CHICAGO — Ohio Gov. John Kasich Tuesday unveiled a highly anticipated two-year budget that tackles an $8 billion shortfall and avoids raising taxes by cutting spending, selling state assets, and pushing off near-term debt payments.

Kasich planned to hold a televised town hall meeting to tout the $120 billion, all-funds spending plan Tuesday night.

The budget was widely expected to feature a series of high-profile asset privatizations, including the sale or lease of the Ohio Turnpike and the Ohio Lottery. Instead, Kasich turned to plans to sell a handful of state prisons to generate $200 million and a $1.2 billion lease of the state’s lucrative liquor distribution system.

Kasich is reportedly still interested in leasing the lottery and the turnpike, one of the nation’s longest roads and highest-rated highway credits. The Republican governor said he will pursue the plans throughout the legislative session.

The $55.5 billion budget for fiscal 2012 and 2013 formally increases state aid to colleges and K-12 schools, though most schools would not end up seeing new dollars as the $875 million of federal stimulus money in the current budget goes away.

The general fund budget marks a roughly 10% increase from the current budget crafted by former Gov. Ted Strickland, a Democrat.

The spending plan would leave an unreserved ending balance of $135 million in 2013 and put aside no money for the state’s empty rainy-day fund.

It preserves an $800 million, two-year income tax cut that went into effect in 2011.

“Today I keep my promise,” Kasich said in an early afternoon press conference releasing the budget, which he dubbed the Jobs Budget. “This budget is woven with one reform after another.”

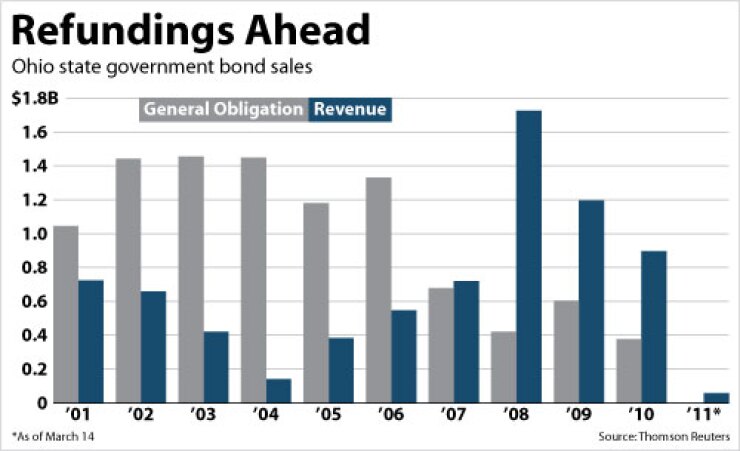

The proposal would push off $440 million of debt service payments due in 2012 and use that money for general fund services. The state would make the delayed payments starting in 2015 through 2025.

Of the $440 million, $322 million would be saved by the sale of general obligation refunding bonds issued by the Ohio Public Facilities Commission and $118 million would come from lease-rental refunding bonds issued by the Ohio Building Authority.

The debt refundings would restructure less than 5% of the state’s outstanding debt and mostly preserve Ohio’s relatively rapid debt-amortization rate. No additional debt restructuring is planned for 2013.

The budget calls for selling five prisons and closing four prison camps to raise $200 million. Leasing the state’s wholesale liquor distribution system to JobsOhio, Kasich’s private jobs development board, would generate $1.2 billion. The state would likely need to pay off at least $1 billion of bonds that are backed by profits from the liquor distribution system.

The Ohio Division of Liquor Control distributes all hard liquor in the state and collects the liquor tax. The system generates roughly $220 million annually, much of which now goes into the general fund. Proceeds from the sale would be used to fund economic development.

The budget cuts deeply into state aid to local governments, reducing it by 25% in 2012 and 50% in 2013. Kasich defended the cuts, saying they are “accompanied by tools to allow local governments to cope.”

Those tools include a push to share regional services, as well as a controversial Republican-sponsored Senate bill that would limit public employees’ collective bargaining rights.

Ohio is not expected to release a capital budget this year, though it has been two years since its last capital bill. The state’s most recent capital bill totaled $1.75 billion for 2009-2010.

The Republican-led Legislature has until June 30 to approve a final budget.