The municipal bond market saw more supply hit the screens on Wednesday, topped by New York City’s big general obligation bond offering.

Among retail investors, there have been some credit concerns, as they have not reached for lower quality credits in lieu of high-quality bonds, according to a New York trader.

"People are being more careful," he said, noting recent credit concerns in Puerto Rico, New Jersey, and Illinois.

"There's a lot of cash out there, and today we have a major Treasury auction, so we will be watching that” for some direction on investor patterns in fixed-income overall, he said.

Primary market

RBC Capital Markets priced New York City’s $809.555 million of tax-exempt general obligation bonds for institutions after a two-day retail order period.

The deal includes Fiscal 2019 Series A and B GOs and Fiscal 1994 Series H, Subseries H3 GOs.

The city also competitively sold $60 million of taxable Fiscal 2018 Series C GOs.

RBC Capital Markets won the bonds with a true interest cost of 3.3903%. The financial advisor is Public Resources Advisory Group and the bond counsel is Norton Rose.

The deals are rated Aa2 by Moody’s Investors Service, and AA by S&P Global Ratings and Fitch Ratings.

Jefferies received the official award on the New York Triborough Bridge and Tunnel Authority’s $270.09 million of Series 2018B general revenue refunding bonds for institutions on Tuesday after holding a one-day retail order period.

The deal is rated Aa3 by Moody’s, AA-minus by S&P and Fitch and AA by Kroll Bond Rating Agency.

A hefty balance on the New York City general obligation deal this week demonstrates how the summer doldrums may have deterred some retail investors from the deal, but municipal sources said they expect institutions to come in and sweep up what's left.

"We have not seen a lot of retail interest in the NYC GO deal," a New York municipal manager said on Tuesday. "It seems the rest of the Street is feeling the same based on the balances; it was an $809 million deal, retail orders were $398 million, and the balance was $506 million.”

The Triborough Bridge & Tunnel Authority did well with its $273 million general revenue refunding offering, he noted. "The marketing is boring, but the market is in good shape and very competitive on everything" in the primary and secondary market, he added.

Piper Jaffray priced Houston’s $322,255 million of Series 2018D combined utility system first lien revenue refunding bonds. The deal is rated Aa2 by Moody’s and AA by Fitch.

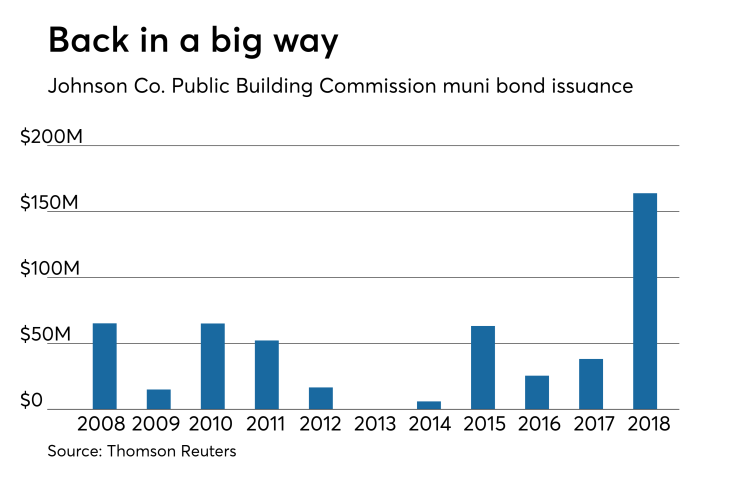

In the competitive arena, the Johnson County Public Building Commission, Kan., sold $163.925 million of Series 2018A lease purchase revenue bonds for courthouse and medical examiners facility projects.

Wells Fargo Securities won the bonds with a TIC of 2.3934%. The deal is rated triple-A by Moody’s and S&P. The financial advisor is Springsted and the bond counsel is Gilmore & Bell.

Since 2008, the commission has sold about $511 million of bonds, with the most issuance prior to this year coming in 2008 when it offered $65.2 million of bonds. It did not come to market in 2013.

Wednesday’s bond sales

New York

Texas

Kansas

Secondary market

Municipal bonds were mostly weaker on Wednesday, according to a midday read of the MBIS benchmark scale. Benchmark muni yields rose less than one basis point in the seven-year and 13- to 30-year maturities, fell less than a basis point in the one- to five-year and 10-year maturities and remained unchanged in the six-year, eight- and nine-year and 11- to 12-year maturities.

High-grade munis were also mostly weaker, with yields calculated on MBIS’ AAA scale rising less than one basis point in the seven- to nine-year and 16- to 30-year maturities, falling less than a basis point in the one- to six-year and 10- to 14-year maturities and remaining unchanged in the 15-year maturity.

Municipals were weaker on Municipal Market Data’s AAA benchmark scale, which showed the yield on the 10-year muni general obligation rising as much as one basis point while the yield on the 30-year muni maturity increased as much as two basis points.

Treasury bonds were stronger as stocks traded lower.

On Tuesday, the 10-year muni-to-Treasury ratio was calculated at 83.5% while the 30-year muni-to-Treasury ratio stood at 98.1%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Bond Buyer 30-day visible supply at $10.32B

The Bond Buyer's 30-day visible supply calendar decreased $277.6 million to $10.32 billion for Wednesday. The total is comprised of $1.97 billion of competitive sales and $8.36 billion of negotiated deals.

NYC Water to sell $270M bonds

The New York City Municipal Water Finance Authority said it plans to sell $270 million of tax-exempt fixed rate second general resolution revenue bonds on Wednesday, Aug. 15.

A retail order period will be held the morning of the sale.

The bonds will be priced by authority’s underwriting syndicate led by book-running lead manager RBC Capital Markets and joint lead managers Barclays and Blaylock Van. Raymond James and Siebert Cisneros Shank & Co. will serve as co-senior managers on the transaction.

Proceeds from the sale will be used to refund outstanding bonds.

Previous session's activity

The Municipal Securities Rulemaking Board reported 39,196 trades on Tuesday on volume of $11.64 billion.

California, Texas and New York were the states with the most trades, with the Golden State taking 19.695% of the market, the Lone Star State taking 12.295% and the Empire State taking 9.417%.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.