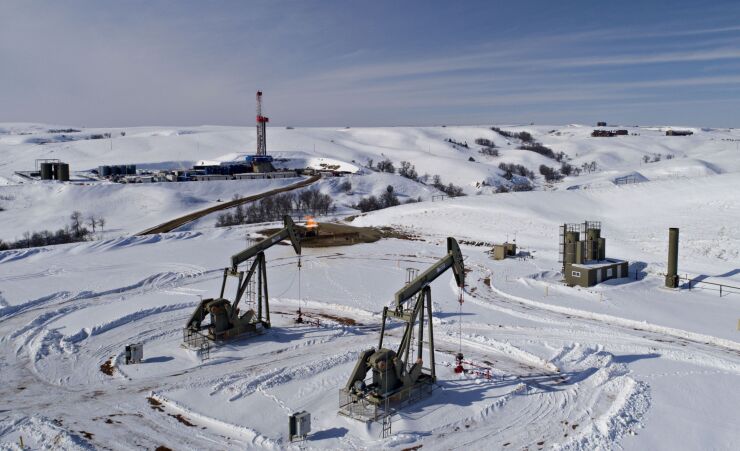

Heading into the New Year, weak oil prices and production declines will continue to strain several North Dakota cities dependent on oil-related revenue.

A prolonged period of production declines will hit the state’s Bakken Shale hub cities of Williston, Minot and Dickinson the hardest, according to a Moody's Investors Service comment. Moody’s rates Williston Ba2 with a stable outlook and Minot Aa2 with a stable outlook. It does not rate Dickinson.

Williston has the highest reliance on production revenue and faces the most risk because its economy and tax collections are highly dependent on oil and gas production revenue.

“The decline in oil production will have a significant, though much less severe, impact on Dickinson. Minot, which has a lower reliance on this revenue source and benefits from a more diverse economy, will endure far less budget stress, if any, related to a production decline,” Moody’s analyst Jennifer Card Bernhardt said in the recent report.

Oil and gas tax revenue are major revenue drivers for Williston and Dickinson at 51% and 34% of their operating revenue, respectively. Minot, which benefits from the economic stability of the nearby Minot Air Force Base, is at 8%.

The decline in oil-related revenue is worsened by drops in local sales tax revenue due to the impact of the COVID-19 pandemic’s impact.

“Hub cities are heavily reliant on local sales tax revenue and have endured varying declines during the pandemic, with Williston suffering the most dramatic drop-offs,” Moody’s said.

The drag on oil production adds to the state’s woes as it grapples with sales tax declines due to the impact of the COVID-19 pandemic and that could trickle down to local governments. The state produces more crude oil than any other with the exception of Texas.

North Dakota's oil production statewide remains 30% below last year despite improving since a May low.

“Even with the recent uptick, the Energy Information Administration estimates that US crude oil production will decline to 11.1 million barrels per day in 2021 on an annual average basis, down from 11.3 million in 2020 and a record 12.2 million in 2019,” Bernhardt said in the report.

Moody’s said the price of West Texas Intermediate (WTI) crude is not projected to return to its $47.30 per barrel price from the first quarter of 2020 until the second quarter of 2022. The Bakken region's distance from refineries and storage hubs means its oil often sells more cheaply than WTI and the price difference for Bakken crude and WTI has widened to about $5 from $4 per barrel, Moody’s said.

Other North Dakota cities like Fargo, West Fargo, and Grand Forks are less exposed to oil revenue but remain susceptible to sales tax declines and potential state aid cuts as do other local governments if oil production and prices don’t pick up. Cities rely on less than 20% of state aid for operations, Moody’s said of the cities it rates.

“While the governor has not recommended any state aid cuts in the biennium that ends June 30, 2021, a decline in production-related taxes and state sales taxes have the potential to reduce local government funding. While the state forecasts a modest 2% revenue decline in the 2021-23 biennium, it has asked state agencies to prepare budgets with 5% to 15% reduction scenarios,” Moody’s said.

Moody’s expects most cities to manage. “Cities' generally strong liquidity, flexibility to raise taxes and ability to reduce personnel costs provide tools to help offset revenue shortfalls,” Moody’s said.