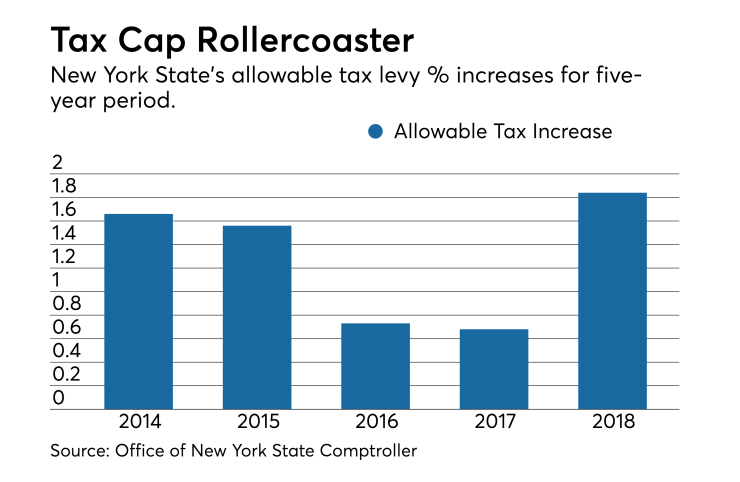

A rise in New York’s allowable property tax levy increase from 0.68% to 1.84% is a credit positive for the state’s municipalities, who now have more revenue raising powers, according to Moody’s Investors Service.

New York State’s tax cap, which was first implemented by Gov. Andrew Cuomo for the 2012 fiscal year, limits tax levy increases to the lesser of 2% or the rate of inflation based on the consumer price index. The caps have been below the maximum 2% in recent years at 0.73% for fiscal 2016 and 0.68% in 2017.

“Property taxes make up a large portion of operating revenues for many issuers, usually comprising the first or second largest source of revenue,” said Moody’s analyst Cristin Jacoby in a July 21 report. “Any ability to increase this revenue source allows for greater budgetary flexibility.”

While local governments can override the property tax cap with a 60% governing body vote, this can prove to be politically challenging, Jacoby said. Roughly one-fifth of localities have passed overrides each year in the tax cap era. School districts, which require a 60% voter approval for an override, have attempted it less than 5% of the time annually.

“Though the increase in the tax cap is a credit positive for the sector, New York local governments continue to operate in a constrained environment due in part to reliance on economically-sensitive revenues,” said Jacoby. “Sales taxes have continued to underperform in many regions, with counties in particular often experiencing budget gaps as a result.”

New York municipalities have also been challenged in cutting spending because of state mandates and a strong union presence, Jacoby said. However, most local governments have managed to maintain adequate reserves with fund balances remaining stable or improving for 79% of cities and 88% of counties from fiscal 2011 to 2015, according to Moody’s data.