Even with two warning shots from bond rating agencies and gloomy scenarios amid the COVID-19 crisis, New York City Comptroller Scott Stringer said the city is in a strong position in the capital markets.

Stringer, in Tuesday's

“Obviously we are concerned. We want to make sure our ratings are as high as possible,” Stringer told reporters during a video conference. “I do think we are in a strong position despite this calamity.

"We’re constantly monitoring the bond markets. We’re constantly looking to see when that stabilizes. I am much more optimistic that we will get through this.”

Moody’s Investors Service and Fitch Ratings last month revised their outlooks on the city’s general obligation bonds to negative. Moody’s rates the city’s GOs Aa1, while S&P Global Ratings and Fitch rate them AA. S&P has a stable outlook for now.

While joining the call for further federal assistance, Stringer, a presumptive mayoral candidate in 2021, scolded the de Blasio administration for leaving the city with insufficient savings.

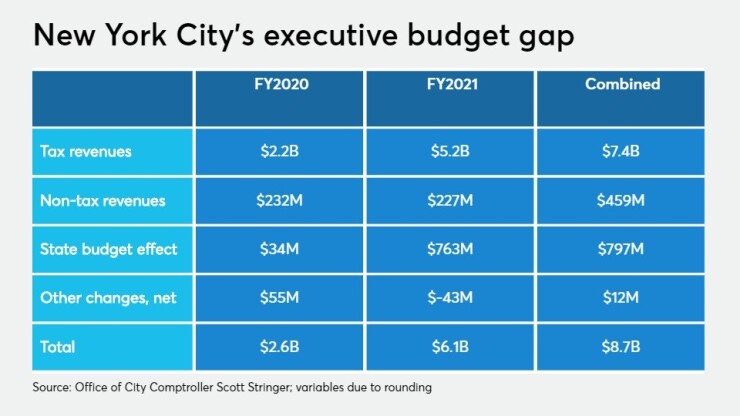

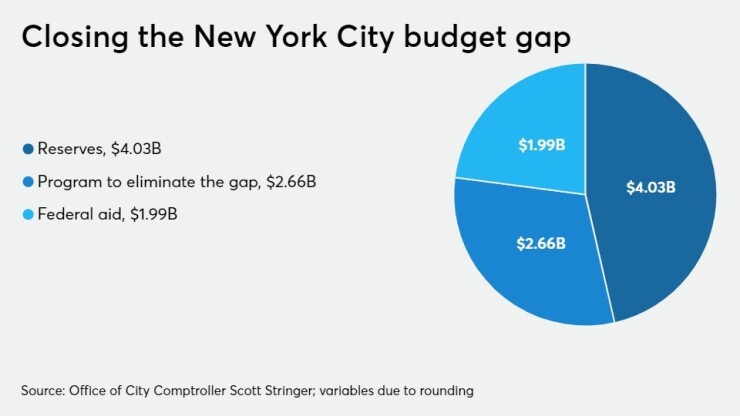

The mayor intends to cover the shortfall through a $4 billion withdrawal from reserves, $2 billion from the federal CARES Act rescue package, and $2.7 billion in departmental cuts through a so-called program to eliminate the gap, or PEG.

The latter, according to Stringer, relies too much on stopgap measures, such as summer pool closings or suspending the summer youth employment program.

“These one-time cuts don’t translate into longer-term savings, and those recurring savings only represent a small fraction of the agency budgets,” said Stringer, who called on the administration to match a 4% cut for his own office. Such a move, he said, would save the city $1 billion.

The City Council, which must approve a spending plan by June 30, has scheduled a budget hearing for Wednesday.

"Every single year we've come to common ground, gotten to a budget on time, gotten to a fair, smart, balanced budget," de Blasio said earlier Tuesday.

According to data on the Municipal Securities Rulemaking Board's

New York relies on multiple reserve sources rather than a single rainy-day fund, although voters last fall approved the establishment of such a fund, which bond analysts see as a credit enhancer. The city and state, however, need to execute its implementation.

“The city’s inability to allocate funds to a true rainy day fund is one of the reasons that there are limited resources available to lessen the severity of the current fiscal crisis,” said Jonathan Rosenberg, director of budget review for the nonpartisan Independent Budget Office. “The use of over $4 billion of reserve funds in the current and next fiscal year leaves very little capacity available if the city’s fiscal outlook deteriorates further.”

Stringer said he and Deputy Comptroller for Budget Preston Niblack are monitoring the capital markets.

“Look, I’d be lying if I said there isn’t concern,” Stringer said. “We are constantly evaluating our position in the capital markets and we will act accordingly but right now, I am optimistic that we’ll pull through.”

“Our pension fund, our bond strategy has never been about short-term investing. The system is built for these kinds of issues. We’re not short term, we’re long term.”

One major variable to the city’s recovery, Stringer said, is the widespread availability of testing, which could allay fears and return residents and tourists to theater and sports events, and restaurants.

“New York has become more diversified as an economy, I think, and it’s mostly in the metropolitan area,” Howard Cure, director of municipal bond research for Evercore Wealth Management, said on a

“New York is, for better or worse, also a big tourist area and that’s going to take a hit,” Cure added. “It’s still the center of a lot of different industries: finance, law, communications.”

Also said Cure, the city’s “eds and meds” reach — education and healthcare — is often overlooked as an attribute.