Growing expectations by the municipal bond market for an interest rate cut by the Federal Reserve, along with heavy redemption flows, continuing demand and dwindling volume will make it difficult for investors with extra cash to find bonds, says Patrick Luby, senior municipal strategist with CreditSights.

Writing in a Monday market comment, Luby said that after last week’s Federal Reserve Open Market Committee meeting, odds for a July rate cut jumped to 100% from 81%.

“That helped municipal bond yields rally lower across the curve but VRDO yields — as reflected in the SIFMA Index — moved in the opposite direction,” he wrote. “The one-year spot on the Bloomberg BVAL triple-A rated benchmark yield curve declined by seven basis points last week while the SIFMA Index rose by 19 basis points.”

The S&P 500 hit an all-time high last week as the U.S. Treasury 10-year yield fell below 2% for the first time since 2016.

“While the Global Investment Committee is skeptical that rate cuts are the right medicine for a business cycle imperiled by trade uncertainty, the historical record may provide additional perspective,” Lisa Shalett CIO of Morgan Stanley Wealth Management, wrote in a Monday comment. “Of the last four episodes of Fed easing, stocks continued to gain after cuts in 1995 and 1998. However, both episodes were mid-cycle reflations as opposed to a late-cycle slowing ahead of a recession, which is what we believe is happening now. We remain cautious.”

Societe Generale also noted the decline in Treasury yields.

“We now expect the 10-year Treasury to end the year at 1.70% and to decline to 1.50% by mid-2020,” Subadra Rajappa, Head of U.S. Rates Strategy at Societe Generale. “Following the dovish June FOMC meeting, our economists now expect the Fed to cut in July and September, and deliver a total of five 25 basis point cuts by end-2020.”

But wait a minute, not all analysts are on the same page.

“What’s the argument for cutting the Fed funds rate either 75 or 100 basis points before the end of the year, again? I have the feeling that markets blew right past that question on Wednesday, and simply equated the Federal Reserve leaning toward cutting interest rates with a massive amount of monetary stimulus. That is all it took and stocks and bonds were off to the races with no interest in looking back,” said Scott Anderson, chief economist at Bank of the West.

“Maybe I missed something this week. I read through the FOMC statement and summary of economic projections, and listened intently to Fed Chairman Jerome Powell’s press conference, and maybe I’m tone deaf, but outside the steep inversion of the Treasury yield curve and intense pressure from the Trump administration to cut interest rates, the economic arguments for panicked rate cuts as soon as next month seem pretty thin right now,” he wrote.

Turning to supply, Janney pointed out the excellent response by investors to last week’s new-issue sales.

“In post-sale trading, Pittsburgh Water and Sewer Authority (A3/A/NR) bonds maturing in 2037, wrapped by Assured Guaranty (A2/AA/NR), had block trades on Friday at a 2.54% yield to the 2029 call, 15 basis points below original pricing, and yields for Friday trades of Pennsylvania Turnpike Commission sub debt (A3/NR/A-) 4% due in 2049 fell by seven and six basis points, respectively, compared to the new-issue pricing,” Janney managing director Alan Schankel wrote in a Monday comment. “This strong aftermarket response, in part, reflects the challenge faced by mutual fund portfolio managers, who continue to see strong inflows of cash that must be put to work.”

CreditSights estimates that more than $34 billion in principal will be returned by issuers on July 1, the lion’s share of the $41.9 billion returned for all of July. August redemptions are forecast to be the heaviest of the year, with $48.8 billion in municipal bonds coming due or being called.

Last week’s sale of $280 million of green bonds by Connecticut (Aaa/AAA/AAA) saw retail orders topping $240 million in one day, while interest costs dropped to a record low at 2.69%, Connecticut State Treasurer Shawn Wooden said Monday.

The $240 million of retail orders was the highest level of orders by individuals in the 20-year history of this bonding program while the overall interest cost on the Series A 20-year bond issue was 2.69%, the lowest cost achieved on the sale of any similar bond issue in the past 20 years. In addition, the pricing spreads on the bonds were among the lowest achieved in the program’s history, Wooden said.

Primary market

Raymond James & Associates priced for retail the New York City Municipal Water Finance Authority’s (Aa1/AA+/AA+) $452.945 million of Fiscal 2020 Series AA water and sewer system second general resolution revenue bonds. The deal will be priced for institutions on Tuesday. Proceeds from the bond sale will be used to refund certain outstanding bonds for savings.

Also Tuesday, BofA Securities is expected to price Whiting, Ind.’s (A1/A-/NR) $300 million of Series 2019A environmental facilities refunding revenue bonds for BP Products North America.

Wells Fargo Securities is set to price the Illinois State Toll Highway Authority’s (A1/AA-AA-) $300 million of Series 2019A toll highway senior revenue bonds on Tuesday.

The authority last sold bonds in December 2018, when JPMorgan priced the tollway’s $515.25 million of Series 2018A senior revenue refunding bonds. The 2029 maturity was priced at 118.171 as 5s to yield 2.89%. The maturity traded in a block of $1.4 million on June 4 at 125.414 to yield 2.06%.

In the competitive arena, the Toms River Regional School District’s Board of Education, N.J., (NR/AA-/NR) will sell $147.148 million of unlimited tax general obligation school bonds.

