Although there will be no more new issuance in 2019, municipal bond investors can expect to get plenty of returns as seasonal trends should provide opportunities from now through January.

Together, December and January have accounted for approximately 44% of full-year total returns on average the past five years, according to Blackrock.

The Blackrock municipal bonds group said it has shifted strategy to an overall long stance on duration, taking more interest rate risk from a more neutral stance they had in November.

“We are using a barbell yield curve strategy with concentrations in maturities of 0-5 years and 20 years and out,” the group said in a report. “We hold favorable view on credit and prefer revenue bonds, lower-rated investment grade credits and issues in high tax states.”

The group, which features Peter Hayes as head of the group, James Schwartz as head of muni credit research; and Sean Carney as head of muni strategy, expects the trend of taxable issuance — and specifically taxables issued to advanced refund higher cost tax exempt debt — to continue.

“All the taxable issuance has been well absorbed, with taxable issues benefiting from a broad buyer base of both foreign and crossover investors seeking income in a world with over $12 trillion in negative-yielding debt.”

Charles Schwab: Opportunities for munis may come knocking in 2020

With higher yields expected in the muni bond market for 2020, income-oriented investors figure to benefit, according to Cooper Howard, director, fixed income strategy for the Schwab Center for Financial Research.

“We suggest investors focus on higher-rated issuers and target an average duration between five and eight years for an attractive balance of risk and reward,” he said. “2019 is on pace to be the first year in 18 years in which every major fixed income asset class returned at least 5%.”

Howard noted that returns were primarily driven by falling Treasury yields, but Schwab forecasts yield may rise modestly in 2020, creating headwinds for performance.

“Muni returns are likely to slow but still be positive in 2020,” he said. “We like municipal bonds in 2020 and while returns aren’t likely to be as strong as they have been in 2019, valuations have improved from their lows earlier this year, presenting a more attractive entry point for longer-term investors.”

Secondary market

Munis were stronger on the MBIS benchmark scale, with yields decreasing by a basis point in the 10-year maturity and by less than a basis point in the 30-year. High-grades were also stronger, with yields on MBIS AAA scale falling by no more than basis points in both the 10-year and 30-year maturities.

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yields were unchanged on both the 10- and 30-year maturities at 1.45% and 2.09%, respectively.

The 10-year muni-to-Treasury ratio was calculated at 74.9% while the 30-year muni-to-Treasury ratio stood at 88.5%, according to MMD.

Treasuries were on the rise, while stocks continued a hot streak with all three major indexes in the green.

The Dow Jones Industrial Average was up about 0.40% as the S&P 500 Index rose 0.13% while the Nasdaq gained 0.29%.

The Treasury three-month was yielding 1.546%, the two-year was yielding 1.652%, the five-year was yielding 1.752%, the 10-year was yielding 1.935% and the 30-year was yielding 2.362%.

Previous week’s actively traded issues

According to

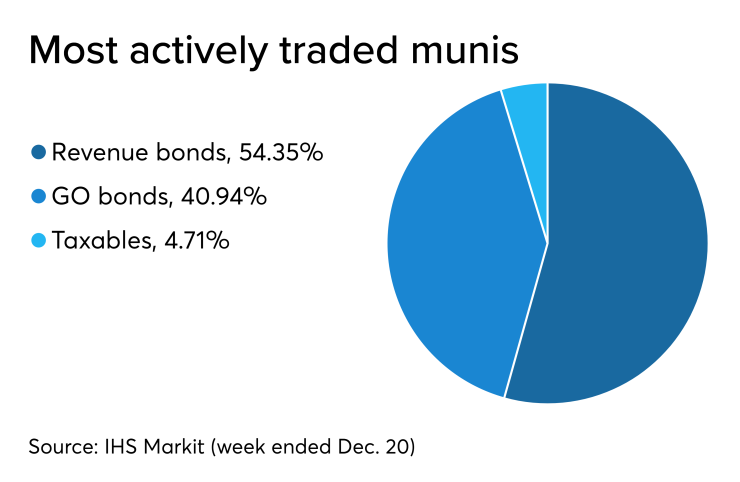

Some of the most actively traded munis by type in the week ended Dec. 20 were from California and New York issuers, according to IHS Markit.

In the GO bond sector, the Los Angeles Community College District, Calif., 4s of 2038 traded 30 times. In the revenue bond sector, the Dormitory Authority of the State of New York’s 4s of 2047 traded 61 times. In the taxable bond sector, the City and County of San Francisco Public Utility Commission, Calif., 3.303s of 2039 traded 68 times.

Previous week’s actively quoted issues

Puerto Rico, South Carolina and Florida bonds were among the most actively quoted in the week ended Dec. 20.

On the bid side, the Puerto Rico Sales Tax Financing Corp. revenue 5s of 2058 were quoted by 43 unique dealers. On the ask side, the Columbia Waterworks and Sewer System, S.C., revenue 4s of 2044 were quoted by 137 dealers. Among two-sided quotes, the Florida Hurricane Catastrophe Fund Financing Corp., taxable 2.995s of 2020 were quoted by 13 dealers.

Previous session's activity

The MSRB reported 28,482 trades Friday on volume of $9.483 billion. The 30-day average trade summary showed on a par amount basis of $11.75 billion that customers bought $6.28 billion, customers sold $3.41 billion and interdealer trades totaled $2.05 billion.

California, New York and Texas were most traded, with the Golden State taking 14.475% of the market, the Empire State taking 12.446% and the Lone Star State taking 9.159%.

The most actively traded security was the Rhode Island State and Providence Plantations GO bonds, 3s of 2038, which traded 10 times on volume of $23.1 million.

Treasury auctions

The Treasury Department Tuesday auctioned $40 billion of two-year notes with a 1 5/8% coupon at a 1.653% yield, a price of 99.945138.

The bid-to-cover ratio was 2.30.

Tenders at the high yield were allotted 4.42%.

The median yield was 1.625%. The low yield was 1.450%.

Treasury auctions discount rate bills

Tender rates for the Treasury Department's latest 91-day and 182-day discount bills were higher, as the $42 billion of three-months incurred a 1.555% high rate, up from 1.540% the prior week, and the $36 billion of six-months incurred a 1.570% high rate, up from 1.550% the week before.

Coupon equivalents were 1.587% and 1.609%, respectively. The price for the 91s was 99.606931 and that for the 182s was 99.206278.

The median bid on the 91s was 1.530%. The low bid was 1.495%.

Tenders at the high rate were allotted 22.71%. The bid-to-cover ratio was 2.94.

The median bid for the 182s was 1.535%. The low bid was 1.495%.

Tenders at the high rate were allotted 44.09%. The bid-to-cover ratio was 3.03.

Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.