CHICAGO – This year's Illinois budget hole of up to $1 billion could balloon to $3 billion annually over the next five years, ratcheting the state’s bill backlog up to $23.7 billion, according to a grim budget forecast laid out by the outgoing administration of Gov. Bruce Rauner.

“The projections used for fiscal year 2019 assume optimistic growth in revenues under existing law and the five subsequent fiscal years are driven by the pessimistic economic forecast scenario, increases in pension payments, projected debt service amounts, and moderate increases in other spending,” according to the

“All projections assume no significant reforms or spending controls aside from what is in current statute,” the report says. The governor submits the overview of state finances in mid-November annually to the General Assembly.

The numbers are somewhat speculative because they are based on varying economic scenarios, existing taxes, and current costs, all of which will be shaped by Gov.-elect J.B. Pritzker, who takes office in January.

Democrat Pritzker, who ousted the GOP's Rauner Nov. 6, wants to generate more revenue by legalizing marijuana, expanding gambling and asking voters in 2020 to approve a shift to a graduated income tax from a flat tax. He’s also proposed more spending on capital and education.

The forecast numbers will provide a base for crafting the new state budget due in February and a warning for what must be tackled in the coming months.

THIS YEAR

Revisions to revenues and expenses in the current-year fiscal 2019 $38.5 billion general fund will result in a $546 million deficit, the report said.

Various changes include the loss of a potential $300 million from the long-stalled sale of the state’s downtown Chicago office building. Debt service of $33 million expected on borrowing to fund pension buyouts is no longer needed but $118 million is being transferred to cover outstanding debt payments.

A secondary projection factors in step raises based on experience the state had previously withheld from employees during contract negotiations. The Illinois Labor Relations Board has ordered the state to pay them a not yet finalized amount.

The state estimates a potential liability range of $170 million to $500 million. The state is still awaiting a final decision but should it owe $500 million this fiscal year the deficit grows to $1 billion.

Another uncertainty in the numbers is the status of pension buyout savings. An early buyout program for three of the state’s five funds is in the early stages of implementation.

“These programs are projected to result in general fund savings for the state of approximately $400 million, but the state can provide no assurance as to the amount of savings actually realized from the implementation of such programs,” reads the report.

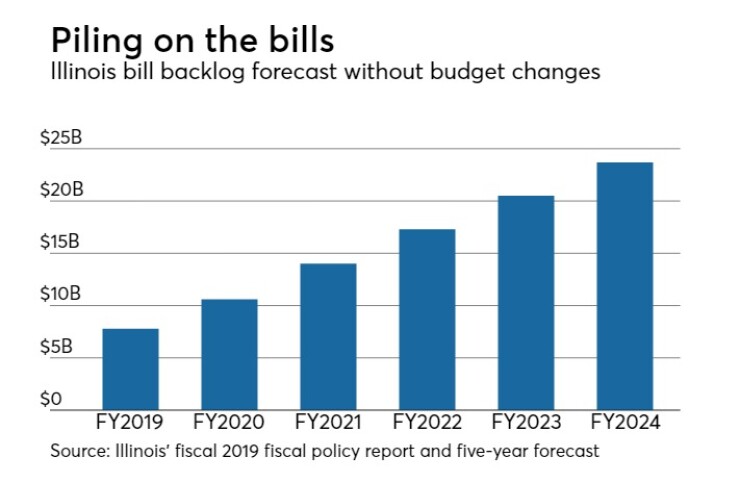

The bill backlog, which hit a record of more than $14 billion due to the state’s two-year budget impasse that broke in July 2017, is estimated to creep up to $7.8 billion at fiscal year-end on June 30 from $7.3 billion. That’s due to the anticipated red ink unless the state takes measures such as dipping into non-general fund surpluses to cover the gap.

FIVE-YEAR FORECAST

The forecast warns of deficits of $2.5 billion in fiscal 2020 and about $3 billion annually in the next four years. The annual gaps will pile on top of the state’s already burdensome unpaid bill backlog, growing to $23.7 billion in fiscal 2024. It’s a figure being closely watched by rating agencies who have warned the state a buildup, after borrowing $6 billion in 2017 to pay it down, could drive a downgrade.

“Options must be considered for implementing structural reforms, imposing spending reductions and enhancing revenues to balance the state’s budget and resolve the budget shortfalls projected in this report,” the report said.

The revenue forecast factors in a potential risk of a recession based on scenarios laid out by the firm IHS Markit that would tamp down tax growth. The possibility of a recession translates into a forecast in which individual income tax gross receipts grow approximately 2% in fiscal years 2020 and 2021 and then grow at closer to 7% after that, says the report.

Corporate income tax receipts are expected to grow 3% in fiscal year 2020, stagnate in fiscal years 2021 and 2022, and grow at approximately 5% after that. Federal revenues are projected to show only moderate growth over the forecast horizon.

The state raised the income tax rate last year which is generating at least $4.5 billion in new annual revenue.

Projected expenses are expected to grow at a moderate rate without significant changes to programs.

Pension contributions head steadily up to $9.4 billion in 2024 from $7.1 billion this year although that too could change based on annual actuarial changes or buyout savings. Education spending rises to $12.1 billion in 2024 from $10.2 billion this year while healthcare costs rise to $9 billion from $7.9 billion this year.

The five-year figures only project savings from the current valuations in 2019 for the teachers’ and state employees’ funds and in fiscal year 2020 for the universities fund, says the report.

Debt service on up to $1 billion of general obligation borrowing that would cover the costs of the state buyouts is estimated at between $90 million and $100 million annually between 2020 and 2024. The state may begin tapping the bond authorization late in the current fiscal year.

The report puts interest costs for fiscal 2019 at $419 million on the backlog of state employees’ group health insurance program bills, but said it can’t calculate the costs of all outstanding bills as the state comptroller makes the final decision on the timing of payments based on priority criteria. The state comptroller has previously said that the total interest tab due to the two year budget impasse amounted to about $1 billion.

Release of the report comes as Pritzker’s budget and innovation transition working committee is set to meet for the first time this week.

Former state Comptroller Dan Hynes is leading the committee with members that include Chicago’s chief financial officer, the Chicago treasurer, and the leaders of two local civic research organizations. Crafting a balanced fiscal 2020 budget is a top priority and it “will impact everything our new governor is trying to accomplish,” Hynes said when the group was announced last week.

The state’s GOs are rated Baa3 with a stable outlook from Moody's Investors Service. S&P Global Ratings has Illinois at BBB-minus with a stable outlook, and Fitch Ratings has Illinois at BBB with a negative outlook.