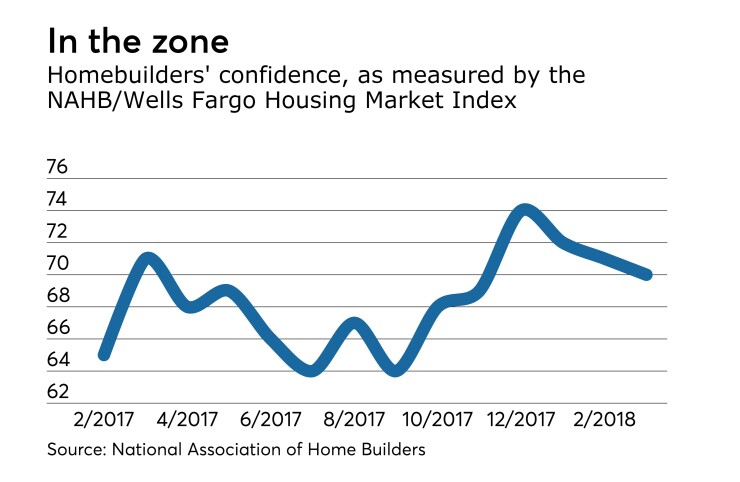

Builders’ confidence in the market for new single-family homes remained high as the National Association of Home Builders' housing market index dipped to 70 in March from a downwardly revised 71 in February.

February’s index was first reported as 72.

IFR's poll of economists predicted the index would be 72.

“Builders’ optimism continues to be fueled by growing consumer demand for housing and confidence in the market,” NAHB Chairman Randy Noel said. “However, builders are reporting challenges in finding buildable lots, which could limit their ability to meet this demand.”

“A strong labor market, rising incomes and a growing economy are boosting demand for homeownership even as interest rates rise,” according to NAHB Chief Economist Robert Dietz. “With these economic fundamentals in place, the single-family sector should continue to make gains at a gradual pace in the months ahead.”

Derived from a monthly survey that NAHB has been conducting for 30 years, the NAHB/Wells Fargo HMI gauges builder perceptions of current single-family home sales and sales expectations for the next six months as either "good," "fair" or "poor." The survey also asks builders to rate traffic of prospective buyers as either "high to very high," "average" or "low to very low." Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view sales conditions as good than poor.

The current single-family home sales index held at 77, the sales expectations index for the next six months declined to 78 from 80; and the traffic of prospective buyers index dropped to 51 from 54.