The Puerto Rico Electric Power Authority moved closer to restoring its credit, as it canceled a plans for a natural gas port and received five bids for its transmission and distribution system.

The developments are both financially positive for the authority, Moody's Investors Service analyst Rick Donner said Tuesday. Last month the authority canceled a plan to build a natural gas port that had been criticized as costly and possibly inflationary, depending on gas prices, and on Dec. 6 the governor announced the authority received the bids for its grid.

“Today, the specialized private sector shows that they trust what we are doing and they are willing to invest in the island,” Gov. Ricardo Rosselló said last week, in announcing that the five private sector entities had bid for the PREPA concession.

Puerto Rico’s Public Private Partnership Authority will evaluate the bids, the governor said. Puerto Rico hopes to pick one of them by December 2019, Donner said.

Donner, Moody’s Senior Credit Officer, said the number of bidders was a good sign: “five is better than one.”

How this process and the sale of PREPA’s power generation facilities will affect the debt isn’t fully clear yet, Donner said. The local government plans to use some of the proceeds to pay off the debt. How much of the debt could be paid off this way remains to be seen.

“The public private partnership concession of PREPA’s transmission and distribution system is the type of structural reform that provides sustainability, and thus capacity for debt repayment, to the economy of Puerto Rico,” said Advantage Business Consultants President Vicente Feliciano.

“For the private sector, the timing of the public private partnership is particularly good,” Feliciano said. “For one, [after recent federal post-hurricane aid] many parts of the system are going to be brand new. In addition, thanks to these same recovery efforts, there is a good sense of the conditions of the system. Therefore, a lot of the uncertainty with regards to future capital expenditures is addressed. The lower uncertainty means less risk, a better business opportunity, and willingness by the bidders to offer a higher price.”

In late November PREPA canceled plans for building an offshore natural gas port at Aguirre, on the south coast. The authority had been preparing for this port since 2010 and it was its chief planned capital project since at least 2012.

“The natural gas transshipment port in Aguirre was going to cost PREPA consumers more than $300 million,” said Puerto Rico Senate Minority Leader Eduardo Bhatia. “Thanks to our creation of an Energy Commission, by Law 57-2014 that I authored, the public had a defender which, in 2016, stopped this madness.” In 2016 the Energy Commission barred PREPA from proceeding with the gas port.

“Natural gas investments in Puerto Rico are expensive and risky,” said Tom Sanzillo, director of finance at Institute for Energy Economics and Financial Analysis. “The island’s fiscal plan prioritizes renewable energy investments because they are cheaper and anti-inflationary. If implemented it gives Puerto Rico a fighting chase to recover and grow.”

People had been planning for the Aguirre gas port for a long time, Donner said, and it “seemed like it wasn’t going to happen.”

Given PREPA’s selling of its power production system it will be up to the new owners how much investment to put into the use of natural gas, Donner said.

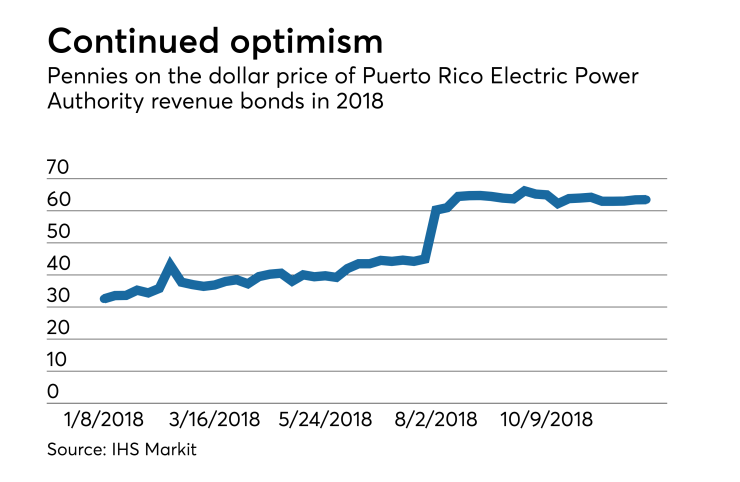

On July 30 a preliminary deal to restructure PREPA’s roughly $9 billion in debt was announced. There have been confidential negotiations between bondholders, bond insurers, the Oversight Board, and possibly representatives of the Rosselló government to bring enough bond-side support aboard to allow a vote in favor of the restructuring.

Before the board will file a plan of adjustment, it wants to gain the support of bond insurers who insure the bonds, Donner said. The fact that the board hasn’t yet filed the plan isn’t surprising because these sorts of deal are complicated, he said.

On Oct. 3 bond insurers National Public Finance Guarantee Corp., Assured Guaranty Corp., Assured Municipal Guaranty Corp., and Syncora Guarantee Inc. filed a motion in Puerto Rico District Court to be given the power to name a receiver for PREPA. The next hearing in this case is in March.

The completion of a deal concerning the debt of the Government Development Bank and the nearing completion of a deal for Puerto Rico Sales Tax Financing Corp. (COFINA) debt, “bodes well” for PREPA, Donner said.