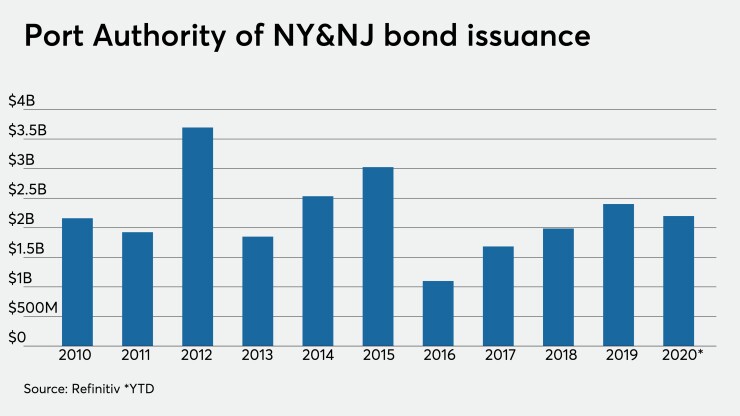

The Port Authority of New York and New Jersey's scaled down 2021 $7.3 billion budget includes plans to sell $3.6 billion of bonds in 2021, as it deals with massive revenue losses caused by the COVID-19 pandemic.

The bi-state agency’s fiscal plan will be voted on Thursday. Debt service payments would increase by $160 million to $1.6 billion, from the new debt needed to fund its proposed $2.4 billion capital budget. Budget documents detail a $92 million year-over-year increase in debt service and $68 million for interest on the new bonds.

The capital plan trims spending for infrastructure projects by 33% from the agency’s 10-year capital budget from 2017. The budget cuts and increased borrowing reflects the agency’s projected $3 billion revenue hit from March 2020 through March 2022 caused by declining use of its facilities resulting from life and work changes caused by the COVID-19 pandemic.

S&P Global Ratings credit analyst Todd Spence said the planned new debt would not materially impact the Port Authority’s credit profile. The agency, which has $23 billion in outstanding consolidated bonds and notes, he said, has available liquidity of around $3.8 billion.

“As issuers respond to activity declines and revenue impacts related to COVID-19 we are seeing a variety of management actions including expense reductions, debt refundings and restructurings, capital program deferrals and reductions,” Spence said. “We view these actions as prudent and timely responses to the financial impacts they are facing.”

S&P downgraded the Port Authority’s bond ratings one notch to A-plus from AA-minus this past June citing plummeting usage levels at all its transportation assets during the pandemic. The Port Authority’s debt is rated Aa3 by Moody’s Investors Service and AA-minus by Fitch Ratings.

The Port Authority said in budget documents that specific allocations for capital spending are still under development. During 2020, the agency continued redevelopment projects at LaGuardia and Newark Liberty airports as well as the restoration of Superstorm Sandy damage incurred on the PATH system and Holland Tunnel.

Overall capital spending was slowed by $1 billion in order to align with reduced volumes at its transportation facilities during the pandemic. The agency’s combined two-year $2.2 billion reduction in capital spending will be cut further in 2022 absent additional federal aid, according to Port Authority Executive Director Rick Cotton.

Moody's analyst Kathrin Heitmann noted in a Dec. 14 report the Port Authority's high fixed cost structure and commitments to support the New York metro area's economic recovery will "constrain" its ability to reduce future expenses. Operating revenue increased by over 50% from 2010 to 2019 after the last recession, she said, while annual debt service more than doubled during the same period.

Nicole Gelinas, a senior fellow at the Manhattan Institute, said the Port Authority will eventually need to reconsider bigger cuts to its long-range capital program, such as scaling back a proposed Manhattan bus terminal and delaying a planned overhaul of John F. Kennedy International Airport. Added debt fund capital projects next year won’t be a credit concern, she said, as long as airline revenues return to pre-pandemic levels in the next few years.

“Their business is basically dependent on growing airline revenue,” Gelinas said. “I think tourism travel will bounce back but am not so sure about business travel.”

The overall proposed Port Authority budget cuts spending by 15%. It would reduce the workforce by 626 positions largely through voluntary retirements as well as overtime reductions.

"Overall, the proposed 2021 budget is an austerity budget,” Cotton said in a statement. "We have aggressively but prudently cut costs."