Proceeds will be used to finance improvements to various school buildings. Phoenix Advisor is the financial advisor; McManimon Scotland is the bond counsel. The district is a Type II regional school district that serves the Township of Toms River, the Borough of Beachwood, the Borough of Pine Beach and the Borough of South Toms River.

The Virginia Independent School District Number 707, Minnesota, is selling $142.165 million of Series 2019A GO school building bonds backed by the state’s school district credit enhancement program.

Proceeds will be used for financing the construction of a new high school and a new elementary school. Ehlers is the financial advisor; Dorsey & Whitney is the bond counsel. The district comprises an area of 156.82 square miles and is located about 195 miles northwest of the Minneapolis-St. Paul metropolitan area and about 65 miles north of Duluth.

Monday’s bond sale

Secondary market

“Investors’ attention shifts to the political agenda at the start of the week,” Ipek Ozkardeskaya, senior market analyst at London Capital Group, wrote in a Monday market comment. “Besides the Iranian tensions, the upcoming G20 meeting brings the trade war between the U.S. and China back on the table. While Trump and Xi are expected to meet at this week’s summit in Osaka, the chances of a trade deal between the two countries remain slim.”

Munis were mixed on the

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on the 10-year muni GO remained unchanged at 1.63% while the 30-year muni fell one basis point to 2.31%.

The 10-year muni-to-Treasury ratio was calculated at 79.0% while the 30-year muni-to-Treasury ratio stood at 89.5%, according to MMD.

Treasuries were stronger as stocks traded mixed. The Treasury three-month was yielding 2.128%, the two-year was yielding 1.745%, the five-year was yielding 1.759%, the 10-year was yielding 2.025% and the 30-year was yielding 2.559%.

“Light volume in the muni sector has the ICE Muni Yield Curve down about one basis point,” ICE Data Service said in a Monday market comment. “The shorter end of the curve has drifted down a little more than the longer end. High-yield and tobaccos are very quiet and unchanged. The five-year taxable maturities lead the sector down by 5.6 basis points.”

Previous session's activity

The MSRB reported 29,264 trades Friday on volume of $10.414 billion. The 30-day average trade summary showed on a par amount basis of $12.63 million that customers bought $6.33 million, customers sold $4.22 million and interdealer trades totaled $2.08 million.

Texas, California and New York were most traded, with the Golden State taking 13.936% of the market, the Empire State taking 11.882% and the Lone Star State taking 9.451%.

The most actively traded security was the Puerto Rico GDB Debt Recovery Authority taxable 7.5s of 2040, which traded 21 times on volume of $27.41 million.

Last week's actively traded issues

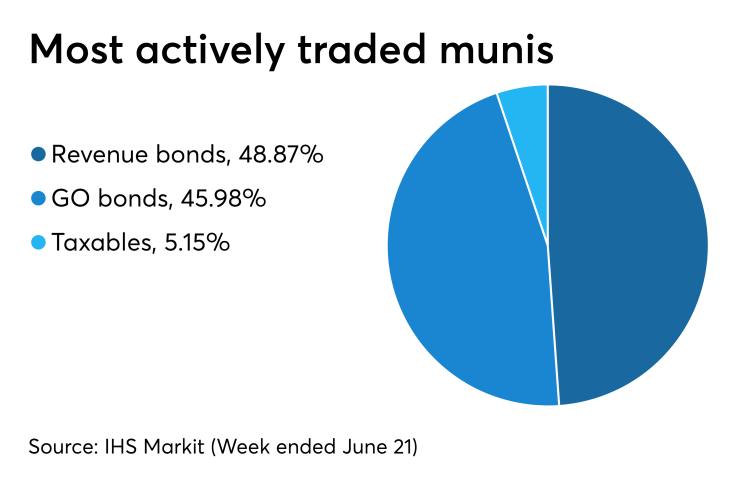

Revenue bonds made up 48.87% of total new issuance in the week ended June 21, up from 48.59% in the prior week, according to

Some of the most actively traded munis by type in the week were from Puerto Rico and Pennsylvania issuers.

In the GO bond sector, the Puerto Rico 8s of 2035 traded 72 times. In the revenue bond sector, the Pennsylvania Turnpike Commission 4s of 2049 traded 40 times. In the taxable bond sector, the Puerto Rico GDB Debt Recovery Authority 7.5s of 2040 traded 42 times.

Treasury auctions discount rate bills

Tender rates for the Treasury Department's latest 91-day and 182-day discount bills were lower, as the $36 billion of three-months incurred a 2.085% high rate, down from 2.170% the prior week, and the $36 billion of six-months incurred a 2.030% high rate, off from 2.130% the week before.

Coupon equivalents were 2.131% and 2.085%, respectively. The price for the 91s was 99.451472 and that for the 182s was 98.923167.

The median bid on the 91s was 2.055%. The low bid was 2.030%. Tenders at the high rate were allotted 1.83%. The bid-to-cover ratio was 3.00. The median bid for the 182s was 1.990%. The low bid was 1.950%. Tenders at the high rate were allotted 14.16%. The bid-to-cover ratio was 2.69.

Gary E. Siegel and Aaron Weitzman contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.