With the primary market at a standstill Thursday, attention turned to the first major deal of the New Year, a planned bond sale by the New Jersey Economic Development Authority that’s being challenged in court.

RBC Capital Markets is expected to price the N.J. EDA’s $381.195 million of state lease revenue bonds for state government buildings on Jan 4. The deal is rated Baa1 by Moody’s Investors Service, BBB-plus by S&P Global Ratings and A-minus by Fitch Ratings.

Fitch noted in a ratings report issued Thursday that some legal issues are still swirling around the bond sale.

“A lawsuit has been filed challenging the legality of this bond issue under the debt limitation clause of the state constitution; however, bond counsel strongly believes N.J. EDA's ability to issue debt authorized by its enabling act is not subject to the limitations of the clause. Bond counsel will render a clean legal opinion concurrent with the sale of the bonds,” Fitch said.

The offering is comprised of $197.275 million bonds for the Health Department and Taxation Division office project; $19.225 million taxable bonds for the Health Department office project; and $164.695 million of bonds for the Juvenile Justice Commission Facilities project.

Moody’s noted in a report last week that the litigation would probably not affect the state’s credit.

“A lawsuit has been filed challenging the authorization of these bonds, which if decided against the state, would potentially invalidate the bonds and the use of their proceeds,” Moody’s said. “The timing of the litigation resolution is uncertain, and the risk of a negative decision does not materially impact the state's credit profile at this time.”

S&P said the bonds are bonds are being issued to finance the construction of a new state health department office building and a new state taxation division office building in Trenton and to finance the construction of various new juvenile justice commission facilities in Ewing and Winslow townships. They are secured by basic rent payments in amounts sufficient to let the N.J. EDA pay the aggregate debt service on the bonds.

"The rating reflects our assessment of the general creditworthiness of the state of New Jersey (general obligation rating A-minus/stable) and pledged lease revenues that are subject to annual state legislative appropriation," S&P credit analyst David Hitchcock said on Wednesday.

Fitch said the state’s issuer default rating of A incorporates: a history of structurally imbalanced financial operations and slim reserves; persistent underfunding of its liabilities; and an elevated long-term liability burden, as well as the state's diverse and high wealth economy that has returned to sustained growth.

“The A-minus rating for the current N.J. EDA bond issue, one notch below New Jersey's A issuer default rating, reflects N.J. EDA's pledge to make annual payments equal to debt service on these obligations, subject to annual appropriation by the state legislature,” Fitch said.

“In the absence of additional pension reforms Fitch expects that incremental pension contribution increases will consume the bulk of natural revenue growth for the next several years and remain a significant part of the state's budget going forward. The rating also incorporates the strong control over revenues and spending inherent in a state's powers,” the rating agency said.

Moody’s said its Baa1 rating “is notched off the state's A3 [general obligation bond] rating, reflecting the need for annual legislative appropriation of state lease rental payments backing the bonds. A large majority of the state's net tax-supported debt is subject to appropriation, and the importance of maintaining access to the capital markets provides strong incentive for the state to make these appropriations.”

Moody’s also said that pension funding was an ongoing concern.

“The stable outlook reflects our view that the current A3 rating is well positioned for the next 12-18 months due to solid economic performance and the expectation that any fiscal 2018 budget gaps will remain manageable,” Moody’s said. “However, in the longer term, the state's credit profile will continue to weaken as large long-term liabilities grow and the state's budget is challenged by growing pension contributions in a low revenue growth environment.”

Bond Buyer 30-day visible supply at $3.14B

The Bond Buyer's 30-day visible supply calendar increased $28.7 million to $3.14 billion on Thursday. The total is comprised of $1.28 billion of competitive sales and $1.87 billion of negotiated deals.

Secondary market

The MBIS municipal non-callable 5% GO benchmark scale was stronger in late trading.

