The Pittsburgh Water and Sewer Authority intends to sell $94.4 million of first-lien revenue bonds on Thursday.

Morgan Stanley is senior manager for the negotiated sale, for which there is no early retail period.

The sale consists of $93.4 million of Series 2020B tax-exempt bonds and $1 million of Series 2020A federally taxable bonds.

S&P Global Ratings and Moody's Investors Service Authority’s rate its bonds A and A3, respectively. Both assign stable outlooks.

The ratings affect roughly $624 million of parity debt outstanding.

Moody’s, in a July commentary, said municipal water and sewer utilities are among the best positioned public finance sectors to confront COVID-19 related credit risks.

“Since the last recession, utilities have proactively increased rates, added to strategic reserves and reduced leverage while raising debt-service coverage,” Moody’s said. “Revenue growth will slow over at least the coming year as a result of moderated rate increases, lower connection fees, higher delinquency rates and some reductions in usage.”

Even under severe stress scenarios, strong liquidity ensures debt service coverage for an extended period, Moody’s added.

Moody’s said its rating of PWSA reflects the authority’s “considerable size and dynamic, urban service area, and also considers its relatively narrow, though improving, cash position compared to similarly sized peers.” It also cited PWSA's management controls, including comprehensive budgeting.

Pittsburgh, the economic center of western Pennsylvania, has transitioned in recent years from reliance on steel and heavy manufacturing to a healthcare and education focus. Key industries include information technology, financial services and advanced manufacturing.

The authority’s operating performance has exceeded budget expectations for two years.

PWSA, which began in 1984, is Pennsylvania's largest combined water and sewer authority. It provides services to more than 300,000 customers throughout Greater Pittsburgh, covering roughly 84% of the city’s population. The authority absorbed the water department in 1995, and became the sole proprietor of the sewer system four years later.

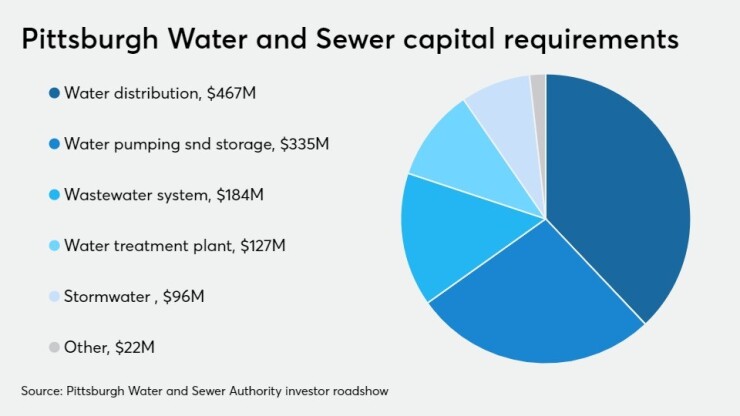

Its five-year capital program for 2021 to 2025 totals $1.2 billion. Goals for the plan include reducing non-revenue water to below 20% within 10 years.

The authority’s board has scheduled its next meeting for 10 a.m. Friday.

Because of the COVID-19 impact, revenues are down by $5.4 million, or nearly 3%, year-over-year as of Sept. 30.

Officials, during an investor roadshow, cited decreases in consumption during business closures after Gov. Tom Wolf ordered a shutdown of non-essential businesses in May.

While businesses have slowly started to reopen, limitations still prohibit businesses from functioning at pre-coronavirus levels.

The PWSA has been delaying and reducing costs this year to help offset revenue reductions. While the authority has not been eligible for any COVID-19 relief, “the PWSA will continue to monitor all opportunities,” it said in a statement.

Public Resources Advisory Group is the municipal advisor for the sale. McNees, Wallace & Nurick LLC is bond counsel.

The authority also intends to remarket $218.8 million of Series 2017C first lien revenue bonds on Dec 1.