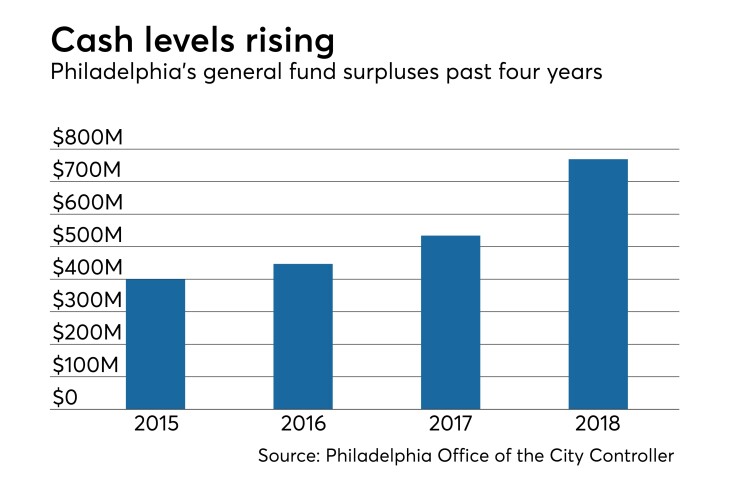

Economic growth and increased local taxes drove Philadelphia to its highest surplus since the Great Recession in the last fiscal year, according to the city’s fiscal watchdog.

Philadelphia finished the 2018 fiscal year that ended June 30 with $769 million of leftover cash in its general fund, the city’s largest year-end balance since 2007 ($993 million), City Controller

“Cash levels are important to the financial health of a government,” said Rhynhart, who was elected last November on a transparency platform and is planning to release reports on the city’s cash position every quarter. “Our first report shows that the City is in a historically strong cash position — its strongest since the Great Recession.”

Rhynhart said that in addition to seeing economic expansion and increased tax revenues, Philadelphia benefited from grant reimbursements that were filed in a timely fashion. The city also has cut down on its short-term borrowing, issuing $125 million of tax and revenue anticipation notes last year, down from $350 million in 2009.

Mike Dunn, a spokesman for Mayor Jim Kenney, said the cash balance doesn't factor in expenditures the city still needs to settle for the last fiscal year. He projects the general fund balance for 2018 will be $228.5 million, once the city’s unaudited 2018 fiscal year financial statement is released by the end of October.

“Once we release our unaudited FY18 financial statement (by month’s end) we will better be able to determine the size of the projected fund balance and, therefore, we’d have a better sense of the likelihood of creating a Rainy Day Fund,” Dunn said. “That conversation that will be part of the budget process for FY20 and we’ll discuss it with Council at the appropriate time.”

Though Philadelphia established a rainy day fund policy starting in 2011, it has remained empty under recent budgets because of projections that the fund balance would be too small. City officials established a fund balance target goal of 6 to 8% of general fund expenditures during its most recent five-year strategic plan in hopes of being able to set aside deposits into the rainy day fund.

Philadelphia began the 2019 fiscal year with local control of its school district for the first time since 2001 and Mayor Kenney committing to inject nearly $1 billion of