Municipal bond buyers swarmed in and snapped up the JFK Airport $332 million refunding deal, which came to market on Tuesday. Sources told The Bond Buyer the offering was massively oversubscribed, with one source saying they heard billions of dollars in orders came in for the bonds.

JPMorgan Securities was able to reprice the deal and cut long yields by up to 45 basis points on the New York Transportation Development Corp.’s (Baa1/NR/BBB/NR) $331.57 million of special facility revenue refunding bonds for the John F. Kennedy International Airport Terminal 4 Project.

The $282.02 million of Series 2020A tax-exempts subject to the alternative minimum tax were repriced to yield from 1.05% with a 5% coupon in 2022 to 2.73% with a 4% coupon in 2042. The tax-exempts had been tentatively priced to yield from 1.20% with a 5% coupon in 2022 to 3.18% with a 4% coupon in 2042.

The $49.55 million of Series 2020B taxables were repriced at par to yield 1.36% in 2021 and 1.61% in 2022. The taxables had been tentatively priced at par to yield 1.56% in 2021 and 1.81% in 2022.

“It’s an iconic project that will change the flying experience for all time,” said John Hallacy, founder of John Hallacy Consulting LLC. “It will ease the flow of people and traffic through the terminal. That’s why there is so much interest in it — after COVID, flights will resume as we begin to travel more.”

The issue is the first part of a $1.1 billion offering from the N.Y. TDC, which will also sell a $671 million non-AMT tax-exempt issue the week of Dec. 14. Proceeds from the issues will be used to defease or redeem JFK IAT’s outstanding Series 6 bonds, sold in 1997, and Series 8 bonds, sold in 2010, and repay JFK IAT’s subordinated Port Authority investment.

In secondary trading, municipals were steady to weaker as Treasuries weakened and equities rose after Joe Biden was acknowledged as the apparent winner of the presidential election by a federal agency in a move that reduced political uncertainty and calmed markets.

Yields on top-quality munis were unchanged to one basis point higher on the AAA scales, with Treasury bond yields rising by as much as five basis points.

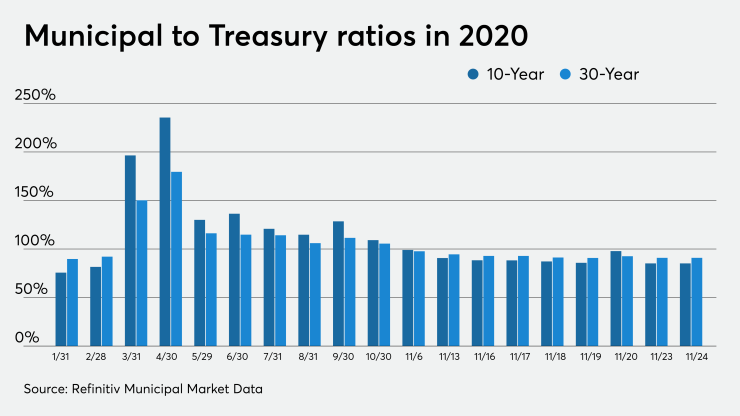

Muni-to-Treasury ratios have been falling sharply in this month’s trading sessions, according to Refinitiv MMD.

The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable Treasury with comparable maturities. If the muni-to-Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

“Muni-to-Treasury ratios have reached pandemic level lows during the past week. This recent decline may have been facilitated by the thin supply of new issues,” according to Daniel Berger, Refinitiv MMD senior market strategist. Late Tuesday, the ratios fell to new lows, with the 10-year M/T ratio at 82.7% and the 30-year ratio at 88.4%.

This week’s paltry new-issue slate of about $1 billion, he added, might be a short-term factor in keeping ratios low.

“We expect that ratios could drop further this week, but that they might rise when volume increases for the typical December rush,” Berger said.

Kim Olsan, senior vice president at FHN Financial, noted the lack of supply had an effect on Monday’s trading.

“Without enough primary direction, the secondary market struggled to find momentum yesterday,” she said. “Total par value traded failed to reach $4 billion and it likely won’t be until next week when a better focus can develop with a larger calendar.”

Olsan said November’s gains — 0.57% in five-years and 1.36% to 2.34% in 10-years and longer — would be tested in December.

“Despite quieter trading sessions, ultra-short volume is active on strong note sales,” she said. “Many recent issues that carry short-term ratings are finding solid distribution at concessions to the AAA one-year spot, as well as favorable cross-market ratios above 125%.”

Further out on the curve, she said, the trend was toward “tighter spreads and as a result, more demand for coupon and call variations that offer any yield relief.”

Primary market

Citigroup priced the Denton Independent School District, Texas’ (NR/AAA/AAA/NR) $269.445 million of Series 2020A taxable refunding bonds. The deal is backed by the Permanent School Fund guarantee program.

The bonds were priced to yield from 1.091% with a 5% coupon in 2027 to 2.456% at par in 2040 and 2.556% at par in 2045.

Also Tuesday, BofA Securities priced the Delaware Economic Development Authority’s (Baa3E/BBB-E/NR/NR) $247.182 million of exempt facility refunding revenue bonds for the NRG Energy project.

There were no competitive sales over $50 million on the calendar.

NYC MWFA to sell $494M of bonds next week

The New York City Municipal Water Finance Authority said Tuesday it expects to sell $494 million of tax-exempt fixed rate bonds next week.

Book-running lead manager Siebert Williams Shank is expected to price the deal on Wednesday, Dec. 2, after a one-day retail order period. Barclays Capital, BofA Securities, Goldman Sachs, Loop Capital Markets, Raymond James and UBS Financial will serve as co-senior managers on the transaction.

Proceeds will be used to fund capital projects and refund certain outstanding bonds for savings.

Secondary market

Some notable trades Tuesday:

Maryland 5s of 3/15/2027 [574193SD1] traded in a block of over 5 million at 128.732 at a yield of 0.380% while Maryland 5s of 8/1/2020 [574193TD0] traded in a block of 5 million-plus at 139.713 at a yield of 0.740%. Anne Arundel County, Md., 5s of 10/1/2028 [03588HZL3] traded in a block of 5 million-plus at 133.548 at a yield of 0.613%.

Loudoun County, Va., 5s of 12/1/2026 [54589TJZ6] traded in a block of 5 million at 126.608 at a yield of 0.354% and Loudoun County 5s of 12/1/2025 [54589TJZ9] traded in a block of 5 million at 126.617 at a yield of 0.254%.

High-grade municipals were steady across the curve on Tuesday, according to final readings on Refinitiv MMD’s AAA benchmark scale. Short yields were flat at 0.14% in 2021 and 0.15% in 2022. The yield on the 10-year muni was steady at 0.73% while the yield on the 30-year was flat at 1.42%.

The ICE AAA municipal yield curve showed short maturities rising by one basis point to 0.15% in 2021 and 0.16% in 2022. The 10-year maturity rose one basis point to 0.72% and the 30-year yield gained one basis point to 1.44%.

The 10-year muni-to-Treasury ratio was calculated at 84% while the 30-year muni-to-Treasury ratio stood at 89%, according to ICE.

The IHS Markit municipal analytics AAA curve showed short yields at 0.13% and 0.14% in 2021 and 2022, respectively, and the 10-year steady at 0.70% as the 30-year yield remained unchanged at 1.44%.

Treasuries were weaker as stock prices traded higher.

The three-month Treasury note was yielding 0.09%, the 10-year Treasury was yielding 0.88% and the 30-year Treasury was yielding 1.60%. The Dow rose 1.40%, the S&P 500 increased 1.50% and the Nasdaq gained 1.20%.