Puerto Rico’s May General Fund revenues were $217.7 million or 32% higher than budgeted, marking a recovery from September's hurricane devastation as the territory seeks to restructure its bond debt.

The surge in money for Puerto Rico’s government left its revenues $78.9 million or 1% ahead of budget projections for the first 11 months of the fiscal year.

April revenues had been $242.1 million or 20.2% ahead of projections.

The recovery in revenue may fuel arguments that there's more leeway to resume bond payments than was anticipated in the Puerto Rico Oversight Board's latest fiscal plan.

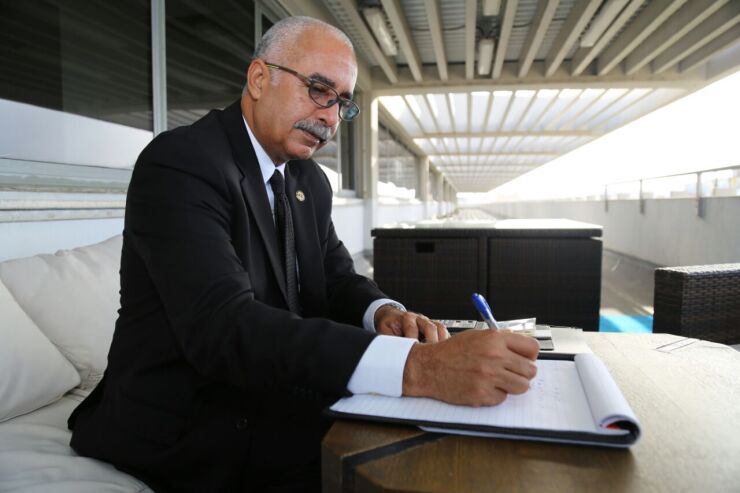

The fact that revenues are now ahead of budget “is a favorable fact in view of the fiscal challenges faced by public finances since before the hurricanes collections were favorable but after the hurricanes for several months the revenues were low,” said Puerto Rico Secretary of the Treasury Raúl Maldonado Gautier.

According to Maldonado Gautier much of the increase was due to temporary economic activity of companies engaged in recovery tasks and to the flow of money from insurance payments, both in response to the two hurricanes that hit Puerto Rico in September.

In terms of dollars, the tax categories that performed the furthest ahead of projections in May were non-resident withholding ($63.1 million), sales and use tax ($40.9 million), and the individual income tax ($25.8 million). Non-resident withholding includes the payment of royalties for the use of patents in the manufacturing sector.

Over the first 11 months, the tax categories deviating the most from projections in dollar terms were the corporate income tax, which came in $197.4 million ahead of budget, and the Law 154 foreign corporate profit tax, which arrived $151.2 million short.

Maldonado Gautier said he was confident that once June’s revenues are included, fiscal year 2018’s revenues will come in ahead of projections.

In early December 2017 Geraldo Portelo Franco, Puerto Rico Fiscal Agency and Financial Advisory Authority executive director, said that he expected Puerto Rico’s revenues to come in 25% short of budget in the fiscal year.

None of the figures in this story include any federal grant or loan money. Federal grant money comes in outside of the commonwealth’s General Fund and Puerto Rico’s central government has yet to take loan money.