While a Pennsylvania report on debt costs weighed against the backdrop of COVID-19, state Treasurer Joe Torsella said it could help trigger discussion of underlying fiscal challenges.

“COVID-19 lays bare the cracks in our foundation that have been forming for many years, but now put the commonwealth in a difficult position with substantial cash-flow shortfall projections and very little savings for a rainy day,” Torsella said Monday upon releasing “

Refinancing of $2.4 billion of outstanding bonds that Pennsylvania authorities hold could reduce costs by up to $180 million in present-value savings, according to Torsella. That includes general obligation debt issued through the state budget office.

Torsella said refinancings coluld also benefit the Delaware River Port Authority, Harrisburg Area Community College, Montgomery County Community College, Northampton Area Community College, the Pennsylvania State System of Higher Education and the Pennsylvania Infrastructure Investment Authority.

He called the report the first modern, comprehensive review of the full scope of debt held by commonwealth authorities and related entities.

Act 37, which Gov. Tom Wolf signed June 30, directed Treasury to analyze the debt obligations of commonwealth authorities and related entities and identify refinancing opportunities.

“The success of Pennsylvania’s future economic recovery relies on informed, prudent fiscal policies today,” Torsella said.

Torsella, a Democrat, will leave office at the end of the year. He narrowly lost his re-election bid to Republican Stacy Garrity.

“COVID-19 ended the longest U.S. expansion on record. While some states used those years to prepare for a fiscal emergency, Pennsylvania — except for a laudable initial deposit to the rainy day fund in 2019 — largely did not,“ Torsella said.

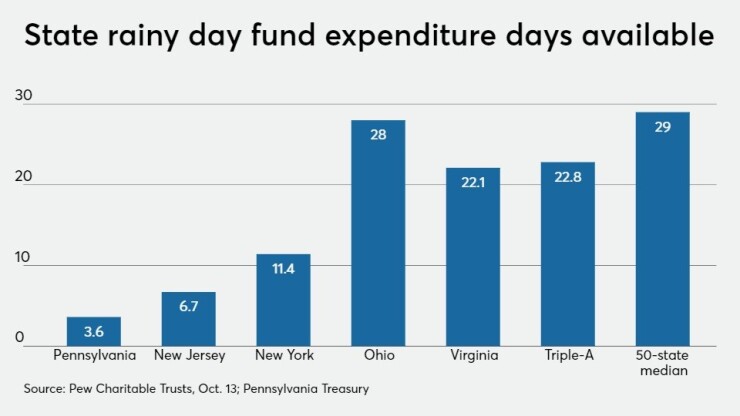

Pennsylvania largely depleted its rainy-day fund in response to the last recession. Pew Charitable Trusts estimated the commonwealth held zero days’ worth of expenditures in the fund between fiscal 2010 and fiscal 2018.

After its $317 million deposit in July 2019, the fund is now projected to hold 3.6 days’ worth of expenditures as of fiscal 2020 — still well below its peer states, the media for Triple-A rated states and the 50-state median.

S&P Global Ratings, citing pandemic-induced revenue shortfalls and with pre-existing budgetary and structural deficiencies,

S&P rates Pennsylvania GOs A-plus while Fitch Ratings and Moody’s Investors Service rate them AA-minus and Aa3, respectively. Fitch and Moody’s assign stable outlooks.

Citing a recommendation by the Pew Charitable Trusts, Torsella said Pennsylvania’s General Assembly should require a biennial debt affordability study that coincides every other year with the commonwealth’s budget process, “to provide full information to our budget writers and assist in setting broader policy priorities.”

He also called on the commonwealth to make a long-term commitment to shore up its rainy-day fund and its other post-employment benefit, or OPEB, trust fund.