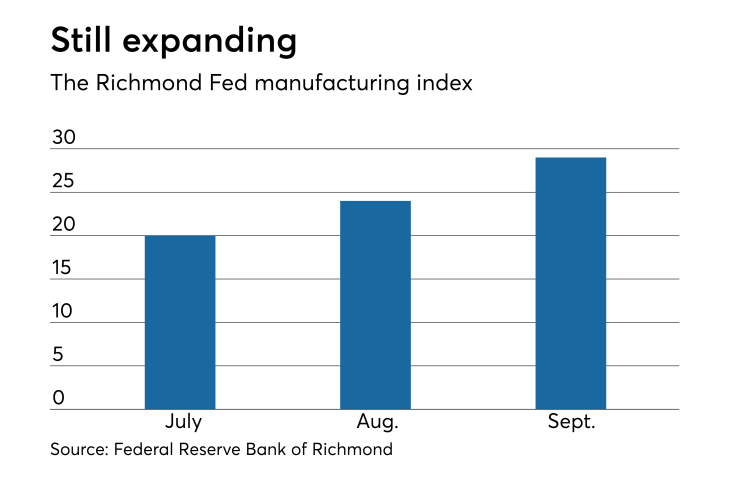

Manufacturing activity was "robust" in September, the Federal Reserve Bank of Richmond reported on Tuesday.

The composite index rose to 29 this month from 24 in August, buoyed by increases in shipments and new orders. The employment index fell in September, but remained positive, while growth in wages and the average workweek expanded, the Richmond Fed said. Manufacturing firms continued to struggle to find employees with the skills they needed, and they expect this difficulty to continue in the coming months, the Fed said.

Index readings above zero show expansion, while numbers below zero indicate contraction.

“Firms reported faster growth in both prices paid and prices received in September, after price growth had slowed in August. Growth in prices paid continued to outpace growth in prices received,” the Fed said. “However, firms anticipate slowing of growth in prices paid and accelerated growth of prices received to narrow the gap in the near future.”

Shipments climbed to 33 from 23 as the volume of new orders rose to 34 from 25 while the backlog of orders index gained to 20 from 15.

The capacity utilization index increased to 20 from 18 while the vendor lead time index dipped to 32 from 35.

The number of employees index fell to 16 from 25, the available skills improved to negative 11 from negative 17 while the average workweek index increased to 19 from 16 and the wages index rose to 33 from 27.

As for the outlook six months from now, the shipments index inched up to 43 from 42 while the volume of new orders index decreased to 37 from 40 and the backlog of orders index gained to 26 from 20. Capacity utilization increased to 40 from 37, the vendor lead time index grew to 29 from 23, the number of employees index fell to 23 from28 while the average workweek index slipped to 12 from 13; the wages index was rose to 45 from 43 while the available skills declined to negative 12 from negative 8.

The current trend in prices paid rose to 3.47 from 3.31 in August, while surging to 1.93 from 1.58 from 2.24 for prices received. The expected trend for the next six months fell to 3.04 from 3.24 for prices paid and slid to 2.37 from 2.63 for prices received.

All companies surveyed were located within the Fifth Federal Reserve District, which includes the District of Columbia, Maryland, North Carolina, South Carolina, Virginia, and most of West Virginia.