The biggest municipal bond deal of the week is coming to market on Tuesday even as a state lawmaker is proposing to abolish the very authority that is issuing the debt.

The New York State Thruway Authority this week is bringing $1.027 billion of Series P general revenue bonds in a transaction led by J.P. Morgan Securities as senior bookrunner and Siebert Williams Shank.

J.P. Morgan priced the bonds for retail investors Monday with yields ranging from 3.09% with a 5% coupon in 2025 to 4.09% with a 4% coupon in 2045. Term bonds in 2049 were priced to yield 4% with a 5% coupon and 4.08% with a 5.25% coupon in 2054. Institutional pricing is Tuesday.

The authority also issued

The deal comes following several toll increases — which have bolstered the authority's credit and is expected to place it on sounder financial footing — that compelled state Sen. Mark Walczyk to introduce Senate Bill S8341, which would

The bill, which would transfer all the authority's functions, employees, duties and debts to the state Department of Transportation, stands little chance of passage in a state where both the legislative and executive branches are dominated by Democrats. It is currently in the state Senate's Transportation Committee.

The deal is rated A1 by Moody's Investors Service and A-plus by S&P Global Ratings.

On Jan 8, S&P raised the long-term rating on the authority's general revenue bonds to A-plus from A and the general revenue junior indebtedness obligations to A from A-minus. S&P's outlook on the ratings is stable.

Moody's revised the authority's outlook to

"The outlook revision to positive is driven by the recently approved multi-year toll increase for the 2024-2027 period, which will support the authority's financial strength and extensive capital plan," Moody's said.

"The upgraded long-term financial ratings by S&P as well as the positive rating outlook by Moody's affirms the Thruway Authority's efforts to solidify and maintain a stable financial plan that ensures the continued viability of the Thruway system," Frank G. Hoare, the authority's acting executive director, said in a statement.

"The multi-year toll adjustment that went into effect in January is leading to an increase in planned investments into the Thruway's capital program that will modernize the nearly 70-year-old Thruway system," he said.

The authority is using the toll hikes to increase its planned investment in capital projects by nearly $500 million, or 25%, over the next five years. The authority has committed to invest $2.4 billion over the next five years for projects in the $2.43 billion 2024-2028 capital program across its 570-mile system statewide.

The increased investment is projected to lead to work on around half of the Thruway's more than 2,800 miles of roads as well as on about 90 of its 817 bridges.

Tolls rose on Jan. 1 for E-Pass users by 5% while out-of-state E-ZPass and Tolls by Mail users saw rates rise from 15% and 30%, respectively, to 75% for both above the E-ZPass rate. In addition, the E-Pass passenger car rate for the Gov. Mario M. Cuomo Bridge will rise 50 cents a year for the next several years.

The authority said with the Jan. 1 toll increase, revenue is projected to grow by 20.6% to $986.0 million this year. Additional hikes through 2027 are expected to increase annual revenues by roughly $298 million by 2028 compared to revised revised estimates.

The authority said the projected higher revenues will increase debt service coverage, reduce future borrowing needs and improve leverage.

In addition to the dissolution bill, the agency also faces a dispute with Tappan Zee Constructors LLC, the contractor of the Mario M. Cuomo bridge, who claims it is owed about $1.3 billion in excess of the approved contract value, Moody's noted when affirming the agency's ratings.

"The ratings affirmation and ratings assignment reflect the current uncertainty on the authority's leverage profile given the ongoing legal dispute with the constructor of the Gov. Mario M. Cuomo bridge," Moody's said.

"An adverse outcome of the dispute could result in additional debt beyond the amounts planned for the current financing plan," Moody's said. "The ratings affirmation recognizes that the authority's long term debt service profile has room to incorporate additional debt, but also reflects the limited visibility on the authority's leverage profile until there is more certainty on the outcome of the dispute."

Proceeds of the deal will fund part of the authority's multi-year capital program; refund Series J bonds; fund a tender for the taxable Series M bonds; make a deposit to the senior debt service reserve fund; and fund capitalized interest.

Co-managers include BofA Securities, Goldman Sachs, Jefferies, RBC Capital Markets, Wells Fargo Securities, Academy Securities, AmeriVet Securities, Barclays Capital, Drexel Hamilton, Loop Capital Markets, Ramirez & Co. and Raymond James & Associates.

Public Resources Advisory Group and Acacia Financial Group are the financial advisors while Hawkins Delafield & Wood is the bond counsel.

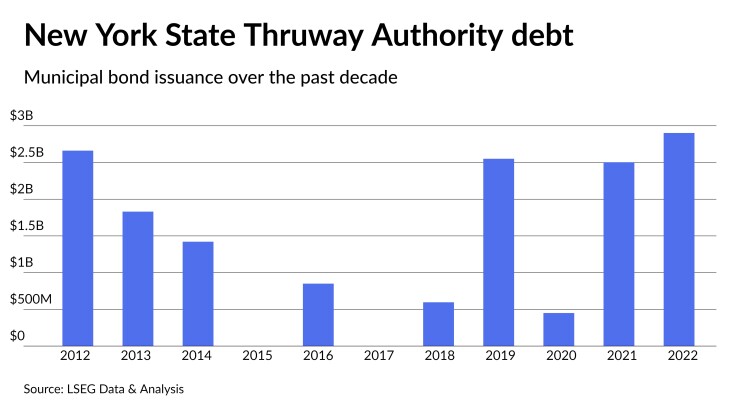

Since 2012, the authority has issued $15.8 billion of bonds in 29 issues, with the most volume coming in 2022 when it sold $2.9 billion of debt, according to LSEG Data & Analytics. It was not in the market in 2015 or 2017.

The Thruway Authority was created in 1950 by state lawmakers to finance, construct, operate and maintain the NYS Thruway System, which is tolled, and includes the Cross-Westchester Expressway. Under a 1992 state law, the authority can finance specific economic development transportation projects and sell bonds on behalf of the state for transportation purposes.