The North Carolina Local Government Commission has approved a request from Wake County for almost $600 million of financing for school and community college construction and renovation.

The LGC also approved the state’s request to issue $300 million of grant anticipation revenue vehicle bonds for Department of Transportation construction projects. Several other school, government building and infrastructure proposals received approval.

The LGC monitors the financial well-being of over 1,300 local government entities in the state. It determines whether the amount of money they want to borrow is reasonable for the proposed projects and looks to see whether the municipalities or agencies are able to repay the debt.

The LGC signed off on the debt proposals at its meeting in Raleigh on Tuesday. The commission is chaired by state Treasurer Dale Folwell, CPA, and staffed by the Department of the State Treasurer.

“The Local Government Commission plays a key role in a low-key way to help North Carolina government units at all levels secure low-cost, tax-free financing for vital projects that serve taxpayers in every corner of the state,” Folwell said.

Wake County’s request for over $584 million of financing for school construction and renovation are part of the county’s seven-year capital improvement plan to provide sufficient public school facilities for more than 160,000 students.

The school district’s student population is rising with the county’s continuing rapid growth. Between 2010 and 2020, Wake County’s population increased 23.4% to more than 1.1 million people.

The financing will be a private placement installment contract in a drawdown, interest only variable-rate installment financing facility with a five-year initial maturity. The county intends to convert the outstanding balance to a conventional permanent financing in intervals when needed as market conditions dictate.

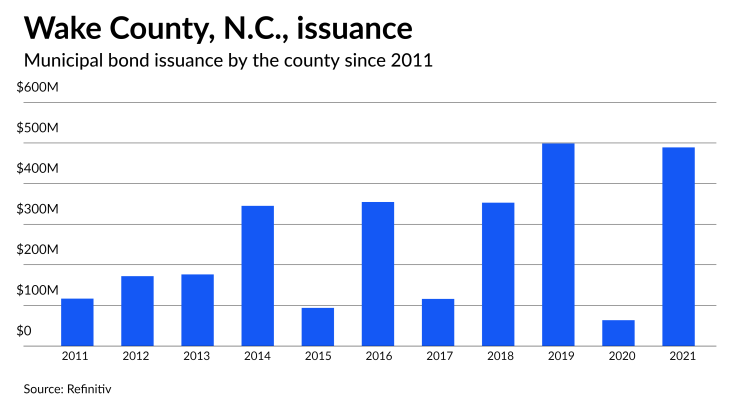

Since 2011, the county has sold about $2.8 billion of bonds, with the most issuance occurring in 2019 when it issued $499 million of debt.

After Tuesday morning’s approval from the Council of State, the LGC granted the state’s request to issue up to $300 million of GARVEEs for NCDOT projects. The GARVEEs will be paid off after the state receives reimbursement from the Federal Highway Fund. NCDOT officials expect to close on the negotiated deal between Sept. 7 and 10.

The state said it expects the bonds to be structured as fixed-rates with a 15-year maturity and be rated A2 by Moody's Investors Service, AA by S&P Global Ratings and A-plus by Fitch Ratings.

This will be the eighth issuance of GARVEE bonds since 2007 and will bring the total outstanding principal to $1.17 billion. Currently, there is $875.87 million in GARVEE debt, according to the state.

The LGC also approved the state’s plan to issue $171.9 million of bond anticipation notes for community college projects. The state said the BANs would help to speed up the work and would be paid off later by issuing general obligation bonds.

“Whether the requests are for hundreds of million dollars or hundreds of thousands of dollars, our staff gives expert review and due diligence to every application,” Folwell said. “We take our obligation seriously to ensure taxpayers’ hard-earned money is protected through prudent borrowing and the state’s valuable AAA bond rating that allows for low-interest borrowing is not put in jeopardy by unwise deals.”

North Carolina is rated triple-A by Moody’s, S&P and Fitch.

Additionally, the LGC approved Johnston County’s application to issue $52.5 million of revenue bonds for water and sewer improvements and Durham County’s request to sell $50 million of GO BANs for school, community college, library and museum projects.

Other financing requests were approved for: the City of Thomasville ($6.1 million); the Town of Ayden ($2.2 million); the Town of Landis ($2.2 million); the Village of Walnut Creek (1.7 million): and the Town of Swepsonville ($1.5 million).

The LGC gave Wilson County a conditional approval for a $13 million loan for school construction projects. Commission members raised concerns about the county’s financial bookkeeping, so the approval included a requirement that county officials submit documentation to show their accounts are being reconciled monthly.

Separately, in accordance with the Local Government Budget and

State law requires local governments to submit audits by Oct. 31 of each year, with a grace period through Dec. 1. The last audit Wilkesboro submitted was for 2018 and it was received two years late.