counsels in school bond elections.

"AB 621 is not going to move this year," Dresslar said. "The author could try advancing it next year."

It only applied to financial advisors and bond counsel and was limited to hard-core electioneering activity such as donating money to school district bond campaigns, managing campaigns and getting out the vote, Dresslar said.

Wagner told The Bond Buyer in May that a loophole in current law allows districts to use taxpayer dollars to fund campaigns. He said the bill would prohibit an end run around conflict of interest rules.

"Abuse of this loophole comes at a high cost to taxpayers," Wagner said in a prepared statement. "Not only are taxpayers responsible for paying those bonds back, but their money is being used to engage in political campaigns and to drive up the costs of the bonds."

This practice also encourages the hiring of the bank that will do the best job on the campaign, not do the best job for the taxpayer on the handling of the bond, Wagner said.

Wagner's bill was similar to unsuccessful legislation proposed in 2011 by former Assembly member Chris Norby, a Fullerton Republican who lost his re-election bid in 2012.

Critics of Wagner's legislation have said the bill would limit the school districts' financial flexibility, making it harder to pass school bond ballot measures in some parts of the state.

Wagner could not be reached for comment on whether he plans to reintroduce the bill next year.

"We did support this bill, but Lockyer's priority was to end the abuse of CABs, which AB182 will do," Dresslar said.