DALLAS — The Lower Colorado River Authority, one of the largest wholesale electricity providers in Texas, will take out commercial paper and callable bonds with $369.7 million of revenue refunding bonds March 13.

The bonds issued for LCRA’s Transmission Services Corp. will retire about $300 million of commercial paper and private notes, and refund about $115 million of 2009 bonds, officials said. The new bonds will mature serially from 2020 to 2049.

Steve Dworkin, managing director at Citi, is lead banker on the negotiated deal scheduled for closing March 28. Steven Adams, managing director at Specialized Public Finance, is financial advisor, consulting with LCRA treasurer and chief financial officer James Travis.

S&P Global Ratings has an A rating on the bonds. Fitch Ratings rates them A-plus.

LCRA’s board oversees three nonprofit corporations, including Transmission Services Corp., created in 2002 to comply with electric utility restructuring rules in Texas.

Regulated by the Texas Public Utilities Commission, TSC generates about 40% of LCRA’s operating revenues and has about $1.9 billion in long-term debt, according to S&P. While LCRA also provides water from a chain of lakes it manages on Texas’ Colorado River, that represents a small portion of the authority’s revenue.

S&P Global Ratings credit analyst Doug Snider anticipates that revenue from the transmission corporation will remain stable over the next two years.

"We also expect that LCRA will not rely on energy sales to non-contractual customers simply to bolster margins, nor cash on hand to help maintain covenant-based minimum financial metrics," Snider said.

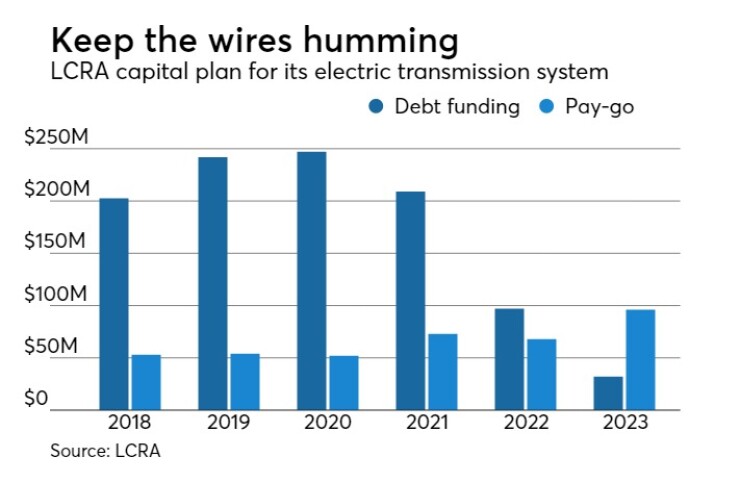

LCRA has a $1.3 billion, five-year capital program that will be about 74% debt financed.

“While leverage levels are above average for the rating category, the revenue consistency of the transmission-only business line can support comparably higher leverage,” according to Fitch analyst Kathy Masterson. “Leverage should remain relatively stable even with the planned additional debt issuance over the next five years.”

Fitch noted that debt service coverage has been at or above 140% in the past five years.

Over the next five years, TSC expects transmission assets to grow from the current $1.2 billion to $2.6 billion spanning 5,465 miles, officials said in an online investor presentation. TSC expects to issue $825.8 million of debt to finance the expansion. The authority plans to use $382.5 million of debt to fund its $436.6 million capital spending in 2019, officials said.

Analysts said TSC has adapted after losing 10 of its more than 40 wholesale power customers. In June 2011, the municipal utilities and electric cooperatives notified the authority that they would not be renewing their 25-year power supply contracts when they expired in June 2016.

“Given that LCRA wholesale electric customer discord, and the related load loss, has already happened, and that its generating asset profile is what we consider now better aligned with its long-term contractual customers, we view downside risk to the rating as less likely,” Snider said. “If the authority had to issue more debt to respond to shifting regulatory requirements, this could pressure financial margins. However, we view this risk as remote.”

Moody's Investors Service has a stable outlook for the public power electric utility sector for 2019, “reflecting the industry's self-regulated cost recovery mechanisms, sound financial metrics and competitive product,” analyst Dan Aschenbach said.

"Challenges for public power utilities include the continued transition to clean energy, cybersecurity risks and lower electricity demand," said Aschenbach, a senior vice president at Moody's and the lead author of the 2019 report. "However, we're confident in the sector's ability to adapt given its strong business model."

Moody’s does not rate this deal but has an A1 rating on LCRA’s transmission bonds with a stable outlook.

With the upcoming deal, LCRA is launching a new investor relations

LCRA created its transmission nonprofit corporation after a 1999 state law changed how electric utilities manage and operate transmission facilities. The law required utilities to separate electric generation and transmission operations as part of preparations for a deregulated retail electric market. The law also allowed LCRA to expand its transmission facilities and operations beyond its traditional Central Texas service area.

On Jan. 1, 2002, LCRA transferred ownership of its transmission facilities to LCRA TSC to satisfy the state's requirements. Since its creation, LCRA TSC has invested more than $2.8 billion in transmission projects to meet demand for electricity, improve reliability, connect new generating capacity, address congestion problems that affect the competitive market and help move renewable energy to the market, the company says.

The LCRA’s board of directors doubles as the board of the TSC. Phil Wilson is president and chief executive.

Some of the projects in the TSC’s 2019 capital plan involve transmission lines from the Fayette coal-fired power plant that LCRA jointly owns with the City of Austin. The plant has been a target of lawsuits by environmentalists as the Trump Administration develops new policies advocating increased burning of coal and rollbacks of environmental regulation.

Last September, LCRA agreed to reduce pollution at Fayette in a settlement with the Texas Campaign for the Environment. The plant, 70 miles southeast of Austin, provides about a third of the city’s power.

The TSC operates in more than 75 Texas counties, linking Texas power plants and the statewide power grid. LCRA TSC facilities integrate more than 9,400 megawatts of generation capacity into the power grid. That is enough to supply power to about 1.9 million homes when demand for power is highest, officials said.

“A number of factors, including favorable bond ratings, help LCRA TSC provide its services at costs lower than those of many transmission providers in Texas,” the authority said.