The 10-year muni benchmark yield fell to 2.284% on Thursday from the final read of 2.310% on Wednesday, according to

The MBIS benchmark index is updated hourly on the

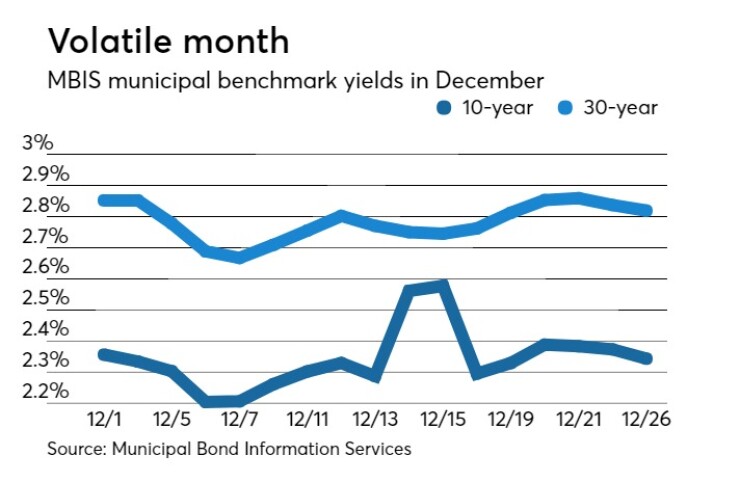

The MBIS benchmarks have been on a volatile ride over the past month.

On Dec. 1, the 10-year muni stood at 2.356% while the 30-year was at 2.852%. On Dec. 6, the 10-year was at 2.204% while the 30-year stood at 2.688%. On Dec. 12, the 10-year was at 2.329% with the 30-year at 2.802%. By Dec. 26, the 10-year stood at 2.343% with the 30-year at 2.819%.

Top-rated municipal bonds finished stronger on Thursday. The yield on the 10-year benchmark muni general obligation fell three basis points to 1.99% from 2.02% on Wednesday, while the 30-year GO yield dropped three basis points to 2.55% from 2.58%, according to the final read of MMD’s triple-A scale.

U.S. Treasuries were weaker on Thursday. The yield on the two-year Treasury rose to 1.91% from 1.90%, the 10-year Treasury yield gained to 2.43% from 2.41% and the yield on the 30-year Treasury increased to 2.76% from 2.75%.

On Thursday, the 10-year muni-to-Treasury ratio was calculated at 81.9% compared with 83.7% on Wednesday, while the 30-year muni-to-Treasury ratio stood at 92.6% versus 94.0%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 37,144 trades on Wednesday on volume of $14.09 billion.

Tax-exempt money market funds saw outflows

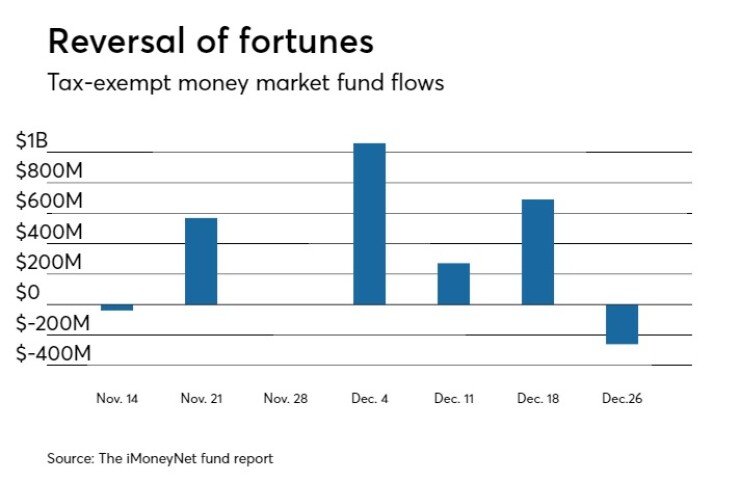

Tax-exempt money market funds experienced outflows of $261 million, bringing total net assets to $130.93 billion in the week ended Dec. 25, according to The Money Fund Report, a service of iMoneyNet.com.

This followed an inflow of $690.4 million to $131.19 billion in the previous week.

The average, seven-day simple yield for the 199 weekly reporting tax-exempt funds leaped to 0.79% from 0.62% in the previous week.

The total net assets of the 827 weekly reporting taxable money funds increased $11.07 billion to $2.670 trillion in the week ended Dec. 26, after an outflow of $22.62 billion to $2.659 trillion the week before.

The average, seven-day simple yield for the taxable money funds rose to 0.89% from 0.85% from the prior week.

Overall, the combined total net assets of the 1,026 weekly reporting money funds increased $10.81 billion to $2.801 trillion in the week ended Dec. 26, after outflows of $21.93 billion to $2.791 trillion in the prior week.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.