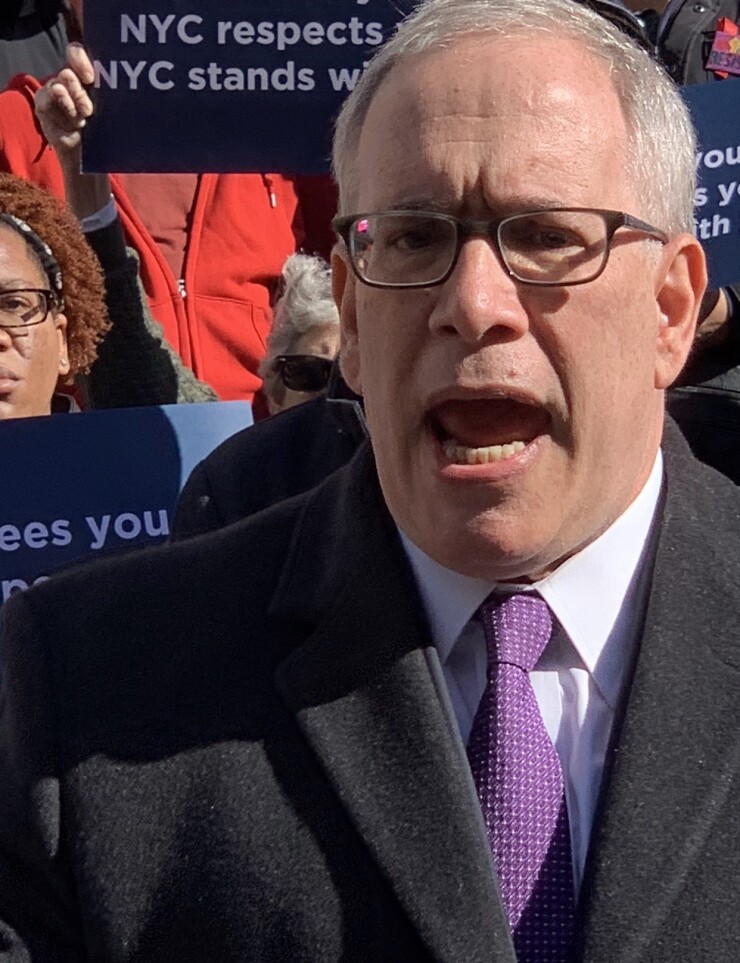

New York City Comptroller Scott Stringer is urging the city to restore money cut from the budget, which funds helps non-profit organizations with certain costs so they can continue to deliver services.

Stringer sent a

The ICR helps non-profit organizations pay the costs of human resources, facilities, finance staff, rent, utilities, and other expenses that are not covered by city contracts.

The non-profit sector has raised concerns about the cuts and is currently facing a

The $54 million annual allocation for the program was cut by $20 million in the fiscal year 2020 budget and in fiscal 2021 — a shortfall Stringer said would impact the stability and operations of non-profits. The letter emphasized the importance of restoring full funding for the program to ensure non-profits can continue to deliver services to the most vulnerable New Yorkers.

“Investing in the human sector is more critical than ever as our residents weather the storm created by COVID-19,” Stringer wrote. “I urge you to ensure that the terms of the city’s indirect cost rate initiative are honored and fully funded.”

Looking at the city’s finances, the comptroller’s office said Monday that personal income taxes withheld from wages and salaries of employees in the city continued its negative downward trend since the beginning of the pandemic.

July’s PIT withholding dropped 7.9% after falling 2.3% in June, the fourth straight month of year-over-year declines.

In the four-month period from April through July, the city has lost over $225 million in withholding revenue compared to last year, the comptroller’s office said in its weekly report New York by the Numbers.

However, the report showed that that initial unemployment claims by city residents in the last week of July fell below 40,000 for the first time since the start of the pandemic.

In part due to Tropical Storm Isaias, the average weekday MTA subway and bus ridership fell in the week ending Aug. 7, the report showed. As of Aug. 5, subway ridership was about 76% below typical levels, while bus ridership was down 40%.

The city is one of the largest issuers of municipal debt in the United States. As of the end of the second quarter of fiscal 2020, the city had about $38 billion of general obligation debt outstanding. That's not counting the various city authorities that issue debt.

The NYC Transitional Finance Authority has $39 billion of debt outstanding while the NYC Municipal Water Finance Authority has $31 billion of debt outstanding. The TFA’s debt consists of future tax-secured senior bonds (Aaa/AAA/AAA), future tax-secured subordinate bonds (Aa1/AAA/AAA) and building aid revenue bonds (Aa2/AA/AA). The MWFA’s debt consists of general resolution bonds (A1/AAA/AA+) and second general resolution bonds (Aa1/AA+/AA+).

Moody’s Investors Service rates the city's GOs Aa1 and S&P Global Ratings and Fitch Ratings rate it AA.